Every year, the final quarter (Q4) - from Labour Weekend through the November sales events, to year end - is the most important period in the online retail calendar. It’s a time when shoppers go hunting for deals, and when smart retailers are ready to make the bulk of their revenue for the year.

Peak 2024 was no exception. In fact, Q4 2024 was our biggest Q4 yet and as we look ahead to Peak 2025, there are many reasons to feel optimistic, despite the mixed economic outlook. Let’s take a look at what made 2024 such a standout season, what it tells us about shopper preferences and behaviour, and what retailers should keep in mind as they plan for Q4 2025.

Peak 2024: Record-breaking sales

Online shopping during Q4 2024 totalled $1.73 billion, up 9% on Q4 2023, making it the largest quarter for online spending since we began tracking this data seven years ago. The average shopper spent $947 online in Q4 2024, $40 more than in Q4 2023. In contrast to online’s strong result, instore spending for the quarter was flat. This resulted in a very modest (below the inflation rate) rise in total retail spending.

Q4 2024 vs Q4 2023

Online Spending $1.73b▲ 9% | Total In-store Spending $14.4b0% | Total Retail spend $16.1b▲ 1% |

While instore still dominates how Kiwi shoppers buy, an increasing number of shoppers have moved online to help them better manage economic pressures. Hopping online gives shoppers access to a wider range of retailers and products, and greater opportunities to research for the best deals.

Peak 2024: Key lessons

In the context of the wider economic slowdown, online’s strong growth stands out not just for its size, but for the lessons it teaches us about consumer preferences and purchasing patterns.

Lesson 1: Transactions driving growth, not basket size

The quarter’s uplift in total spend was largely driven by a significant increase in transaction volumes, up 14% on Q4 2023, with over 18.3 million transactions. In contrast, the average basket size fell 4%, from $99 to $95.

While general inflation had eased by the end of 2024, other household pressures such as higher insurance premiums, council rates, and rents, continued to impact discretionary income. Shoppers responded accordingly, making deliberate decisions to buy items when on sale, to choose lower-cost alternatives, or to spread spending across multiple smaller transactions.

Retailers who adopted value-driven promotional strategies, like bundled offers, loyalty rewards, flexible delivery and payment options, and clear value messaging, were rewarded. So far this year, we’ve seen similar trends, with month-on-month spending up compared to 2024, driven by higher transaction volumes and smaller basket sizes. It’s clear this lesson from 2024 will also apply in 2025.

Lesson 2: Peak season starts earlier and lasts longer

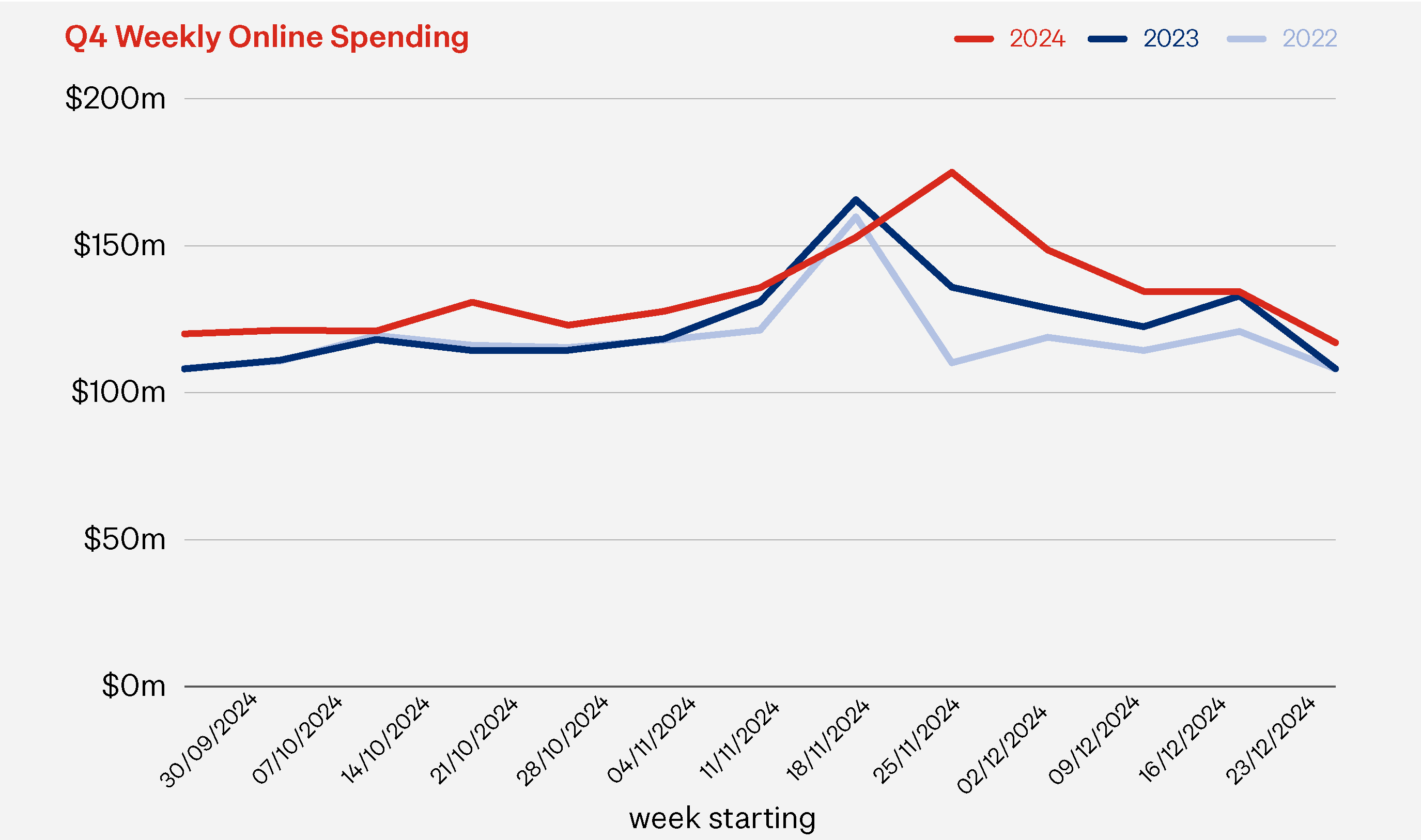

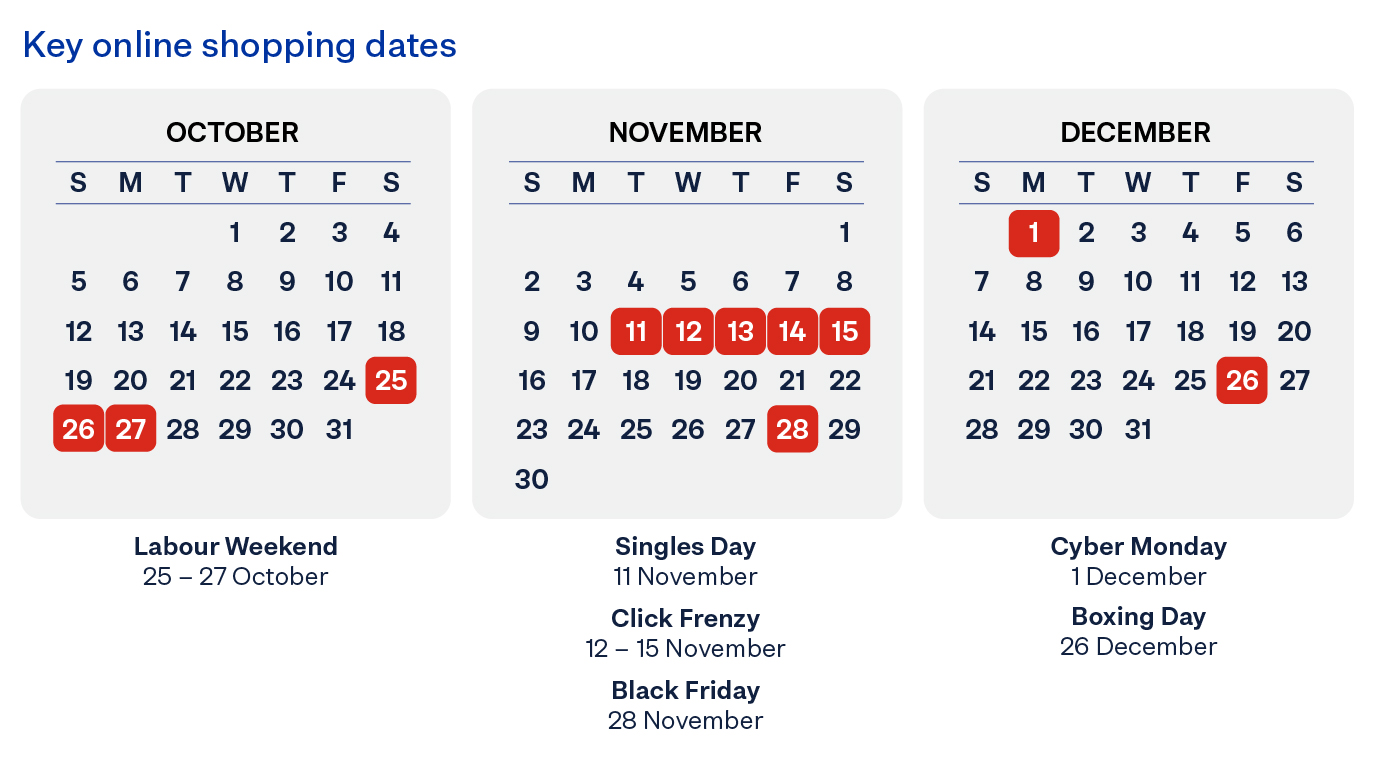

One of the most important structural changes we’ve seen in recent years is the shift from a handful of discrete shopping events – such as Singles’ Day, Black Friday and Cyber Monday – to an extended sale season that stretches from Labour Weekend through to year end. In 2024, this trend was more pronounced than ever.

Labour Weekend marked the informal beginning of the sales season, with Black Friday promotions starting as early as late October and morphing into Christmas sales by early December. The net effect was a gradual flattening of the traditional sales spike. While spending still peaked during the Black Friday–Cyber Monday weekend ($94.6 million in online spend over four days, up 7% on 2023), the ramp-up began earlier and the drop-off afterwards was more muted than in prior years.

This change reflects a more considered consumer mindset. Faced with tighter budgets, shoppers are actively monitoring deals and comparing prices well in advance of key dates. For retailers, it means Q4 should be treated as a sustained sales period that requires coordinated marketing, inventory and fulfilment strategies across 8-10 weeks.

Lesson 3: Boxing Day is booming again

Boxing Day 2024 capped off the season with an impressive 21% lift in online spending compared to the previous year. This was largely driven by a 30% increase in online transactions, with Kiwi shoppers embracing Boxing Day as an online event, rather than braving the crowds.

This was the second consecutive year of double-digit growth for online Boxing Day spend. It’s a chance to clear inventory, re-engage customers, and extend the lifetime value of seasonal shoppers. Importantly, it also sets the tone for early January, especially as many sales now roll straight into New Year promotions.

Lesson 4: Growth across the board, but not evenly spread

While the macro trends drove headline growth, it’s worth noting that not every region and sector benefitted in the same way.

All regions recorded online spending growth in Q4 2024, however, the pace of growth varied significantly. Taranaki led the way with a 35% increase in online spending, followed by Nelson (+24%) and Tasman (+18%). In contrast, Wellington (+4%) and Auckland (+6%) posted slower growth.

At a sector level, Clothing & Footwear saw the strongest year-on-year spending growth (+17%), fuelled by a 25% rise in transaction volumes, though average basket size fell 7%. Recreation, Entertainment, Books & Stationery (+14%) and Homewares & Electronics (+10%) also posted healthy gains in spending levels, suggesting consumers were still willing to spend on items that support lifestyle and comfort, particularly when offered at a good price.

Our largest online sector, Department, Variety & Miscellaneous saw a 5% increase in spending in Q4 2024, driven by increased spending with offshore retailers (+23%) like Temu. Online spending with domestic retailers in this sector however was down 11% compared to the year before. This largely reflects shoppers’ drive to find cheaper options.

It will be interesting to see if this offshore growth trend is prevalent in Q4 this year, given the trends so far this year. Department, Variety & Miscellaneous spending with international retailers to May this year has grown at the same rate as domestic retailers. In fact, four of the six sectors saw spending with international retailers fall compared to the same five-month period in 2024. This has resulted in an increase in the percentage of spending with domestic retailers. The Speciality Food, Groceries & Liquor sector was the only sector where spending with international retailers has grown at a faster rate than domestic retailers.

Another interesting trend from Q4 2024 was that several discretionary sub-categories, such as cosmetics and liquor, showed growth despite the broader ‘cautious spending’ narrative. Shoppers are cutting back but they’re not cutting out. Small indulgences, and special treat giving, still matter especially during the festive season.

This diversity in regional, sector and domestic/offshore performance underscores the need for segmented strategies. Retailers who leverage their own customer data will be better positioned to tailor offers in order to maximise results.

A full analysis of Q4 2024 is available in this eCommerce Spotlight article.

Looking ahead to Peak 2025

As we look forward to Q4 2025, there are both encouraging signals and lingering uncertainties. The first half of 2025 has seen online spending continue to outpace 2024 levels each month, while instore sales have remained flat. This suggests a continuation of the shift toward online as the channel for value-driven purchases.

However, the broader economic picture remains mixed. The economy is clearly recovering, but at a slower rate than economic commentators expected, and retailers would have wanted. While the Reserve Bank held the Official Cash Rate (OCR) steady at 3.25%1 in July, they noted the high degree of uncertainty in the economic outlook. Food prices were still up 4.6%2 year-on-year as of June, the unemployment rate rose to 5.2% for the June quarter3, and ASB’s June economic update showed a weaker than expected recovery in consumer card spending4, despite mortgage rate cuts.

On the positive side, ANZ’s latest consumer confidence report5 notes that more homeowners are now rolling onto lower mortgage rates, which may ease household pressure in the back half of the year. With nearly half of all mortgages due to reprice before the end of Q4 2025, this could result in a healthy uptick in disposable income, creating more room for discretionary spending.

What this means for Peak 2025 is that we are likely to see one of two broad scenarios play out:

- Sustained caution: If economic conditions remain subdued, we may see a repeat of 2024’s patterns – strong transaction volumes, cautious basket sizes, and an extended sales period where value remains the primary driver.

- Renewed confidence: If mortgage relief and easing inflation translate into higher consumer sentiment, this could result in higher average basket sizes, greater engagement in discretionary categories, and a bit of a local swing back from the large international low-cost retailers in some sectors.

We think the second is the more likely scenario, though we may still see some uneven performance across demographics, sectors and regions, as some households loosen their purse strings faster than others. Retailers should prepare for this more optimistic view, to avoid finding themselves losing sales and frustrating customers as they scramble to scale up at short notice.

We’ll continue to monitor the markets and provide updates on how we see market conditions through our regular eCommerce Spotlight publications.

Setting yourself up for success

No matter which way the economy goes, there are three things retailers can do now to prepare for a strong Peak 2025:

1. Plan earlier and for longer

Peak is no longer a string of shopping events, but a whole quarter of increased retail activity. Retailers must start their strategic planning as early as possible, ensuring they’re ready to activate promotions from late October and sustain them through to year-end. That means aligning marketing, inventory, web performance, fulfilment and customer service in a way that can scale across many weeks of high activity.

2. Invest in the customer experience

Review your end-to-end customer experience before the volumes hit. Consider the things that enhance sales conversion. For example, investing in faster, more flexible delivery options, transparent tracking and easy returns. Check out our eCommerce Market Sentiments Report 2025, for a number of practical strategies to reduce cart abandonment and to drive additional revenue.

3. Double down on value

Even in a recovering market, value will continue to dominate how shoppers buy. How they assess value may evolve however. Remember, value doesn’t just mean lowest price, it can also mean quality, consistency, and customer confidence. Loyalty rewards, product bundles, and well told stories about what you stand for, your community presence and your sustainability credentials all help build trust, and attract and retain customers.

The final word

Peak 2024 proved that Kiwi shoppers are willing to spend, where they see the value. Peak 2025 looks set to build on that, especially if confidence continues to grow. For retailers, that means lots of growth opportunities, especially for those who prepare early and are ready to adapt to whatever market conditions eventuate. As always, our team at NZ Post will be right here with you, delivering the support you need to drive your online success.

This report is published for general information purposes only. The views and opinions expressed, and any advice provided, is general in nature only. NZ Post does not represent that any information or advice it contains is suitable for your circumstances or purposes.

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.

1https://www.rbnz.govt.nz/hub/news/2025/07/ocr-3-25-percent-ocr-unchanged

2https://www.stats.govt.nz/news/food-prices-increase-4-6-percent-annually/

3https://www.stats.govt.nz/news/unemployment-rate-at-5-2-percent-in-the-june-2025-quarter

4https://www.asb.co.nz/content/dam/asb/documents/reports/economic-note/asb-ect-june-25.pdf

5https://www.roymorgan.com/findings/anz-roy-morgan-consumer-confidence-april-2025