Kiwis spent $1.5 billion online on physical goods in the first quarter (Jan-Mar) of 2025 (Q1 2025), 7% more than the year before. The average Kiwi shopper purchased more often and spent more online overall in this quarter than one year ago.

Is this strong first quarter growth a sign that better times are finally here? Q1 2025 gave both shoppers and retailers plenty of reasons to be optimistic but enough uncertainty remains to suggest ‘progress with caution’ is still the best approach.

Key trends this quarter

- Strong online spending growth, outstrips in-store growth

- Online shopping transactions at record levels

- Average shopping basket size stabilises

- Increase in spending with local retailers

- Online spending grows across all sectors and regions

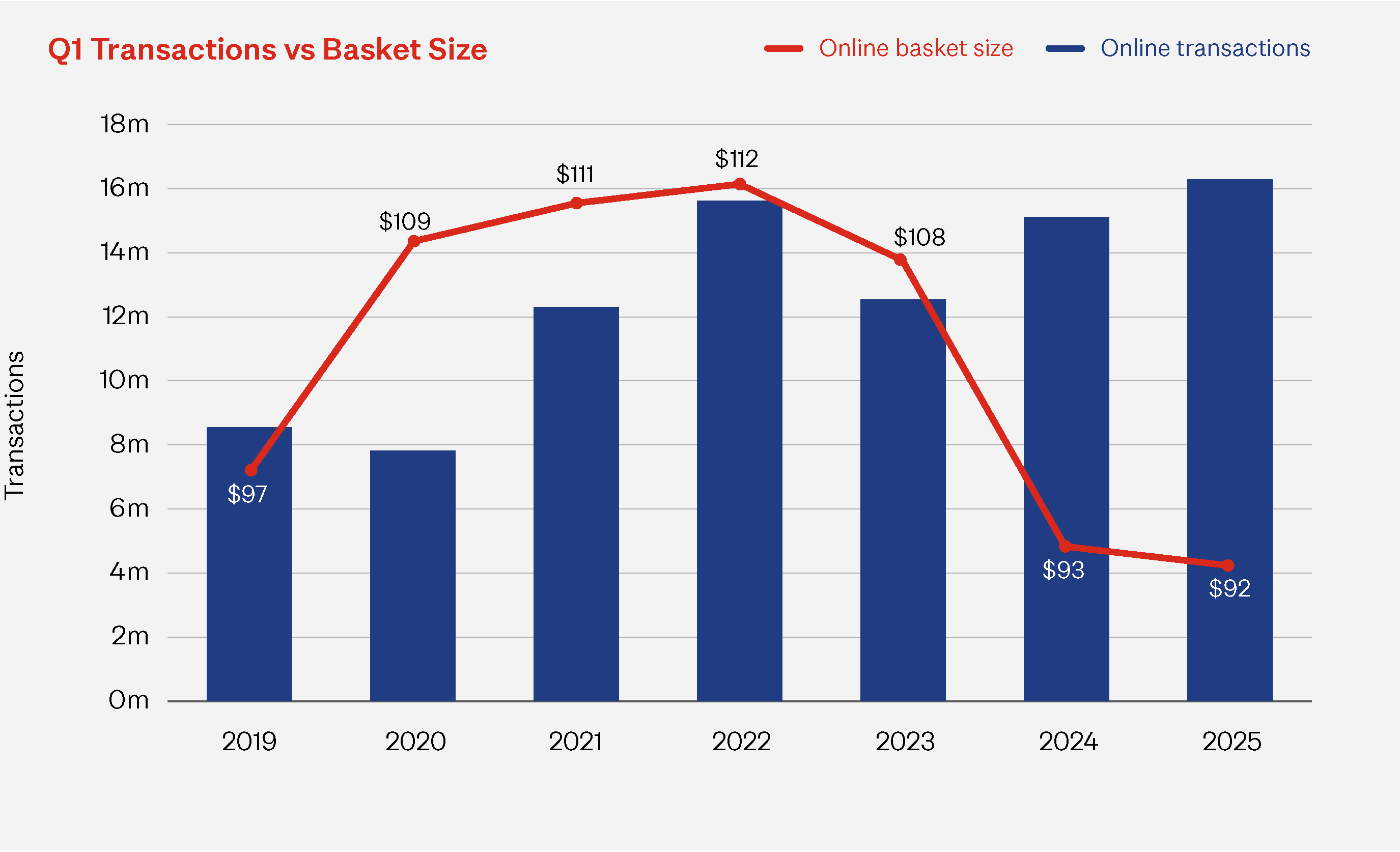

2024 saw shoppers adapt their spending to the economic conditions in search of value. Quarter by quarter, we saw transactions rise as shoppers purchased online more often. At the same time, we saw the average spend (basket size) drop each quarter as shoppers put less in their shopping cart and selected discounted items or cheaper alternatives. Retailers responded by implementing frequent promotions to maintain revenue and cashflow, further accentuating shoppers’ focus on special offers.

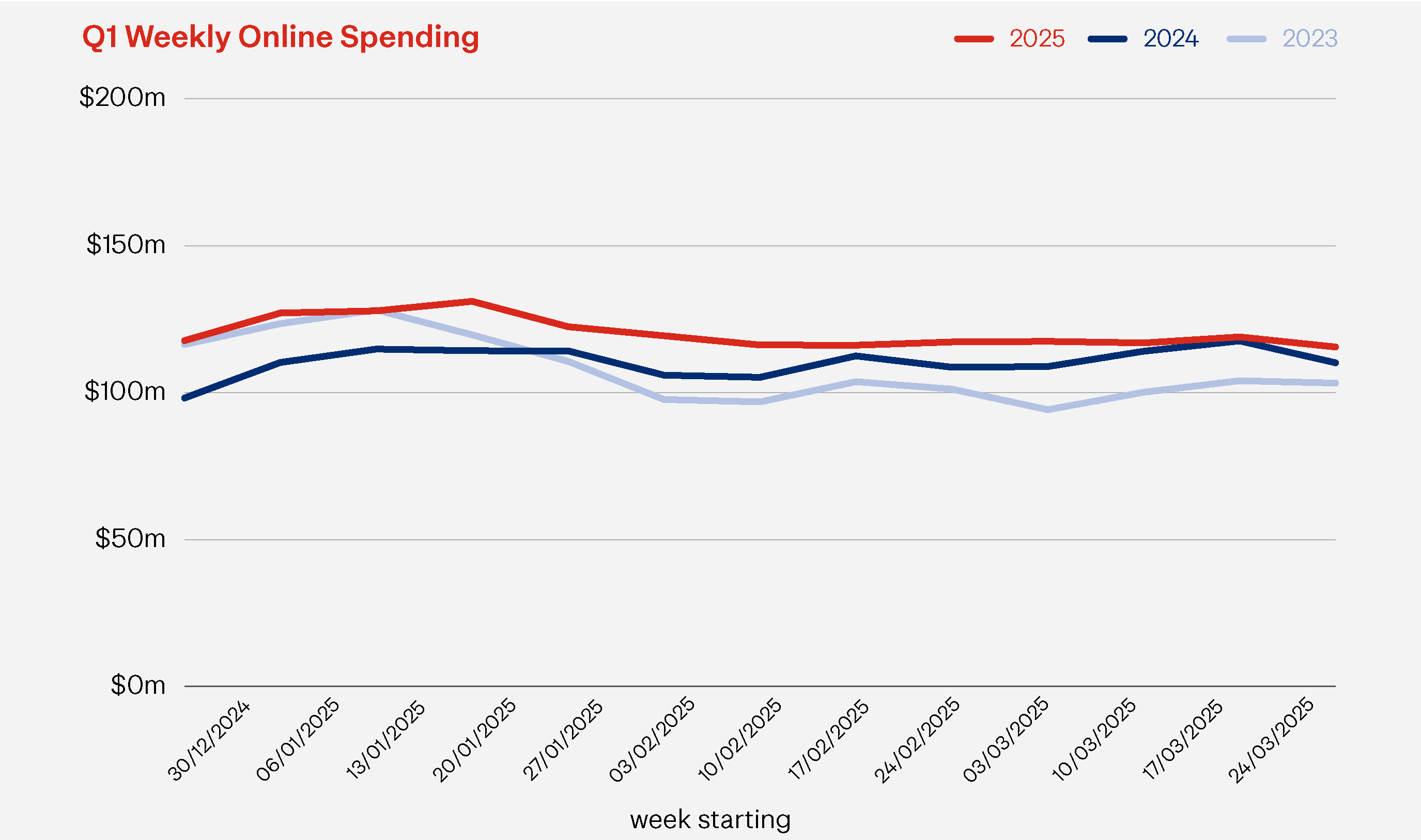

Q1 2025, once again, saw a sharp increase in transactions. However, these weren’t accompanied by the offsetting drop in average basket size. The result was $1.5 billion spent online during the quarter, nearly $100 million more than a year ago. In a quarter when annual CPI inflation was 2.5%1, a 7% lift in online spending represents real and significant growth.

This is the second best Q1 we’ve seen in the last seven years, outperformed only by Q1 2022 ($1.75b online spending) when the country was facing ‘Omicron’-related restrictions. Physical stores were closed for much of that quarter, making online the only choice for many shoppers.

Q1 2025 vs Q1 2024

Online Spending $1.5b▲ 7% | Total Retail Spending $13.6b▲ 1% | eCommerce of total spend 11.1%▲ 0.6% |

Online spending growth looks even more impressive when compared to instore spending, which was at about the same level as Q1 2024. In-store saw both transaction levels and average basket size stay at about the same level as last year. Combined, total retail spending across both online and in-store was up 1% on Q1 2024.

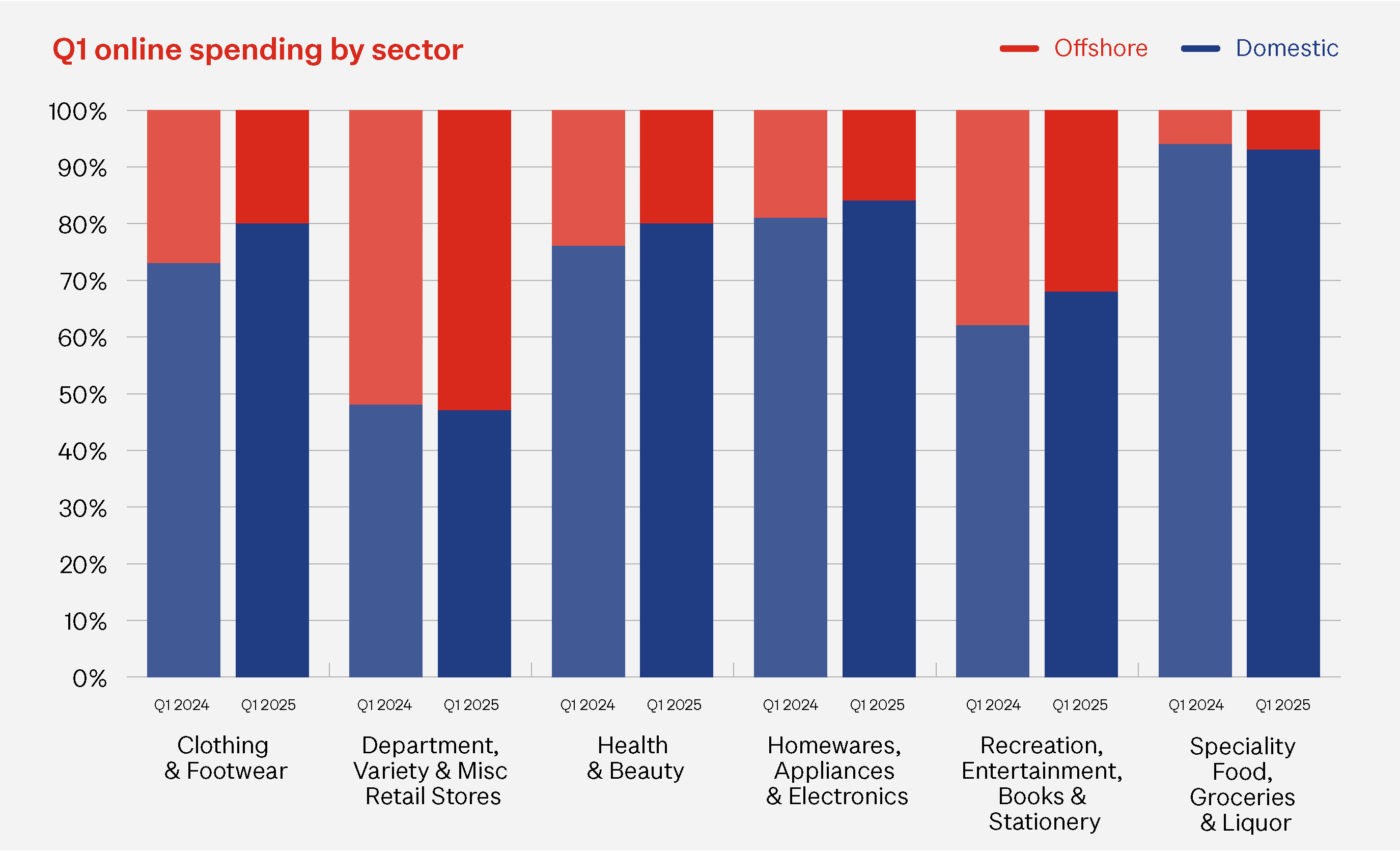

75% of online spending this quarter was with local retailers. In the last quarter of 2024, as shoppers went through the frenzy of sales event days and Christmas sales, we saw faster growth in online spending with overseas retailers compared to local retailers. This trend reversed in Q1 2025, with online spending with NZ-based businesses growing by 10%, while online spending with offshore businesses declined by 2%, compared to a year ago. This is the first quarter that we are seeing this swing back so it’s too early to know if this is a trend that will shape the local eCommerce landscape.

HELPFUL HINT

Deliver the best experience possible. A good online shopping experience can lead to higher customer satisfaction, more repeat business and more referrals. For many shoppers this means having full visibility around the products details, including stock availability, delivery timeframes and costs. Carry this experience through the delivery process, allowing shoppers to track their parcels and give their driver instructions. Even go as far as having a photo sent to them confirming their parcel was delivered.

The drivers of Q1 2025 spending

Three key factors drive online spending. Q1 2025 saw positive news across two of them and a flattening out of a downward trend in the third factor.

Drivers of growth vs Q1 2024

16.3mOnline transactions | $92Average Basket Size | 1.7mOnline Shoppers |

There were nearly 16.3 million online transactions during the first quarter of 2025 – 8% more than a year ago, and the highest Q1 transactions we’ve seen since we started monitoring the market seven years ago. Shoppers buying online more often was the single biggest driver of online shopping growth.

In Q1 2024, we saw a big $15 drop in the average basket size compared to the previous year, from $108 to $93. Shoppers were being selective about what, and how much they purchased, putting fewer items and/or discounted or cheaper alternative products in their shopping carts. In Q1 of 2025, we‘ve seen the average basket size stabilise at about the same level as last year, but still well down on the levels we had a few years ago. Demonstrating that shoppers are still watching their spending levels.

1.7 million Kiwi shoppers (~38% of the population aged 15 and over) shopped online in Q1 2025. This was 3.5% (56,000 people) more than Q1 2024, with shopper numbers growing at a slightly slower pace than the wider population. Shoppers continue to go online in search of bargains and are increasingly buying as they see them, driving up both online shopper numbers and transactions volumes.

The average online shopper in Q1 2025 (compared to Q1 2024)

| 9.7Online transactions | $898Online spend |

Q1 2025’s online sector trends

We saw growth across all online sectors, ranging from modest growth of 4% to a strong 18% growth. Growth for 4 out of 6 sectors was driven by growth in spending with NZ-based retailers. This domestic spending growth is the opposite of what we’ve been seeing in recent quarters, where shoppers were increasingly looking overseas for bargains. We’ll keep a watchful eye on this trend.

Our smallest online sector, Recreation, Entertainment, Books and Stationery led the way in online spending growth, up 18% compared to Q1 2024. Growth in the sector was driven by both increased transactions and average basket size. A 2% decline in in-store spending for the sector also suggests that some of this growth came from shoppers switching retail channels.

Clothing and Footwear also saw strong growth from Q1 2024, up 12%. The difference here was that transactions were 17% up but average basket size was down, suggesting shoppers are jumping online to find deals and discounts. In-store spending fell 4%, further supporting the idea that shoppers see online as the vehicle to deliver better value.

Q1 2025 vs Q1 2024

Clothing & Footwear +12%

| Recreation, Entertainment, +18%

| Homewares, +4%

|

Health & Beauty +9% | Department, Variety & +4% | Speciality Food, +4% |

Health and Beauty led the way in transaction growth, up 21% compared to Q1 2024, resulting in an overall online spending growth of 9%. This growth was across both essential (e.g. medicines, healthcare) and discretionary (e.g. beauty) products. In-store spending also grew by 7% over the same quarter a year ago.

Department, Variety & Miscellaneous Retail, our largest online sector, grew by 4%. This was due to large growth in the Miscellaneous Retail Stores, incorporating a wide mix of specialist online stores including Temu. The sector’s overall growth was driven by strong transaction growth and 7% growth in spending with overseas retailers. This is the only sector where more than half of the online spending and transactions were with overseas retailers.

The Homewares, Appliances and Electronics sector was up 4% online on Q1 2025, but 2% down in-store. Specialty Food, Groceries & Liquor was also up 4% online while remaining flat in the physical in-store environment. This was another sector that saw an increase in offshore spending over local.

Q1 2025’s online regional trends

Online spending in Q1 2025 grew in all regions compared to Q1 2024. The rate of growth however varied significantly, ranging from a massive 34% to a modest 1%.

- Nelson had the fastest growth rate of 34%, followed by Taranaki at 30%. It’s important to note however that these two regions only made up about 5% of New Zealand’s total online spending in the quarter.

- Wellington had the slowest growth rate of 1%. Wellington, which has been impacted by widespread public service job cuts and ongoing job uncertainty, had seen spending declines in recent quarters so this small growth represents a move in the right direction.

- Auckland, where more than a third of the country's online spending comes from, grew by 3%.

The in-store regional story for Q1 2025 is somewhat less extreme. Most regions, including Wellington, had a small level of spending growth while a handful, including Auckland, experienced a small decline.

HELPFUL HINT

Help shoppers see the value. Even in tough times, shoppers will pay a little more for things they love and things they perceive as valuable. Shoppers value unique, good quality and more sustainable products. They also love supporting local and regional businesses that have a good grassroots community story. Think about what you can do to present a better value story to your customers.

Looking ahead

Q1 2025’s strong growth numbers offer many signals that suggest some of the pressures are easing but it would be dangerous for retailers to think that the good times implied by ‘survive to 25’ are actually here.

The recent Ipsos in New Zealand report2 indicated that, despite the positive economic indicators, a quarter of Kiwis are still struggling to manage financially. And if they aren’t feeling a positive shift, chances are they’ll still display the same ‘tough times’ behaviours we’ve seen in the last few years.

The key reasons shoppers aren’t feeling the positive economic shift are: (1) disposable income is still being eroded by rising costs in unavoidable necessities, like food, insurance, rates and utilities; (2) prices remain high, even though lower inflation means they aren’t rising as fast; and (3) many consumers are still on higher fixed mortgage rates.

The good news at least is that wages are now rising at a faster rate than the cost of living (inflation), and that gives shoppers a bit more spending power in what remains an uncertain environment.

The Reserve Bank is expected to keep cutting the OCR, further improving conditions for shoppers. It may however slow these cuts down to cushion the country from the growing trade war between the US and China - our two largest trading partners. This trade war, along with more physical conflicts in the Middle East and Ukraine, are continuing to stir up economic uncertainty.

For retailers, life still remains uncertain and the pressure on profit margins is as intense as it has been in recent years. Customer spending remains tight, and costs continue to rise. Our view is that it’s ‘more than ok’ to feel optimistic about – and plan for – better times ahead, but for Q2 2025 don’t deviate too much from the customer retention and acquisition focus you’ve had over the last few years.

How we can help

We’re passionate about helping you grow your online business, through the tough times and better times ahead. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help

1 Consumers price index (CPI) | Stats NZ

2 https://www.ipsos.com/en-nz/understanding-aotearoa-new-zealand-cost-living-report-2025

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.