Online spend in October 2021 was $765 million, a massive 71% increase on October last year and 89% up on two years ago. Even compared to September 2021, which itself was a massive month, we saw an additional $82 million spent online during the month. Over October’s 31 days, online shoppers averaged nearly $25 million each day.

October 2021 (Compared to October 2020)

$765mOnline spend |

17.2%Share of retail spend |

7.1mOnline transactions |

With Auckland, Waikato and Northland physical stores closed during the month, it’s no surprise that retail store (offline) spend was 13% down on October last year. Over half (52%) of October’s offline spending was with food, liquor and grocery stores, including supermarkets. This was the only sector to show any physical store growth compared to October the year before.

Interestingly, overall retail spending (combined online and offline) was 5% down on October 2020, possibly suggesting that the uncertain economic conditions New Zealanders are living with are being reflected in their wallet.

In October, online shopping represented 17.2% of all nationwide retail. This is one of the highest monthly percentages we’ve seen in the last three years, second only to April 2020. Pre-lockdown in 2021 this number hovered at around 11 to 12%. If we exclude the Food, Groceries & Liquor sector, which was largely available both online and offline during October, online made up a massive 26% of October’s retail spend across the other sectors. This further highlights just how big the shift to online has been.

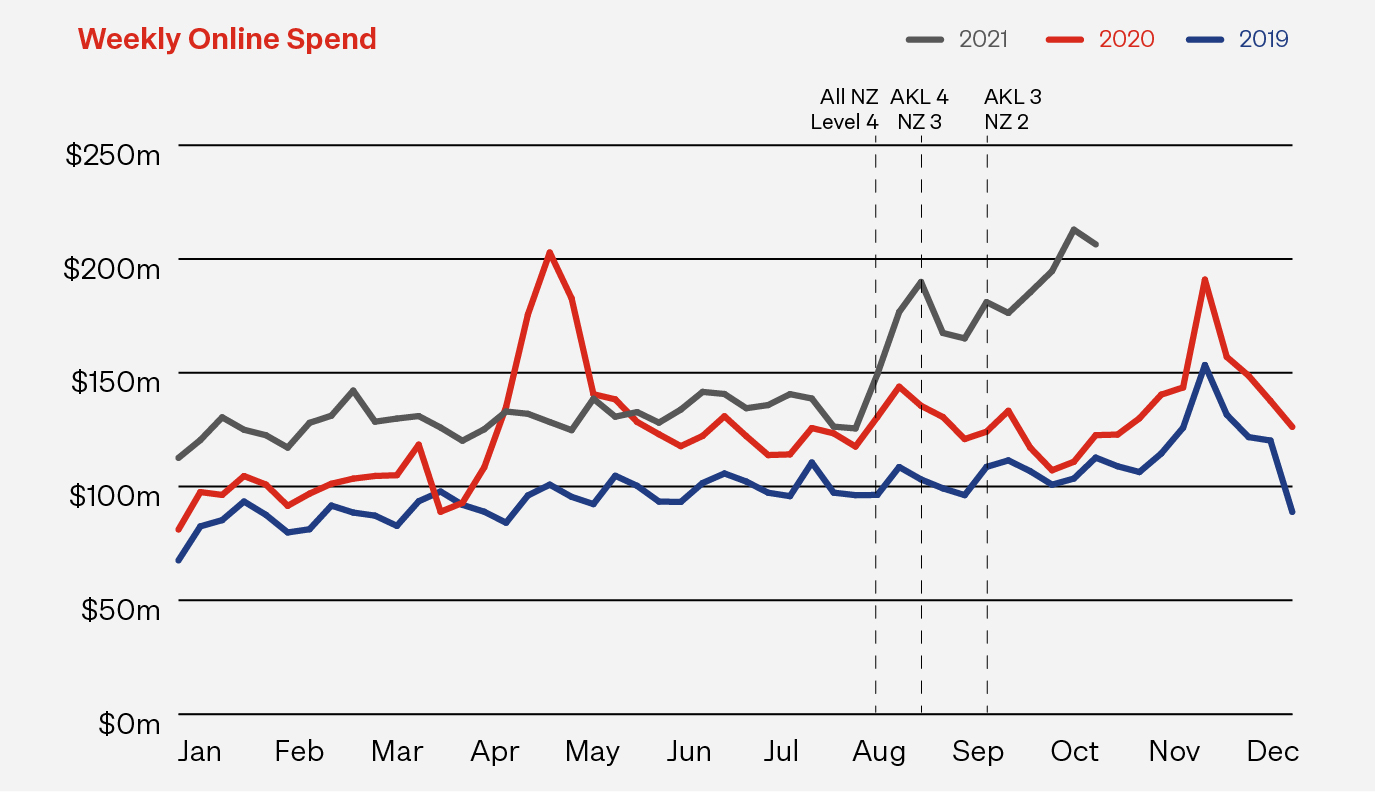

This shift to online has not only been sizeable but it happened at speed, with weekly online spend at the end of October up 64% compared to the last week before lockdown (w/c 09 August 2021). Online shopping transactions increased by 49% over this same period – that’s over half a million more online transactions per week.

To the extent possible online retailers have geared up for this new paradigm. At the same time, many physical retailers have adapted by improving the eCommerce functionality on their website and introducing delivery and click & collect options. But with such a seismic and swift shift, the eCommerce industry has been understandably challenged by the volumes.

A further factor, adding to growth for Kiwi online retailers is shoppers' continued preference for buying local. Two years ago, domestic spend made up about two-thirds of all online shopping. We’ve seen this steadily rise, with lockdowns keeping local sentiment high. In October, 74% of all online spend was with Kiwi retailers.

For the first ten months of 2021, online spend has been 18% higher than the same period last year and almost 50% up on two years ago.

Year to Date 2021 (Compared to 2020)

$5.5bOnline spend |

13%Share of retail spend |

52.3mOnline transactions |

The other big driver, fuelling volumes for local retailers, is the number of people shopping online. In October 2021, 1.5 million Kiwis shopped online, up 24% on the year before, and representing over 300,000 more online shoppers.

Not surprisingly, online shoppers are also buying more often. In October, the average online shopper made 4.6 online transactions (up from 3.2 a year ago). This means that, on average, shoppers are buying something online every week.

Even though there are more people online, buying more often, we continue to see the average spend of each purchase coming down. This is a trend we’ve seen all year, reflecting that online spending has become a channel for ‘everyday spending’ and not just the domain for higher value discretionary spending it may have been before. During October, the average transaction (basket size) was $107, that’s $4 down on the year before.

Combining all these factors, the average shopper spent $492 online in October 2021. That’s $135 more (38%) than they were spending in October 2020.

October 2021 (Compared to October 2020)

1.5mOnline shoppers |

4.6Average online transactions |

$107Average online basket size |

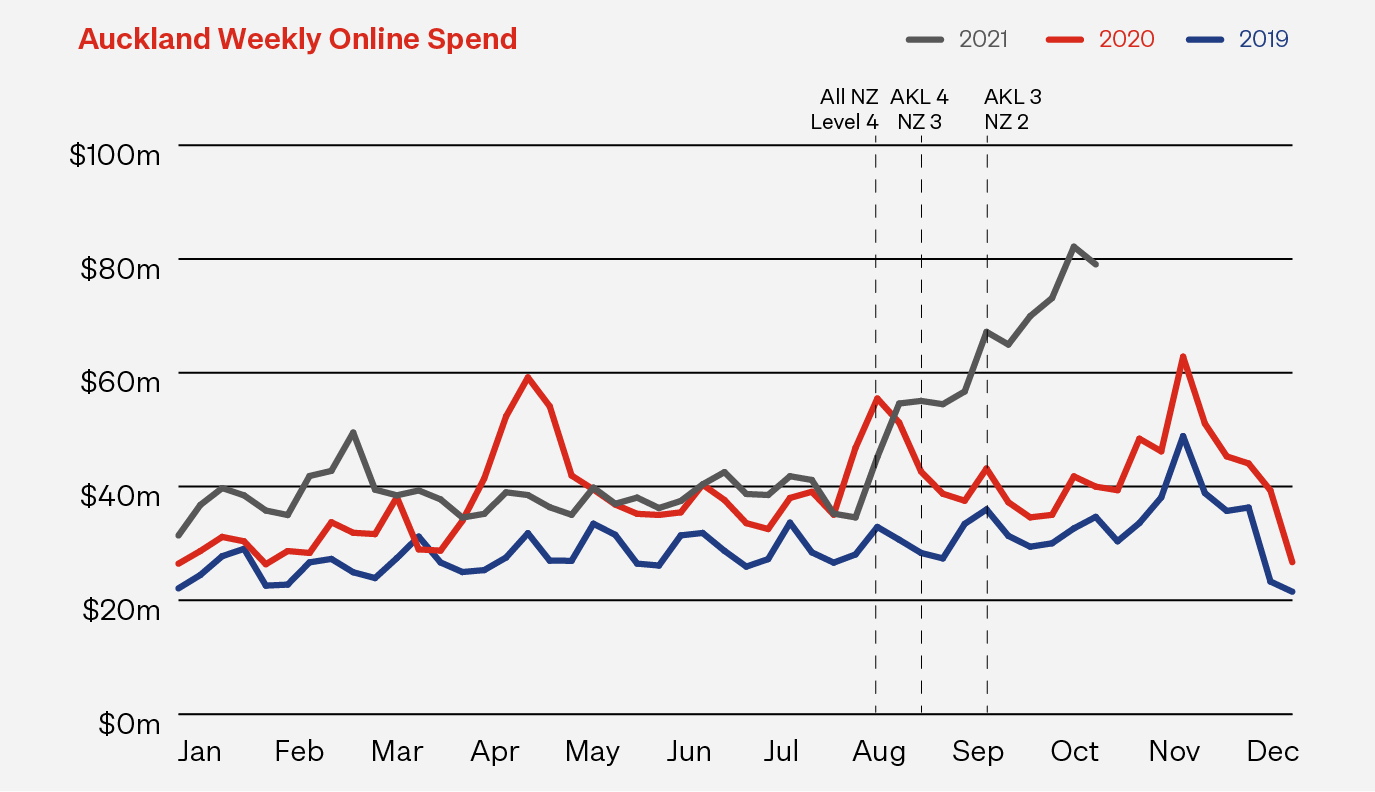

Auckland leads the way

As you’d expect, Auckland experienced the strongest regional growth in monthly online spend, with October 2021 spend more than double (110%) October 2020 spend. Waikato and Northland, the two other regions affected by lockdown in October, also saw strong growth, with online spending up 76% and 60% on October 2020.

Six interesting facts about Auckland’s spend in October 2021:

- At $362 million, Aucklander’s online spending made up nearly half (47%) of New Zealand's total online spending for the month.

- Nearly 650,000 Aucklanders shopped online. This represents 47% of Auckland’s adult population aged over 15*.

- There were 3.25 million online transactions made by Aucklanders during the month – that’s over 100,000 online purchases a day.

- The average Aucklander made 5 online purchases (up from 3 in October 2020) and they spent $558 ($190 more than October 2020).

- The average online transaction was $112: $12 less than the same month one year earlier.

- When we compare the week prior to lockdown (w/c 9 August 2021) to the last week of October, weekly online spending in Auckland is up a huge 129% . This growth is driven by a 152% increase in transaction volumes in the same period.

* Statistics NZ (22 October 2021) Subnational population estimates: At 30 June 2021 (provisional)

Source: Datamine RetailWatch

A sector view

Clothing & Footwear; Homewares, Appliances & Electronics; and Department, Variety & Miscellaneous Retail had the highest growth in online spending for the month compared to October a year ago.

October 2021 (Compared to October 2020)

+85%Clothing & Footwear |

+84%Homewares, Appliances |

+83%Department, Variety |

Interestingly, Homewares, Appliances & Electronics has had a particularly strong period in lockdown, when you consider it in the context of the rest of the year where growth has been a modest 8%. The sector saw the same growth spikes during lockdowns in 2020, as Kiwis looked to improve the place where they spent so much more time.

Auckland drove the strong performance of these three leading sectors. In Auckland, Clothing & Footwear was up 139%; Homewares, Appliances & Electronics was up 114%; and Department, Variety & Miscellaneous Retail was up 141%.

Nationally, for the first ten months of 2021, it’s Clothing & Footwear (31%); Department, Variety & Miscellaneous Retail (24%); and Recreation, Entertainment, Books & Stationary (20%) that have shown the highest levels of growth. Health & Beauty, at 7%, has seen the lowest levels of growth.

Buy Now Pay Later also continued to grow strongly, with a monthly increase of 62% compared to October 2020 and 133% compared to October 2019. 2021 has been a big year so far for deferred payment services, up 40% on the same period in 2020.

Looking Ahead

November is traditionally a big online sales month with Singles Day, Black Friday and Cyber Monday sales events, plus the start of Christmas promotions. Despite the challenges with stock delays, processing volumes, and timely delivery, we are still seeing retailers embrace the sales opportunities ahead. Already we see a trend emerging with many retailers running ‘sale weeks’ or ‘sale month’ instead of the traditional ‘sale days.’

The limited opening of physical retail in Auckland (Alert Level 3.2) is a welcome relief for many shoppers, especially those who enjoy a physical in-store experience. Despite open stores, we expect online sales numbers for November, and the rest of the year, to once again reach new highs.

We anticipate that annual online spending will reach around $7.26 billion for 2021. That’s about 25% higher than 2020, which in itself was 25% on 2019.

Retailers, suppliers, delivery partners, and other industry players are gearing up for these unprecedented volumes but increased strain on the supply chain will no doubt lead to more frustrations for all involved. A little patience will be needed at all stages of the purchase process.

Note: To help you stay up to date with what’s happening during this period of unprecedented online growth, we will produce another eCommerce Spotlight update in December. We’ll then produce our regular quarterly update of online spending in January 2022.