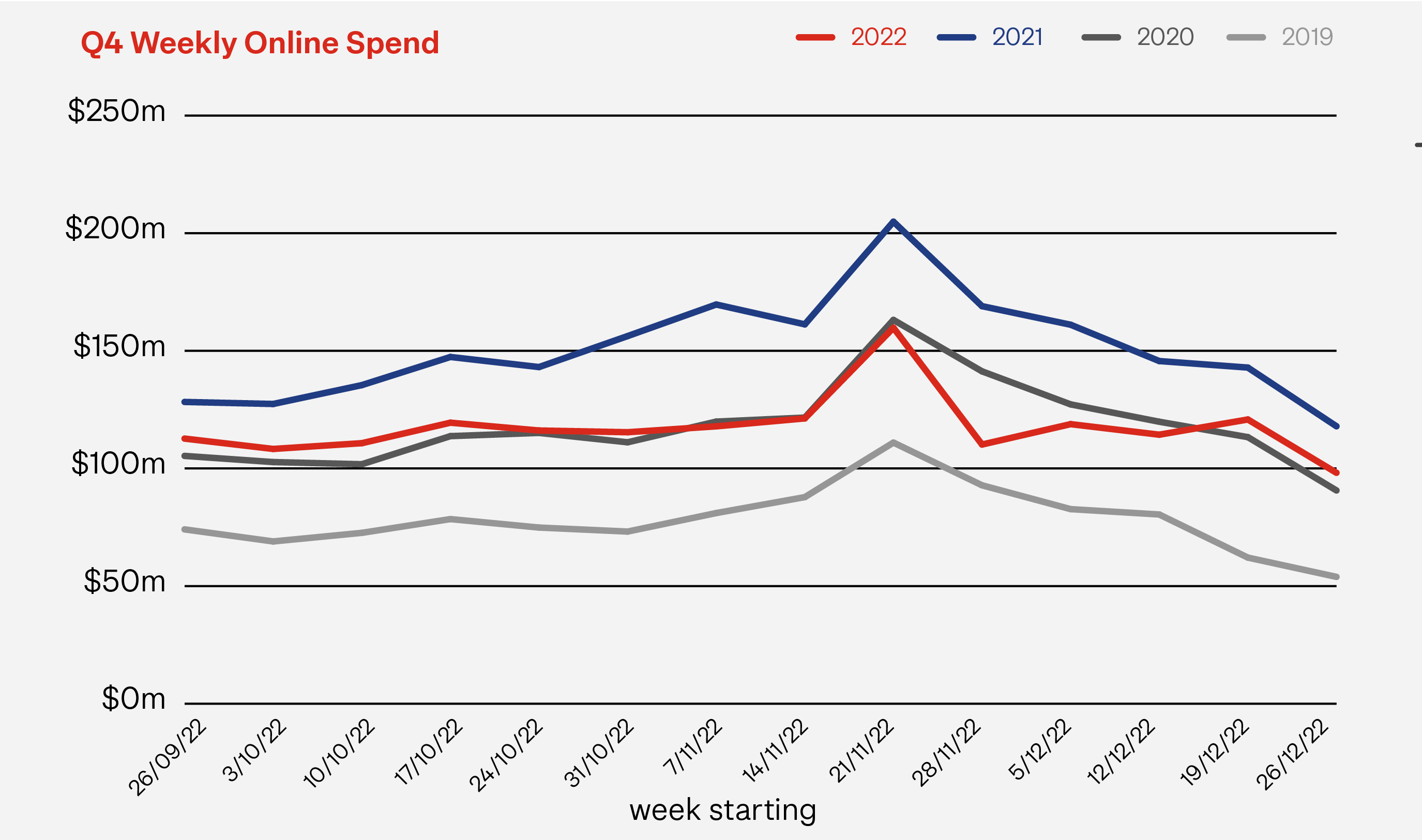

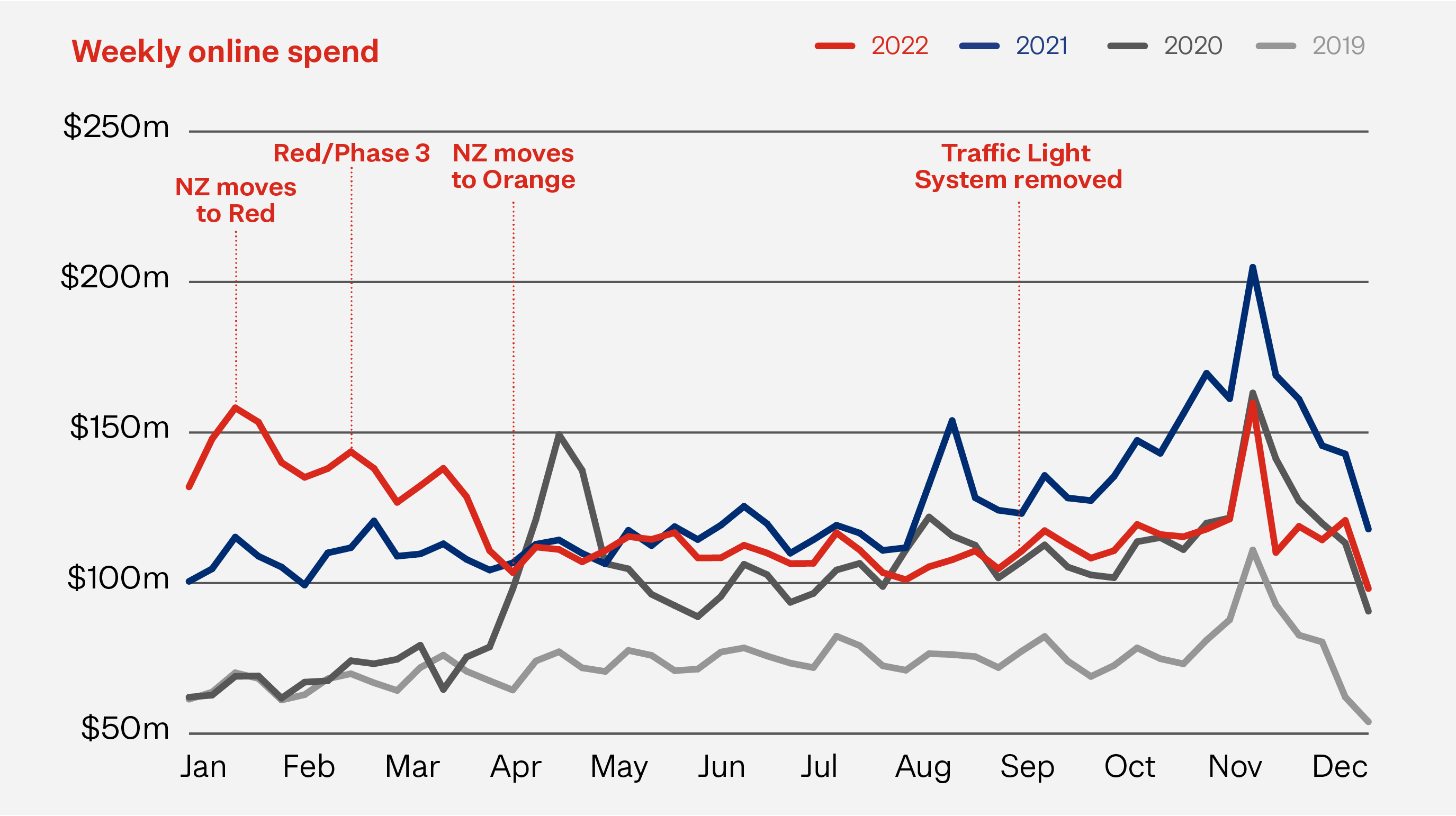

Throughout 2022 we’ve seen online shoppers progressively tighten their belts, resulting in significant spending declines. With high inflation and declining economic confidence, the last quarter of 2022 (Q4 2022) saw online shoppers show real restraint through the big sales events and the lead into Christmas. Combined with physical stores open again, the result was the largest quarterly decline in online spending we’ve seen this year. This isn’t helped by comparing this Q4 2022 to the last quarter of 2021, the biggest quarter we’ve had online in the last five years.

Boxing Day and December 2022

Traditionally, the Boxing Day sales have been part of ‘how Kiwis spend summer’ but in 2022 the tills were definitely not ringing as loudly. Overall Boxing Day 2022 spending, across online and instore, was $165 million, making it the lowest Boxing Day spend we’ve seen since we started monitoring spending in 2019. At 7% lower than Boxing Day 2021 and 2019, this year’s sales number show that the Boxing Day sales aren’t as popular as they once were.

Boxing Day 2022 (compared to 2021)

-27%Online spending |

-5%In-store spending |

-7%Total spending |

Online, Kiwis spent $13.5 million this Boxing Day – down 27% from 2021 – making 25% fewer online transactions and spending around $4 less each time. But it wasn’t a case of online shoppers taking advantage of the holidays and the freedom of not having restrictions this year, to get out to the stores. In-store spending on Boxing Day 2022 was also down, 5% lower than in 2021 and 9% lower than 2019.

Despite underperforming, Boxing Day was the peak of a December that looked very different to previous years. Most years we see online spending remain high following the Black Friday/Cyber Monday sales, followed by a slow steady decline through to Christmas. This year we saw a large decline in late November, followed by a slight increase and a levelling out to Boxing Day. It seems that shoppers either did their Christmas shopping in November’s sales, reduced their spending this festive season or prioritised spending in non-retail areas like travel, entertainment and hospitality.

December’s online spending was $480 million, down 23% from December 2021 and 7% below 2020. This is not surprising, given there was 267,000 (15%) fewer Kiwis shopping online during the month, buying less often, and spending on average around $2.07 less each time.

December 2022 (compared to 2021)

-23%Online spending |

-5%In-store spending |

-7%Total spending |

Instore didn’t fare too much better this last December with sales down 5% compared to December 2021, a month which saw a number of regions impacted by retail restrictions. Total spending, across both online and instore, in December 2022 was $5.75 billion, down 7% from December 2021.

Q4 2022 Spending

Kiwis spent $1.5 billion on physical goods online during Q4 2022, down over $422m (22%) on the same quarter in 2021. It’s important to remember however that Q4 2021 was the largest online quarter we’ve seen, driven by COVID restrictions in some parts of the country during the sales events period. This no doubt contributed to an exaggerated decline that would probably otherwise been a smaller quarterly correction. For context, Q4 2022 is still nearly 50% up on pre-pandemic Q4 2019.

Q4 2022

$1.5bOnline spending |

-22%Online spending vs. Q4 2021 |

+49%Online spending vs. Q4 2019 |

This is the third consecutive quarter when online spending has fallen compared to the same quarter in 2021. The rate of decline has increased each quarter (-2% for Q2, -12% for Q3 and -22% for Q4). While the declines of Q3 and Q4 can be partially explained by reduced instore restrictions and the reopening of travel, hospitality and entertainment, the increasing decline is certainly an indication of the progressive impact the economy is having on shopper behaviour.

For the second year in a row, the Wednesday before Black Friday was the biggest online shopping day for the quarter, followed by Cyber Monday and Black Friday. Retailers seem to have clicked to this opportunity, starting their Event Days sales earlier. For a deeper analysis on shopping numbers for November’s big sales event, please refer to:

https://www.nzpostbusinessiq.co.nz/latest-ecommerce-insights/sales-events-review-2022

Even with the tougher economic conditions, Kiwis continued to support local online retailers with 70% of their online spending with NZ-based retailers during Q4 2022.

Instore spending reached over $14 billion in Q4 2022, only 4% higher than Q4 2021, when lockdowns restricted instore shopping in some regions, including Auckland. While at first glance this may suggest shoppers returned to physical stores, spending is only just above Q4 2020 and only 9% above pre-pandemic Q4 2019 levels. Overall total retail spending on physical goods - online and in-store - was up just 1% on Q4 2021, despite high inflation, driven exclusively by the growth of instore spending. Ecommerce represented 10% of the quarter’s total retail spend, down from 13% in Q4 2021 but well up on Q4 2019’s 7%.

Drivers of Q4 2022 online spending

Our three key online sales drivers – transactions, number of shoppers, and basket size - were all in decline this quarter. As a result, there were fewer people shopping online, they purchased less often, and spent less each time. The average online shopper made 7.6 online transactions during the quarter, down from 8.1 transactions a year ago. They spent $841, a massive $68 less than they did in Q4 2021.

Q4 2022 (compared to Q4 2021)

-20%Transactions |

-2%Average basket size |

-13%Online shoppers |

- Transactions: Kiwis made more than 13.6 million online transactions in Q4 2022, which equates to nearly 150,000 transactions per day. While this sounds like a big number, transaction volumes for the quarter were nearly 3.5 million (20%) down on the same quarter in 2021. Transaction levels fell to just above 2020 levels but remained well above (40%) pre-pandemic Q4 2019.

- Average basket size: Basket size reflects the value of each transaction. Despite inflation running at over 7%, the average online basket size was down 2%, to $110.89, compared to Q4 2021. Shoppers managed their financial pressures by purchasing fewer items per transaction and by substituting items for lower cost-equivalents. The average basket size remained 7% higher than pre-pandemic Q4 2019.

- Online shoppers: Over 1.63 million Kiwis shopped online during Q4 2022, down nearly 245,000 people (13%) compared to Q4 2021. About 39% of all Kiwis aged 15 and over shopped online in Q4 2022, down from 46% in Q4 2021 but a similar level to the same quarter in 2020.

Q4 2022’s other big trends

What online shoppers bought

- Apart from Health & Beauty, all sectors experienced a significant double digit decrease in online spend compared to Q4 2021. Health & Beauty’s spend was about the same as Q4 2021, 20% higher than Q4 2020 and 73% higher than Q4 2019. This stronger performance of Health & Beauty is driven by spend on essential items like drug store, pharmacy and optical goods.

- Homewares, Appliances & Electronics (down 37%) was the quarter’s fastest declining sector for spend compared to Q4 2021. This was followed by Department, Variety, & Miscellaneous Retail Stores, down 23%.

- Speciality Food, Groceries & Liquor spending fell 17% on Q4 2021 but remained 51% up on Q4 2019. Like Health & Beauty, the experience for essential vs non-essential goods within the sector was very different. Grocery Stores and Supermarkets fell by 7% while Liquor Stores fell by 44% compared to Q4 2021.

- Buy Now, Pay Later continued its charge, up 11% compared to Q4 2021 and 171% up on to Q4 2019. This rapid growth reflects its growing popularity, its extended availability, and also the critical role it's playing in helping Kiwis continue shopping during financially difficult times.

Where online spend came from

- Online spending fell across all regions compared to Q4 2021. Auckland experienced the largest decline, down 31% on Q4 2021 when the region was in lockdown. Waikato and Northland, which were also affected by restrictions in Q4 2021, had the next largest declines in spending of 18% and 16% respectively.

- Online spending declined across the remaining regions, ranging from 5% in Gisborne through 14% in Bay of Plenty.

- Online spending remains well above pre-pandemic levels throughout the country.

For a review of 2022’s full year numbers and trends, please refer to https://www.nzpostbusinessiq.co.nz/latest-ecommerce-insights/2022-ecommerce-review

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.