Following a number of years of strong organic growth, the COVID pandemic elevated online shopping to new levels in 2020 and 2021, changing the retail landscape and making it an essential part of how Kiwis buy physical goods. Lockdowns and restrictions introduced many to the convenience of shopping online, at one point drawing around half of the population over the age of 15. It also forced retailers to adapt, adding digital channels they once saw as the competition.

As a result, annual online shopping spending peaked in 2021 at nearly 70% above 2019 pre-pandemic levels. This was a blessing and curse for online retailers, who had to work hard to manage significant demand in a period of change and extensive supply chain disruption.

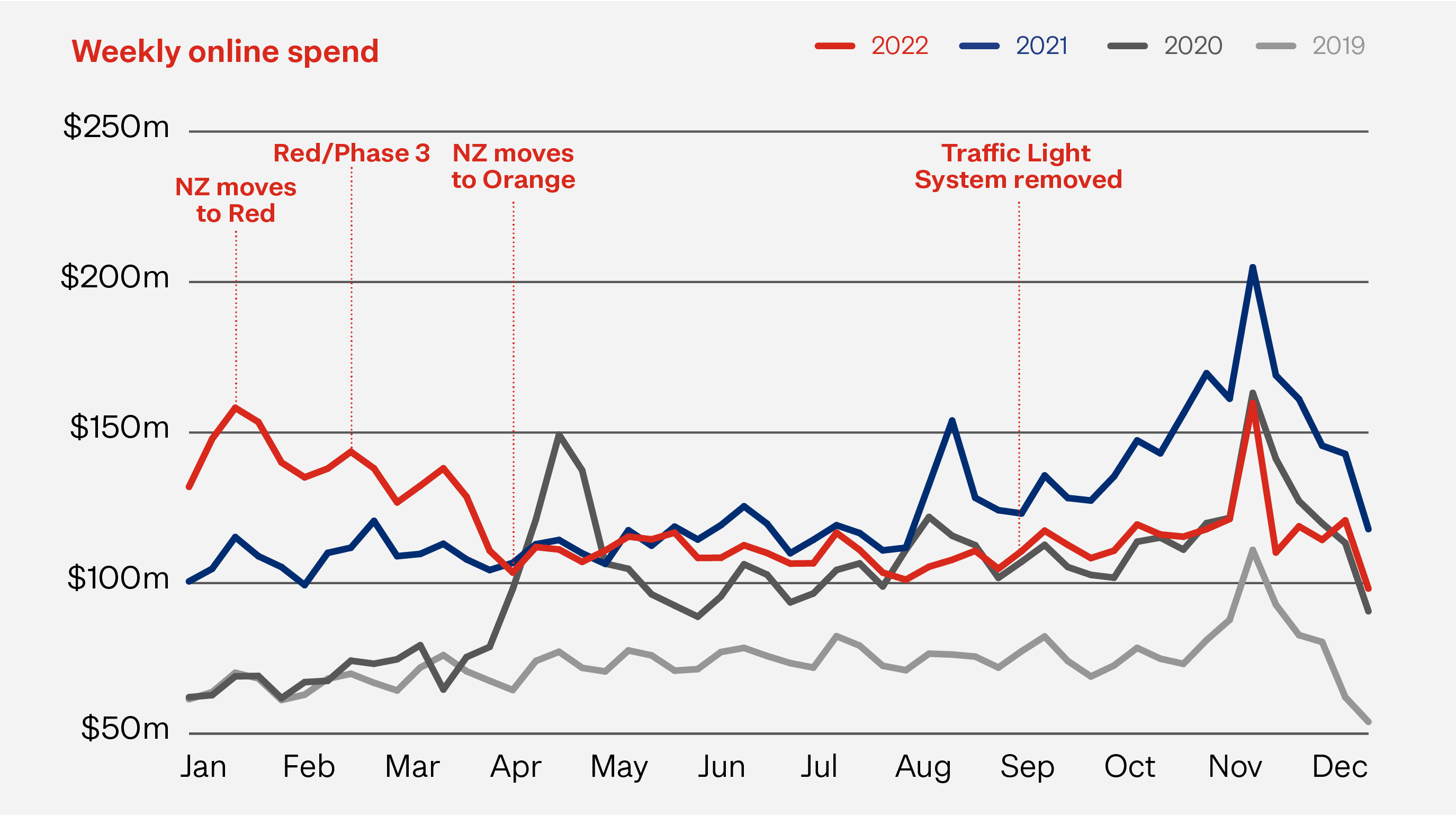

2022 started with the emergence of Omicron, a new and more transmittable COVID variant, leading to further restrictions. A ‘return to normal’ came in the second quarter with Kiwis embracing the freedom to travel, to once again go to cafes, bars and restaurants and to seek out experiences that were denied them in the previous two years.

There was always going to be some correction to online’s hyper-growth in the aftermath of COVID restrictions. What wasn’t expected was the ‘inflation pandemic’ that also followed, characterised by higher prices, rising interest rates, a declining housing market, and a decline in real wages. Kiwis responded by cutting back their online spending over the rest of 2022.

As a result, online spending for 2022 ended up 4% below the highs of 2021, characterised by a strong first quarter and three quarters of increasingly larger spending declines compared to the same period in 2021.

2022’s top line numbers

Online spending reached $6.07 billion for 2022. Given what a tough year it was for shoppers and retailers, ending up just 4% below 2021’s record levels is arguably a strong result. Just as important, online spending in 2022 remained well up on pre-pandemic levels.

2022 Online retail spending

-4%On 2021 |

+20%On 2020 |

+62%On 2019 spending |

The 2022 annual result was driven by a strong start to the year as Omicron led to instore restrictions through to April. While declining compared to the preceding months, online spend in the first quarter was higher compared to the same quarter one year earlier. As instore shopping restrictions eased, and inflationary pressures kicked in, online spending levels settled at levels that closely mirrored 2020 levels for the rest of 2022.

73% of online spending was with NZ-based businesses as local shoppers continued the ‘support local’ trend they started through COVID. In 2019, only 60% of spend was going locally.

Physical retail stores enjoyed a better year in 2022 than in both 2021 and 2020, with a much longer stretch without shopper restrictions and spend from tourists as borders reopened. Instore spending for 2022 was $51 billion, up 7% on 2021, driven largely by an increase in instore transactions. 2022’s instore spend was 13% above pre-pandemic 2019 levels.

Overall total retail spending on physical goods – across online and instore - was $57 billion for 2022, up 6% on 2021. This was solely driven by the growth of instore spending. Online’s overall 2022 spending decline saw eCommerce penetration drop to 11% of total retail spending, down from 12% in 2021 but still well up on the 8% of pre-pandemic 2019.

2022 retail spending

+7%Instore spend (on 2021) |

+6%Total retail spend (on 2021) |

+16%Total retail spend (on 2021) |

In a year characterised by worsening economic conditions, continued (but diminishing) product and supply chain disruptions and significant staff shortage across most sectors, a return to even modest levels of growth was welcomed by the retail sector.

Key drivers of online spend in 2022

The most significant driver of online spending decline in 2022 was the decline in transaction numbers, indicating Kiwis shopped online less often than in 2021. The impact of this decline was partially offset by small increases in the average spend per transaction (basket size) but further compounded by an 8% decrease in online shopper numbers.

As a result, we see that the average shopper in 2022 made 27 transactions, with an average spend over the year of $3,083.

2022 online spend drivers

-5%Transactions vs. 2021 |

+1%Average basket size vs. 2021 |

-13%Online shoppers Q4 2022 vs. Q4 2021 |

- Transactions: Kiwis made just under 53.9 million online transactions in 2022, at an average of 147,655 per day. This is 3.1 million fewer transactions than the year before, down 5%. Online transaction levels remained 19% higher than 2020 and 45% higher than pre-pandemic 2019.

- Average basket size: The average online basket in 2022 was $112.63, up 1% ($1.65) on 2021. Given that inflation was running at over 7% for most of the year, we would have expected this number to be higher. This suggests shoppers managed the tougher economic condition by buying fewer items per transaction and/or substituting goods for lower cost alternatives. The average basket size was about the same as 2020 but remained 12% higher than pre-pandemic 2019’s level.

- Shopper numbers: During the year, we saw an overall downward trend in the number of Kiwis shopping online. Monthly online shopper numbers fell below 2021 levels in April before flattening and then rising again for Sales Events in November. Online shopper numbers fell 13% in Q4 2022 compared to Q4 2021.

What Kiwis bought online in 2022

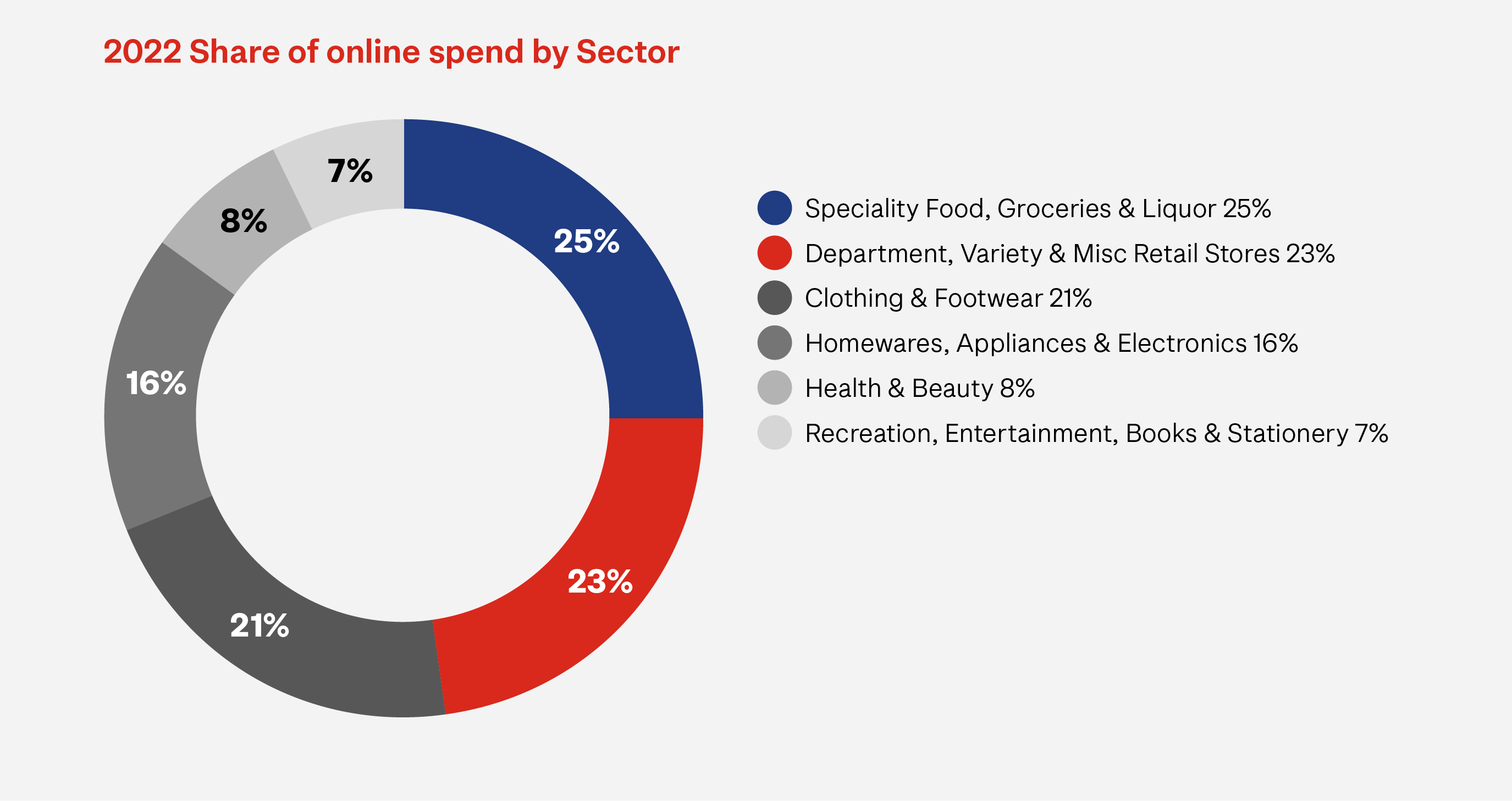

Faced with economic headwinds, shoppers focused their online spend on essentials items in 2022.

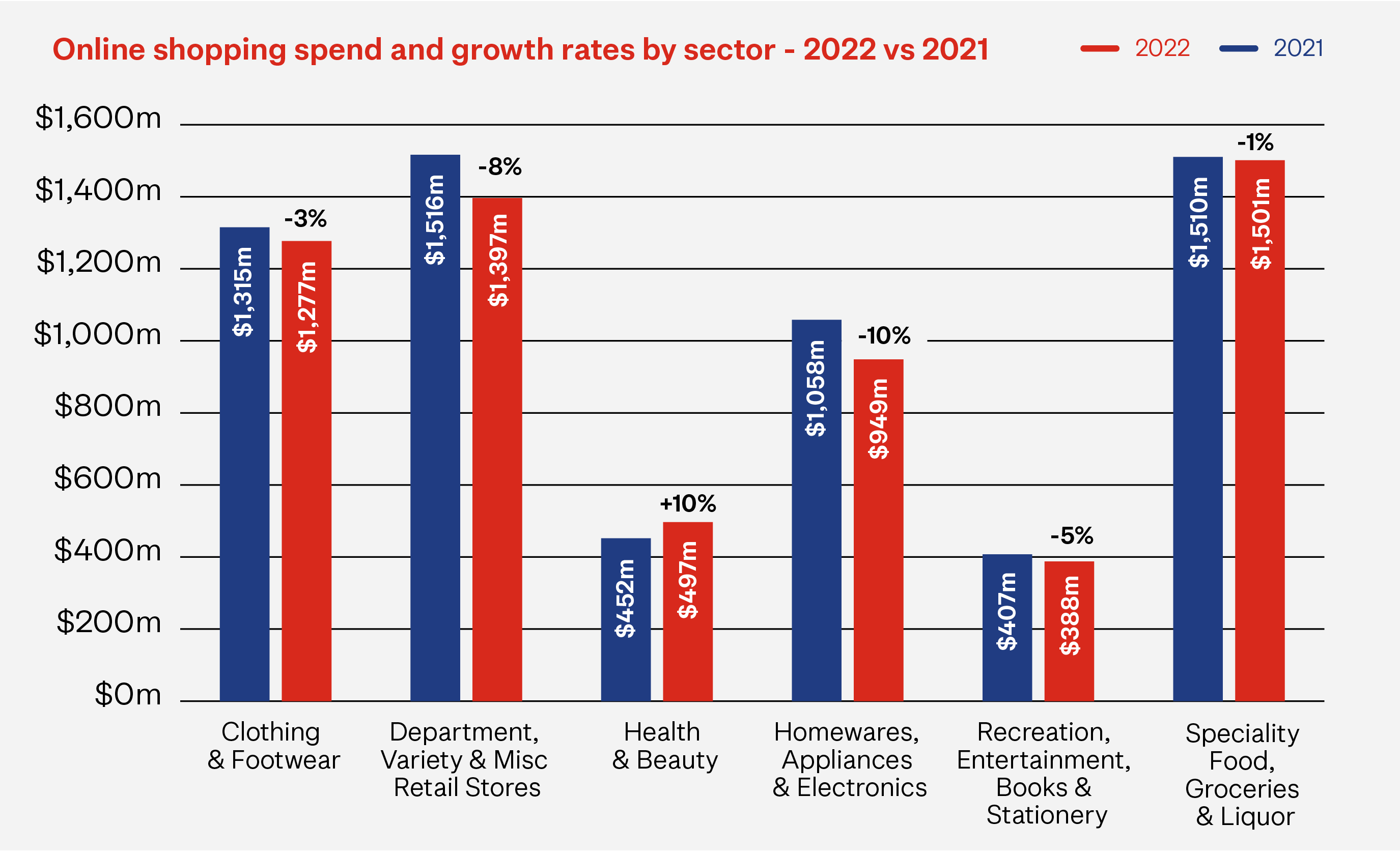

While total spending overall (online and instore) increased across all sectors in 2022 compared to 2021, Health & Beauty was the only online sector to experience positive growth in spending. A 10% increase in online spending was driven by strong growth in essentials like ‘drug stores & pharmacies’ (up 22%) and ‘misc. medical’ (up 24%). Sector spending on discretionary, non-essentials, like cosmetics (-7%) declined.

All other sectors experienced an annual online spending decline with Speciality Food, Groceries & Liquor experiencing the slowest decline (down 1%). Within this sector, we see two stories with essential items like ‘grocery stores and supermarkets’ (up 11%) compared to non-essential like ‘liquor stores’ (down 22%).

Homewares, Appliances & Electronics was the sector with the largest decline (10%) in online spending in 2022. It’s a sector with many higher cost, and discretionary spend, items and therefore it makes sense that spend in the sector would be most impacted as shopper tightened their belts. Furthermore, it’s also the sector most likely to be impacted as restrictions reduced and shoppers returned some of their discretionary spend to travel, hospitality and entertainment.

Tougher economic conditions are also likely to be behind the sales growth (2%) experienced by online marketplaces. Marketplaces allow shoppers to easily compare prices and offer regular deals, making them ideal for those looking for savings. Shoppers also looked for increased help to afford their purchases, resulting in the continued growth of Buy Now Pay Later in 2022, up 29% on 2021. This is the third straight year of strong spend growth, with 2022 Buy Now Pay Later levels over three times those of 2019.

Changes in online spend by shopper demographics

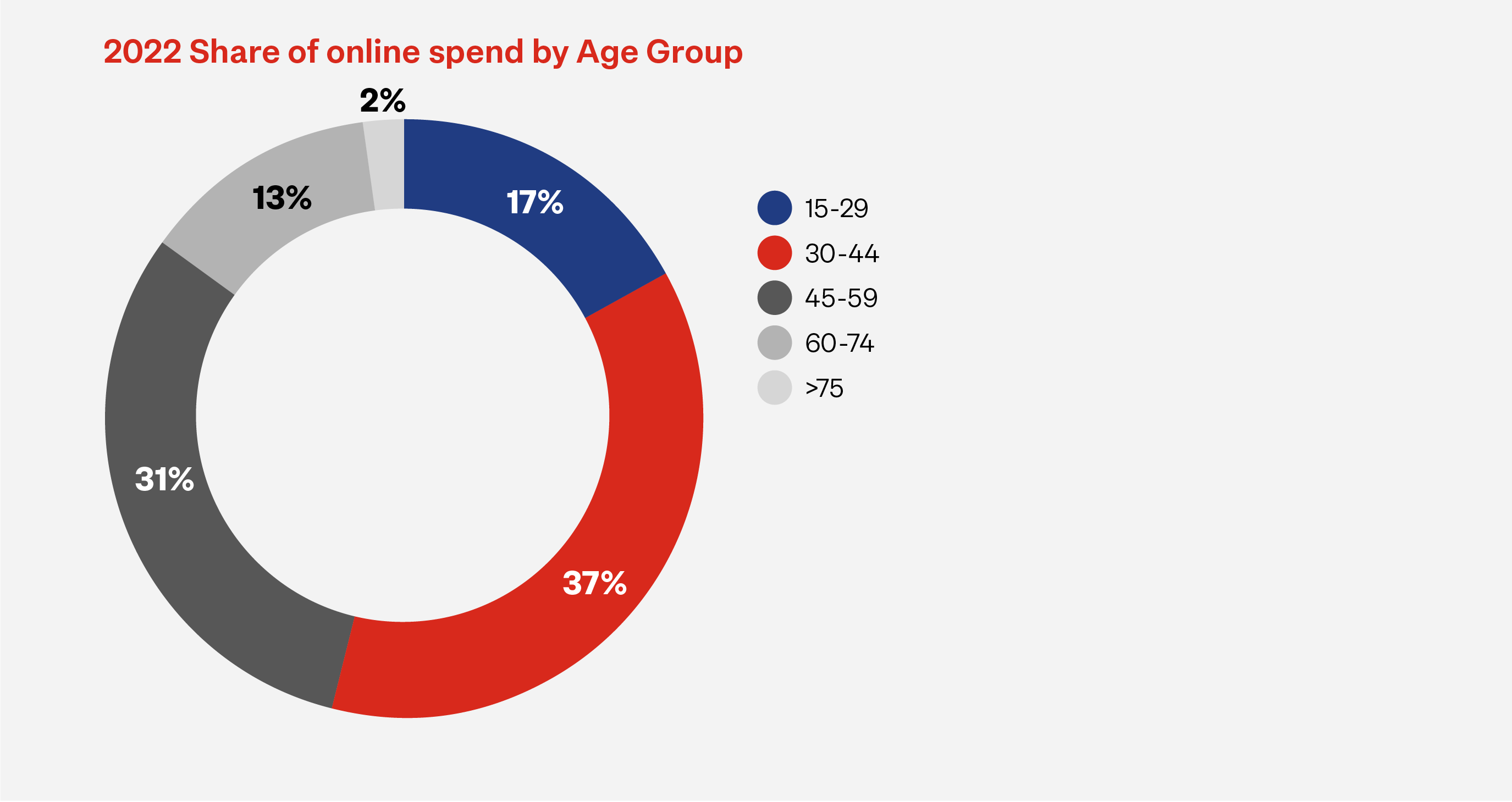

Online shoppers aged 30-44 years old continue to represent the largest share of online spending (37%), followed by 45-59 year olds (31%). Between them – shoppers aged between 30-59 – make up two-thirds of online shopping spend.

Online shoppers aged 15-29 had the greatest decline in spending in 2022, presumably because they have lower discretionary income and are therefore proportionately more impacted by the economy.

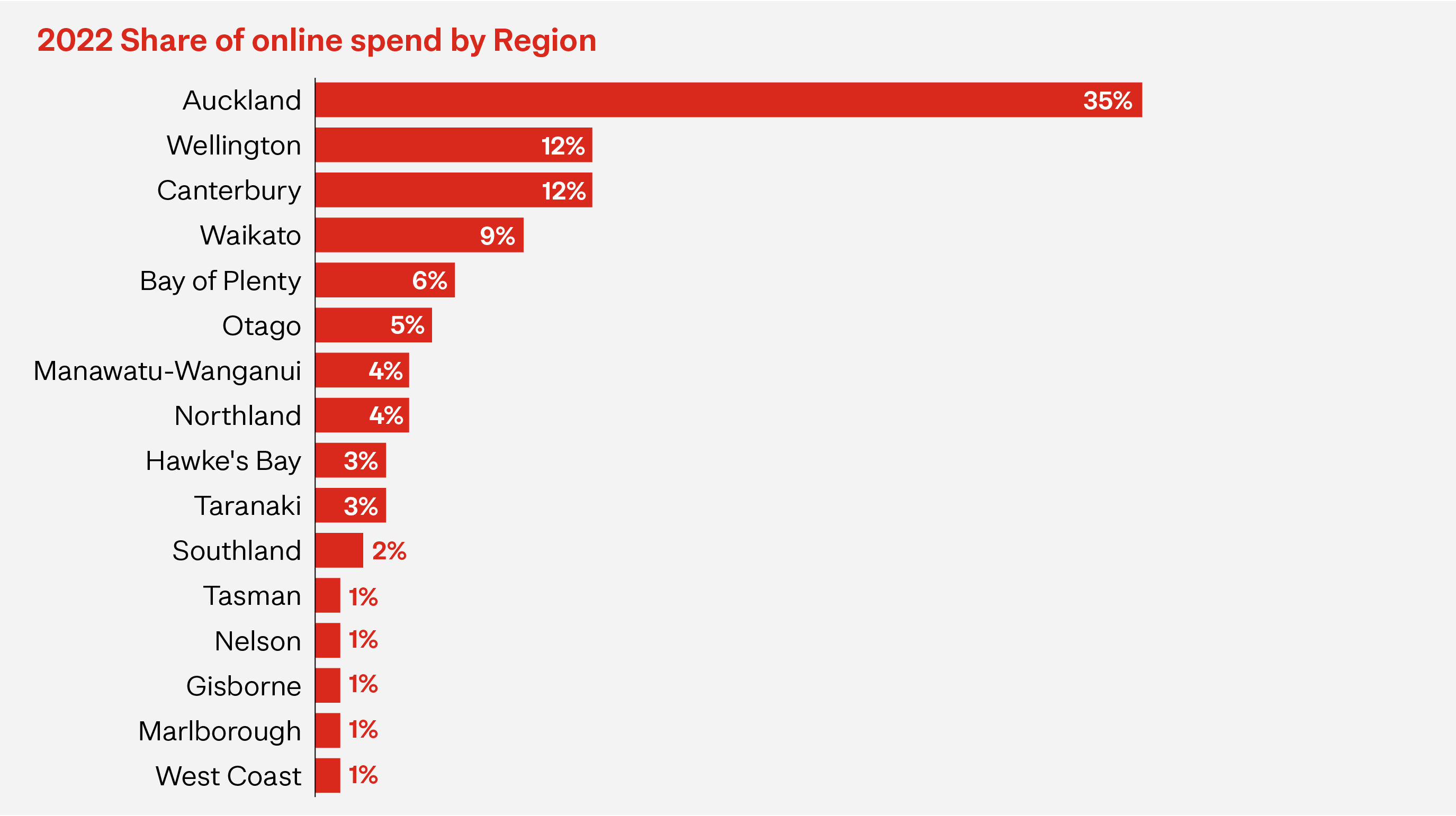

Auckland, which makes up over 35% of New Zealand’s spending online, saw spending levels fall by 8% in 2022. Auckland was the region most hit by lockdowns in 2021 and that was reflected in the highest levels of online growth for that year. It’s not surprising then that it was the region with the largest decline in 2022.

Waikato (-1%) and Bay of Plenty (-1%) were the other two areas to experience declines in online spending in 2022. Like Auckland, Waikato was also affected by extended lockdowns in 2021. Gisborne had the year’s highest level of online spending growth, up 7%. The remaining regions either had similar spend levels to 2021 or small growth of between 2% and 4%.

All regions were up (17% to 30%) compared to 2020 spend, and well up (53% to 85%) on 2019 pre-pandemic levels.

Looking ahead to 2023

2022’s online spending started high off the back of a strong finish to 2021 and had a big first quarter fuelled by Omicron restrictions. Based on how 2022 ended, 2023 started at a much lower level and is most likely to see a continuation of the last three quarters with widening declines in online spending compared to the same quarter a year ago.

The economic environment will no doubt continue to be the key influencer of online shopping’s performance 2023. While inflation is expected to ease slightly, most commentators expect household spending to remain weak, with a recession likely by mid-2023. The Reserve Bank has been explicit in their desire to drive domestic spending down to slow inflation. If not, even higher interest rates will follow, further impacting shopper’s spending power.

COVID is far from over with weekly case (and hospitalisation) numbers still reaching levels that only a few years ago would have been unacceptable. In an election year, there seems little appetite to rush back into the trading restrictions which drove online sales growth over recent years. Staff shortages, due to illness, remains a key risk for most online retailers. The product, supply chain, and delivery challenges of the last few years should be less of an issue in 2023 overall, though the recent floods in the upper North Island will bring new supply and delivery challenges in some areas. The clean-up from the floods will add further inflationary pressure to the economy, impacting both retailers and shoppers alike.

All-in-all it seems likely it will be another challenging year for online retailers in 2023, requiring them to continue to adapt their product, website and delivery experience to meet customers changing needs and to offer more value.

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.