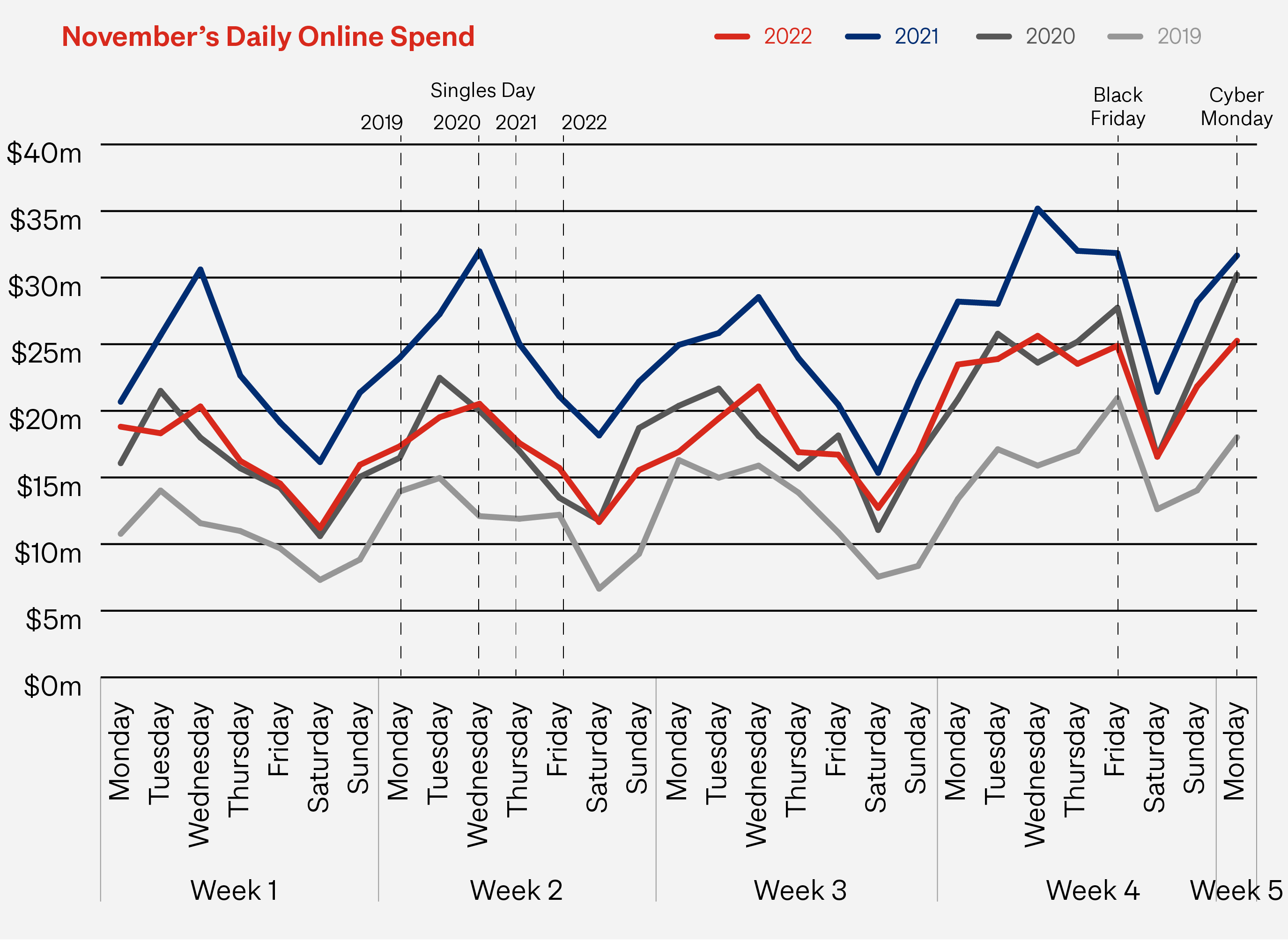

As has now become tradition, Kiwis embraced November’s big sales events – Click Frenzy, Singles’ Day, Black Friday, and Cyber Monday. We spent $550m online on physical goods during November across over 4.8 million transactions. That’s a very busy 161,000 transactions a day. While on the surface this looks impressive, the real story is the impact that the tough economic conditions continue to have on how Kiwis spend their money.

For the first time since we started tracking online shopping (in 2019) we have seen a decrease in November’s online spending numbers – 25% down on a year ago. Tough economic times appear to be the key driver as higher prices, and the reduced buying power of wages, have seen Kiwis become more selective about how much they spend and where they spend it.

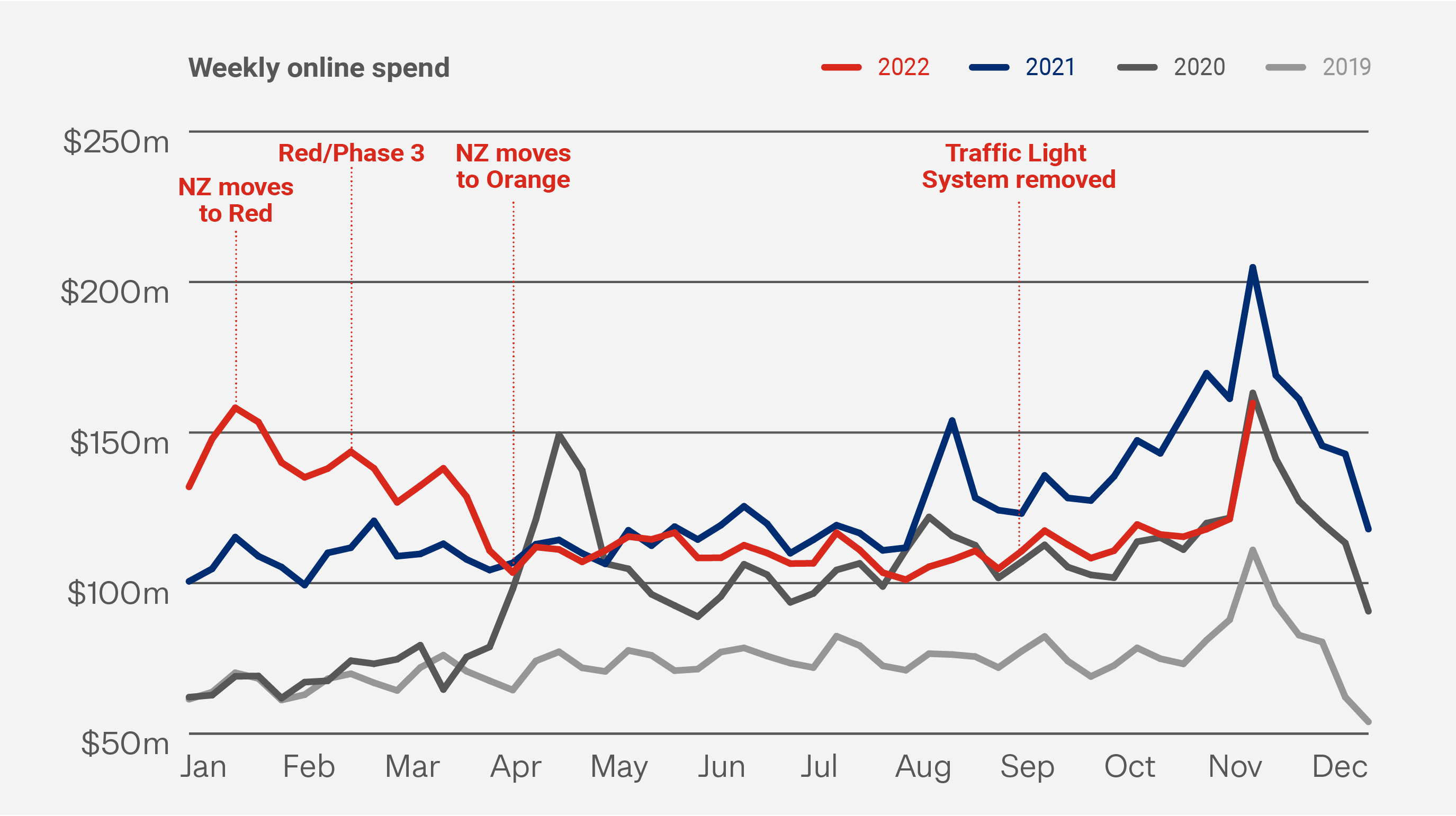

Inflation has impacted spending patterns all year, with the annual inflation rate reaching 7.2% for the September 2022 quarter. This is one of the highest annual levels we’ve seen since 1990, driven by house building prices, utilities, petrol and diesel, airfares, and certain household goods.*

Anecdotally, retailer efforts may have also contributed to the online decline as well, with tougher economics and staff shortages seeing some retailers hold back on their promotional efforts. While sales promotions were clearly prominent, especially from the big retail brands, it certainly didn’t feel like the ‘month long offers’ we saw in 2021.

November 2022 Online Spending

$550mOnline spending |

-25%On Nov 2021 spending |

+55%On Nov 2019 (pre-pandemic) spending |

$550m is around the same level of online spending we saw in November 2020, a number that we celebrated at the time as a new all-time high. November 2021 exceeded that by a massive 33%, fuelled by continued lockdowns driving shoppers online. At the time, physical retail was largely closed in Auckland, and parts of Waikato, for most of the month while the rest of the country was trading with restrictions. We need to go back to November 2019, for a more like-for-like comparison, and see the 2022 result up a massive 55%.

November 2022 Spending

$4.5bInstore spending |

+0.2%Instore vs Nov 2021 spending |

-3%Total retail vs Nov 2021 spending |

But to put the decline of online spending down to just last November’s lockdowns, would be to ignore the retail trend we’ve been seeing all year – Kiwis are spending less across all retail channels. Instore spending for November 2022 was $4.5b, just $11m above November last year, a month when instore trading was restricted. Clearly shoppers didn’t swap their online spend to return instore, choosing instead to spend less and/or to direct some of it elsewhere, like international travel. As a whole, retail spending on physical goods, online and off, reached just over $5b in November 2022, 3% down on a year ago, but 13% up on pre-pandemic November 2019.

Further fuelling the idea that online spending has been impacted by shoppers' reduced spending power is the continued rise of Buy Now Pay Later (BNPL). We see shoppers continue to defer payments and wrack up debt, with BNPL online spend up a further 8% this year compared to November 2021, 81% compared to November 2020 and a staggering 199% up on November 2019.

The big sales events 2022

Retail spending – across online and instore – declined on all this year’s sales event days, falling below spending levels in 2021 and 2020 but remaining well above pre-pandemic (November 2019) levels.

Singles' Day 2022 Online

$15.7mSpending |

-37%On Nov 2021 spending |

+13%On Nov 2019 spending |

Total retail spending, across online and instore, on Singles’ Day was $168m, down 10% on last year.

Black Friday – Cyber Monday 2022 Online

$88.5mSpending |

-22%On Nov 2021 spending |

+35%On Nov 2019 spending |

Total retail spending, across online and instore for the Black Friday to Cyber Monday four-day period was $793.5 million, down 8% on last year.

Our newest online sales event, Click Frenzy, that kicked off in New Zealand in November 2021 with an impressive $84.3m over three days, saw a big 32% decline (down to $57.6m) this November.

November – key drivers of change

- 24% fewer online transactions – despite an impressive 4.8m transactions in the month, online transactions were down 24% on November 2021. Transaction levels were 42% up on pre-pandemic (November 2019) levels.

- 15% less online shoppers – The number of Kiwis shopping online this November was 1.6m. This is around 274,000 down on November 2021, about the same level as 2020, but 24% up November 2019

- 2% drop in the size of the average online transaction – the online average basket size was $113.34, down $1.90 on November 2021. While this may not sound like a large decline, in the context of over 7% inflation it suggests that shoppers put less items in their baskets and/or to switched to cheaper alternatives. The average basket size is up 9% ($9.28) compared to November 2019.

November – key online spending trends

Sectors

- All sectors, except Health & Beauty, experienced a significant decrease (averaging 27%) in online spend compared to November 2021. Health & Beauty’s 3% increase was driven more by essential wellbeing spend rather than discretionary ‘beauty’ purchases.

- Homewares, Appliances & Electronics experienced the largest decline, down 40% on a year ago.

- Online marketplaces experienced an 18% decline in spend.

Regions

- At 35%, the Auckland region experienced the highest decline in online spending compared to last year. This isn’t surprising given that the region was impacted, more than any other region, by lockdowns last November.

- On average, all other regions (excluding Auckland) saw online spending decline by around 18% compared to the year before. Nelson (7%), Gisborne (8%), and Taranaki (9%) had the lowest rates of spend decline.

Domestic vs International

- 69% of all online physical retail spend in November was with domestic retailers. This is slightly down on 2021 and continues a gradual decline in ‘buying local sentiment’ as more international flights become available and international delivery times improve. In November 2019, prior to the pandemic, domestic spend was only 58%.

Demographics

- Online spending decreased in a relatively consistent way, with spend levels down between 18-28% for all age groups compared to a year ago. Spending by males decreased by 30% while for females it declined by 21%.

Where will 2022 end up?

As we approach the end of the year, we consider where online shopping spend may end up. In the year to November 2022, online spending has reached almost $5.6 billion, about 2% below where we were at this point last year. Despite a strong start to 2022, we have seen online shopping spend decline through the year as economic uncertainty has eroded shopper confidence. In addition, as the year progressed, shoppers had more options on where to spend their money, with travel, dining out and other experiences becoming more available.

In the second half of 2022, online spending matched 2020 levels and we expect something similar over the last few weeks of the year. This would suggest that online spending for the whole of 2022 will reach around $6.1b. In a tough economic year, this is a strong result - just 3% below 2021’s record breaking spend. More importantly, this ‘new normal’ is 20% above 2020’s online spending level and a whopping 60% above pre-pandemic levels.

Early in 2023 we will provide a breakdown of online spending for the last quarter (Q4 22) and the whole of 2022, highlighting the key trends that shaped how Kiwis shopped.

* https://www.stats.govt.nz/news/annual-inflation-at-7-2-percent/

The data used in this eCommerce Spotlight is based on anonymised card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we won’t go back and adjust earlier numbers, when comparing current information with past periods we do so using a consistent like-for-like methodology.