Kiwi shoppers spent $1.6 billion online on physical goods in quarter four of 2023 (Q4 2023), up 5% on Q4 2022.

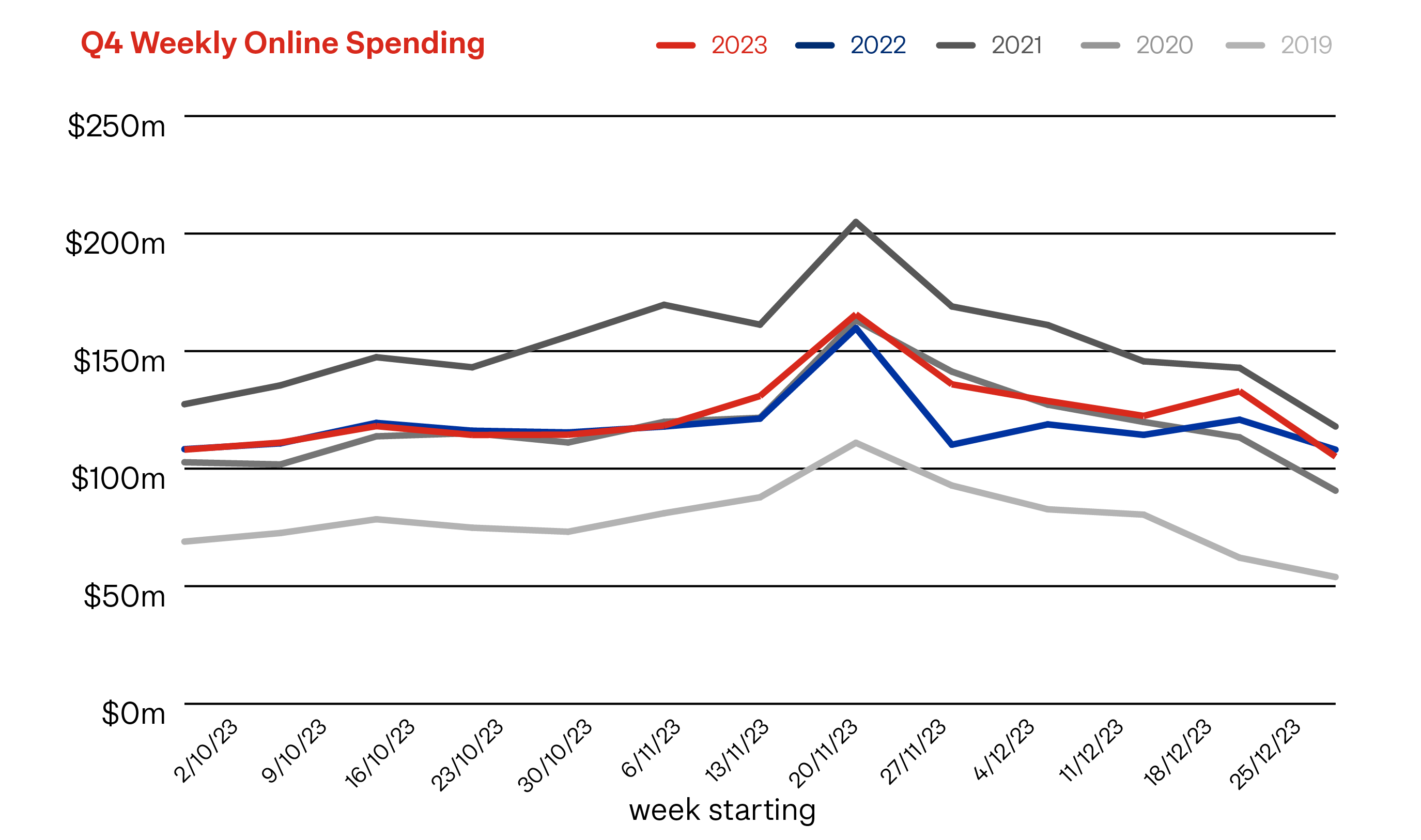

The fourth quarter is generally the most important in an online retailers’ calendar, with a significant lift in spending over the previous three quarters. Like each of the last few years, Q4 2023 was the biggest online spending quarter for the year, as Kiwis ramped up their shopping during the November sales and through to Christmas. The Wednesday before Christmas (20 December) was the largest single online spending day in 2023 with over 226,000 transactions driving a daily online spend of $27.7 million.

The quarter’s key story was a continuation of the trend that has dominated retail shopping throughout the year - shoppers adapting their spending behaviours to the economic conditions. Again this quarter, shoppers looked to make their money go further by buying more often while spending less each time.

Shoppers actively chose to support local retailers, with 72% of online spend remaining domestic during the quarter. Buying from local retailers seems to become an even stronger preference as we get closer to Christmas Day and shoppers want certainty that items will be delivered in time. The ability to easily return (exchange) items is also a driver for buying Christmas gifts from local stores.

Online spending represented 10.0% of total spending on physical goods in Q4 2023, up slightly from 9.7% in Q4 2022.

Total spending on physical goods for Q4 2023, both online and offline, was $16.0 billion, up just 2% on Q4 2022.

Q4 2023 vs Q4 2021

Online Spending $1.6b▲ 5% | Instore Spending $14.4b▲ 2% | Total Retail Spend $16.0b▲ 2% |

The drivers of Q4 2023 spending

The single most important driver of the quarter’s spending levels was the sharp increase in transactions. There were just over 16 million transactions in Q4 2023, an impressive 2.4 million more (17%) than in Q4 2022.

Although shoppers were clearly buying more often, the average value of the quarter’s transactions was $12 less (11% lower) than a year ago.

This was the third consecutive quarter where we saw online transactions grow and the online average basket size fall, compared to the same quarter in 2022.

The instore shopping basket value stayed about the same. This may suggest shoppers were utilising the convenience of researching online to find better value options.

In each of the months through the quarter there were more people shopping online than a year ago, with shopper numbers about 4% higher for Q4 2023 compared to Q4 2022. This added positively to the quarter’s spending increase.

NZ POST’S TIP

Help shoppers make their money go further. Consider offering cheaper alternative products, bundling products together, discounts for bulk, loyalty rewards, and payment options. Other ways include showing price comparisons on your website or demonstrating the value-add features you offer, like a better delivery experience.

Q4 2023’s key shopping days

Historically, the 4th quarter is characterised by a steady climb of online spend towards a sharp increase around Black Friday/Cyber Monday. This is followed by a steady decline towards Christmas. Q4 2023 largely followed this trend, apart from higher than usual spending in the week immediately before Christmas and on Boxing Day.

The tougher retail environment of recent years has seen an increasing number of retailers treat the November/December period as an extended sales period, rather than the series of individual sales events of a few years ago. "Black Friday” sales largely started in early November and carried through to early December to be ‘re-labelled’ as Christmas sales. This was particularly noticeable this year, with many sales carrying through into January as “New Year’s” or “Summer” sales.

NZ POST’S TIP

Make a promotional plan for the quarter. With an extended promotion period, a well-considered marketing plan for all of Q4 is essential. Check out our guide for preparing for Sales Events for some handy tips that can be applied for all of the quarter’s promotions.

Black Friday – Cyber Monday Weekend 2023 online spending (compared to 2022)

Online Spending $88.1b0% change | Online Transactions $14.4b | Average Basket Size -11% |

Online spending for the Black Friday – Cyber Monday four-day period was $88.1 million, about the same level as 2022. Online transactions however were up 12% while the average online basket size was down 11%. This would suggest that shoppers had the same amount of money to spend in the sales but split their purchases over more transactions as they chased more deals.

Total retail spending - across online and instore - for the Black Friday to Cyber Monday weekend reached $825 million, up 4% on 2022.

Singles’ Day 2023 online spending

At $12.3million, online spending in 2023 was 22% lower than Singles’ Day last year. This was driven by decreases in online transactions and average basket size.

Singles’ Day total retail spending - online and instore - was $177.4 million, up 6% on 2022. This was solely driven by a 9% increase in instore spending.

Pre-Christmas

Online spending declined after the Black Friday peak before rising for another mini-peak in the week before Christmas. The Wednesday before Christmas (20 December) was the largest single online spending day in 2023 with over 226,000 transactions driving a daily online spend of $27.7 million.

Instore spending followed a similar pattern throughout December, rising in the week immediately before Christmas as ticking off the remaining items on the Christmas shopping list became a priority.

Boxing Day

Online Spending 16.1m▲ 20% | Online Transactions +30% | Average Basket Size -8% |

Boxing Day 2023 online spending was $16.1 million – up 20% on 2022 - driven by a 30% increase in online transactions Over 152,000 transactions were completed in a single day. This may suggest that shoppers looked online to secure the best deals.

By comparison, Boxing Day instore spending was down 1% on Boxing Day 2022, making it the lowest Boxing Day instore spend in the last 5 years.

Total retail spending – across online and instore – for Boxing Day was same as last year at $165m.

Q4 2023’s Sector and Regional Trends

What online shoppers bought in Q4

- Department, Variety, & Miscellaneous Retail, our largest sector, was the fastest growing and only sector to experience double digit growth in online spend (14%) compared to Q4 2022.

- Homewares, Appliances & Electronics followed, growing by 9%, with Clothing & Footwear next, growing by 6%.

- Two sectors experienced online spending declines in Q4 2022: Speciality Food, Groceries, & Liquor, our 3rd largest sector in Q4 2023, (down 4%); and Recreation, Entertainment, Books & Stationary (down 5%).

- Online transactions increased across all sectors, while the online average basket size fell across all sectors.

Where online spending came from in Q4

- Online spending increased across 14 of our 16 regions compared to Q4 2022, with growth ranging from 14% in Gisborne to 2% in Auckland.

- Only Wellington (down 2%) and Nelson (down 1%) saw online spending declines compared to Q4 2022.

- Instore spending saw small increases compared to Q4 2022 in all regions, except Taranaki where it was down 1%.

NZ POST’S TIP

Keep up to date on the latest data and trends. See how Q4 contributed to the key numbers and trends in 2023 in our 2023 eCommerce Review.

How we can help

We’re passionate about helping you grow your online business. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.