For two years, the dependent relationship between COVID and online shopping has been clear for everyone to see. The higher the levels of COVID, the higher the levels of online shopping. In quarter one of 2022, we saw a significant change in this relationship. COVID numbers, under the Omicron strain, skyrocketed. Online shopping spend saw a decline over the same period. So what’s changed?

Pre-COVID, online shopping was trucking along nicely on its own, exhibiting steady but not overly spectacular growth, fuelled by the emergence and growth of Q4 Sales Events. With online penetration about 10% of total retail spending, New Zealand was well behind other nations like the UK, US and China. The big question was, what would it take to trigger a paradigm shift in online shopping? And now we know - a global pandemic.

In March 2020, COVID hit New Zealand and most physical retail stores were required to close. Shoppers found themselves locked down at home and online shopping became more than just a convenient option - for most, it became the only option. Retailers responded by creating or boosting their online capability.

Not surprisingly we saw an immediate and large spike in online shoppers that continued to rise the higher the case numbers and alert levels got. As alert levels dropped, and restriction on retail stores reduced, we saw online shopper numbers also drop back down. This synchronicity appeared time and time again through 2020 and 2021.

Through all the ups and downs of COVID, the overall trend was a steady rise in online shoppers, transactions and spend. Each spike brought more people online and saw existing online shoppers buy more often across more sectors. The online shopping ‘baseline’ progressively reached higher and higher levels.

An unexpected trend

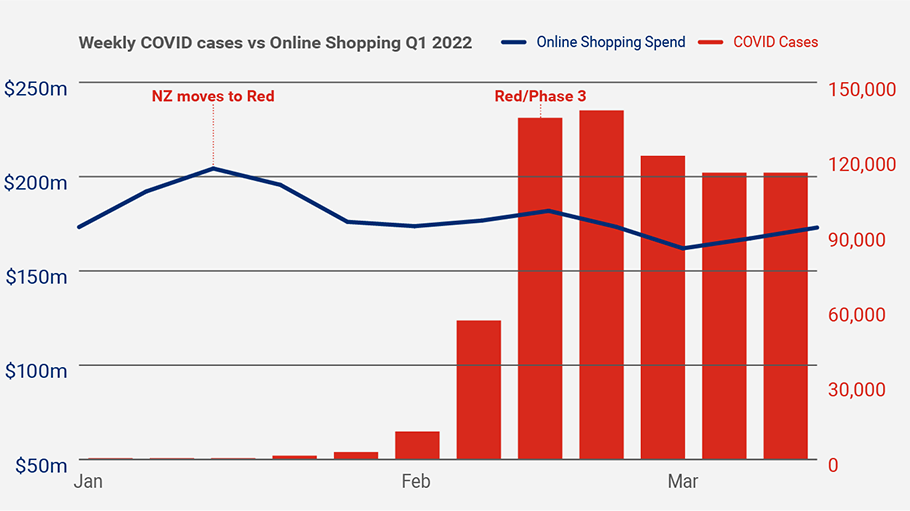

Fast forward to Q1 2022 and it looks like the historic COVID/online shopping relationship has run its course. Omicron hit New Zealand in early January and by the end of the month we found ourselves in ‘Red’ with some store restrictions coming in and many people working from home again. Based on the previous two years, the expectation was that online shopping would once again spike as shoppers took the safe option of avoiding the crowds. But the complete opposite happened - restrictions became a catalyst for weekly shopping numbers to start declining.

Over the next few weeks daily COVID case numbers reached record highs peaking at nearly 24,000, levels 10 times the highs of the previous two years. Despite this, online shopper numbers continued to fall through February and March. In late February, with daily COVID cases at their peak, the country moved to phase 3 of Red under the new traffic light system. Rather than causing online shopper numbers to spike, we saw the number of shoppers online drop even further. While in January there were nearly 2.2 million shoppers online, this dropped to 1.98 million in February and then dropped by another 200,000 in March.

What drove shopper behaviour in Q1?

A number of factors, all working together, appear to have contributed to the unexpected relationship between COVID and online shopping this last quarter.

First and foremost is the Government’s approach. Moving from Alert Levels to a Protection Framework ‘traffic light’ system saw much lower restrictions on both shoppers and retailers. In 2020 and 2021, the higher alert levels meant everyone was home with few options to go out. In 2022, the highest Red level saw some gathering limits but mostly the shops were open and anyone who wanted to get out and about could. And despite the huge COVID case numbers, many chose to, as schools, restaurants, movie theatres and other venues welcomed us.

A further factor was the good summer weather and a general sense of Kiwis being "over COVID". These factors and the call that “we need to learn to live with COVID” saw a much less cautious approach to staying away from the stores.

Add to this the domestic holiday drive that occurred in Q1 and the announced reopening of borders, allowing people to plan their long-awaited overseas holidays. Over the last two years, with limited travel options, we’ve often talked about people redirecting their ‘holiday money’ to online spending. The option to travel again is potentially another pull factor drawing people away from online spending during the quarter.

And of course, Q1 2022 followed Q4 2021, one of the biggest online shopping quarters we’ve ever seen. Generally, the shopping highs are followed by a bit of a lull and it could be that the quarter is just that, a hangover of the massive sales events and Christmas frenzy.

The other big factor is the economic cloud that surrounded the quarter. Global inflationary pressures, fuelled by the war in Ukraine, coupled with ongoing supply shortages, saw inflation hit a 30-year high. Wages on the other hand, haven’t kept up, leaving shoppers with less spending money. Maybe it’s not that shoppers are choosing to spend less – online or instore – but they just can’t afford to.

Looking ahead

We also need to consider that, after two big years of hyper-growth, online spending has now reached a more ‘normal’ level of growth. Most people who will join the online revolution have done so already. New shopping habits have formed and newer ones are less likely to take going forward. Maybe we just need to accept that more modest levels of annual growth, like they were pre-COVID, are the way of the future.

Assuming the worst of COVID is now behind us, it will be interesting to see how online shopping goes in 2022 and beyond, standing on its own two feet without the full impact of COVID to keep its momentum going. Online shopping now makes up around 14% of all retail spend. It’s grown from below 10% over the last three years but is still relatively low compared to other developed nations. We’d suggest, with so many new online shopping habits formed, there is still plenty of room to grow.