Following many years of strong organic growth, the last two years have taken New Zealand’s online shopping spend to a whole new level, making it a major part of how Kiwis shop every day.

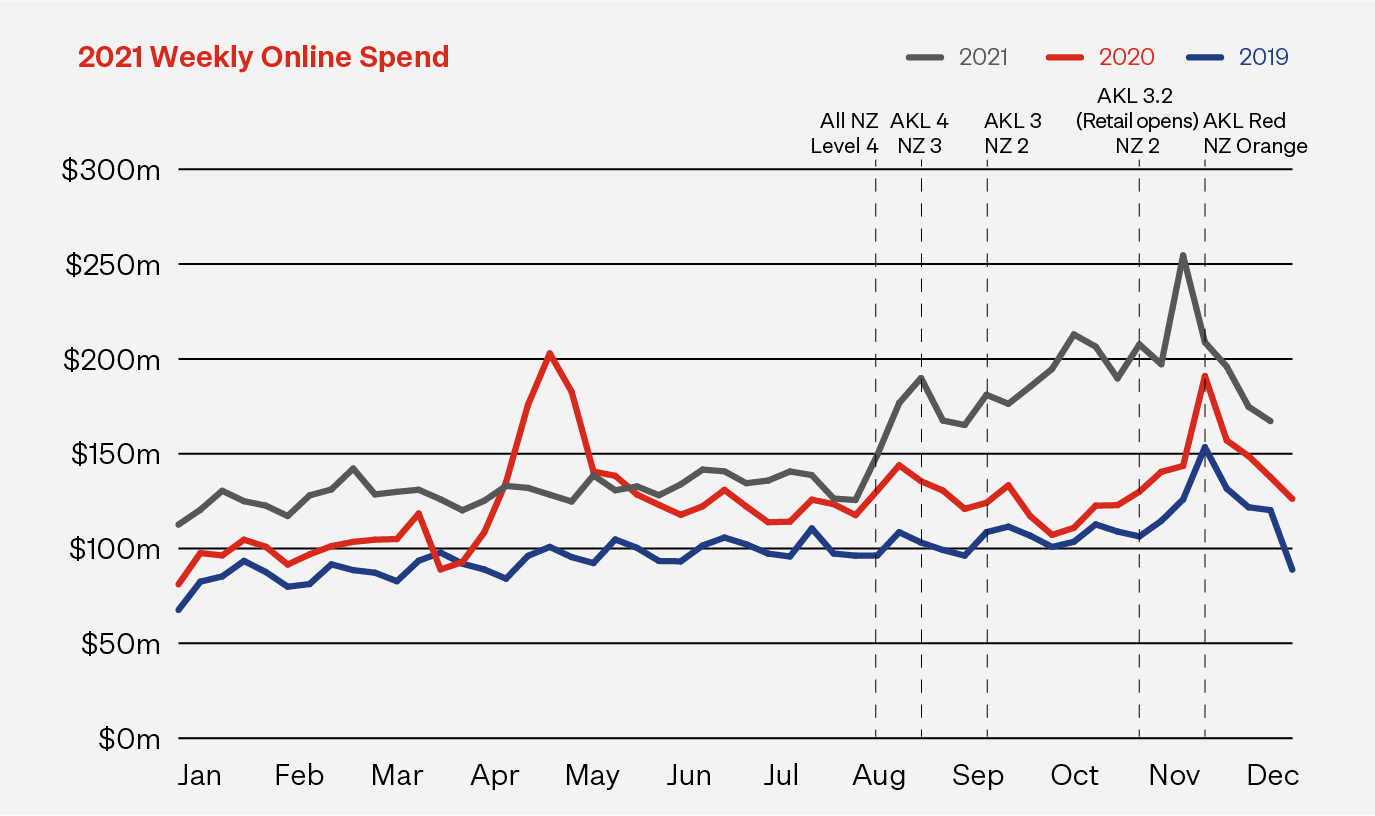

Lockdowns in 2020 introduced many new people to the convenience, safety and ease of shopping online. By the end of 2020 over half of adult New Zealanders were shopping online. The potential was for shoppers to return to their old ways after lockdown restrictions ease. But a series of further lockdowns in 2021 quashed that notion, seemingly lifting online shopping to new levels each time and further cementing an online shopping habit.

The result was over $1.35 billion of new online spending in 2021, driven by a permanent change in shopping patterns that should continue to foster growth in 2022 and beyond.

2021 online spending reached a staggering $7.67 billion, exceeding ours and, no doubt everyone else’s, growth expectations. This represents 21% annual growth which, following a huge year of growth in 2020, sees online spending now 52% larger than it was pre-pandemic. With over 70% of 2021’s spend going to locally based companies, many of those eCommerce retailers who actively adapted to the changing situation have reaped the benefit.

In comparison, physical instore retail spending was up 1% ($654 million) on 2020 full year. This is a pretty good result if you consider how much time during the year the shops were closed or restricted in the way they operated, especially in Auckland.

Overall retail – online and instore - grew by just over $2 billion in 2021. With growth of $1.35 billion, online accounted for two-thirds of that growth, highlighting the rapidly changing way Kiwis are shopping and reinforcing the key role online shopping played in keeping our economy going in 2021.

$7.7bOnline spend 2021 |

$52.2bInstore spend 2021 |

52%Growth in online spend |

Understandably, with more time in lockdown, Auckland saw the biggest online shift in spending, now making up over 40% of the national online annual spend. Aucklanders spent more than $3.08 billion online in 2021, up 27% on 2020 and up 59% on 2019. Putting this growth into context, there were 26.7 million online transactions in Auckland in 2021, averaging out to over 73,000 a day. Just two years earlier in 2019, Auckland’s average daily online transactions were just over 46,000.

The growth of everyday online shopping

While spending growth in 2020 was significantly aided by a large number of new people coming online, in 2021 the number of online shoppers remained constant at 2.15 million. What really drove growth this last year was how often online shoppers purchased. And even though the average spend per transaction decreased, the marked rise in transaction volumes meant that the average shopper spent a lot more online this year than they did in previous years.

2.2mOnline Shoppers |

71.4mOnline transactions |

$107Average basket size |

There were 71.4 million online transactions in 2021, up 23% on the year before. In 2020, the average shopper purchased online an average of 27 times – just over twice a month. In 2021 the average shopper bought something online 33 times. This is more than 2.75 times a month, resulting in a transaction every 11 days or so. By the last quarter of the year, this average had improved even further seeing nearly one transaction a week on average.

Even though shoppers bought more often, they spent less each time in 2021, with average basket sizes down to $107. On the face of it, this may appear a negative result, but it’s an important contributor to increased transaction numbers. Online shopping used to be an occasional thing you did for those ‘special items’ however it has quickly become a key part of everyday shopping. These days, shoppers are just as likely to get online to buy their shoes, clothes, stationery, consumables, groceries, and other everyday living items as they are to pop down to their local stores or mall.

As a result of shoppers buying lower value items more often, we’re seeing significant shifts in the overall online average spend of shoppers. In 2021 the average online shopper spent $3,567 throughout the year, up from $2,913 in 2020 and over $1,000 more than they did in 2019.

Average monthly spend per shopper

$2972021 |

$2432020 |

$2112019 |

We see this ‘growth in everyday online shopping’ notion further reinforced by the sectors who experienced the largest growth in 2021. Clothing and Footwear led the way with online spending up 34% to reach more than $1.58 billion. We also saw strong growth in Dept, Variety & Miscellaneous Retail (26%), and in Recreation, Entertainment, Books & Stationery (22%). These are sectors who offer a larger selection of everyday shopping items, compared to a sector like Homewares, Appliances & Electronics which grew by only 12% in 2021.

The continued growth of everyday online has also helped to cement Buy Now, Pay Later (BNPL) as an important part of the online shopping habit, especially for the younger generation. BNPL spend increased 42% compared to 2020 and is now over double (122%) the level it was in 2019. More than one in ten online transactions in 2021 was via one of the growing number of BNPL providers.

The changing shopper demographic

While overall online shopper numbers have remained relatively static at nearly half of New Zealand’s adult population, our online shopper profile continues to evolve, as new and returning shoppers replaced a similar number of shoppers who dropped off. The changing shape of the online shopping demographic is quickly making online shopping an activity for all New Zealanders of all ages and regions.

To date it’s been the 45-60 age group dominating online shopper spend but in recent years, we’ve seen the younger shoppers growing at the fastest rate. In 2021 the 15-29 and 30-45 year olds increased their online spending by 25% meaning that their combined online spending made up 43% of 2021’s total online spending.

$3.3bOnline Spend by under 45s |

$2.2bOnline Spend by 45-60 age |

$1.1bOnline Spend by over 60s |

And the older demographic continues to grow online, albeit off a much smaller base. The over 60’s age group saw their online spend rise by over 20% in 2021.

The other demographic shift is regional. Not surprisingly, Auckland had the largest growth in online spend, up 27%. Following very closely behind is Gisborne on 26% and slightly behind them is Northland (20%) and Bay of Plenty (19%). The Waikato, which found itself in lockdown later in the year, saw online spending growth of 18%. While lockdowns were probably the biggest driver of these regional results, we’ve seen steady growth in the regions above and others, like Taranaki and Hawkes Bay, throughout the year regardless of COVID alert levels.

$70mGisborne |

$266mNorthland |

$646mWaikato |

All regions experienced double digit online spend growth over 2021. The North Island averaged 22% regional growth, mostly thanks to Auckland’s growth, while the South Island averaged 17% growth.

The ongoing retailer challenges

Growing by over 50% in two years and moving from 9% of total retail spend to 13% brings with it a number of challenges for online retailers and the networks that support them. We saw that first hand in 2021 with volumes driving supply chain, processing and delivery challenge for large parts of the year. Many retailers adapted at pace, finding new ways to manage customer expectations and to work around the hurdles before them. Many have acknowledged that the shift is permanent and re-geared their business to make online core to their model. Others are still working to manage the volumes before them.

There’s no doubt that 2022 will have continued challenges as the emergence of Omicron and the nationwide shift to the Red traffic light setting in the opening weeks of the year indicates. The overseas experience tells us that on-going supply chain and workforce disruptions, as well as growing inflationary pressures, are likely to significantly impact the retail environment. Business continuity and disruption planning is a key part of how we’re getting ready for 2022 and we encourage all retailers to make a similar plan for their business.

On the positive side, it is reasonable to expect that there will be more shoppers making the switch to online and existing shoppers using online channels more often, for more shopping transactions, across more sectors. Accordingly, we believe there will be many growth opportunities for retailers willing to keep adapting to the dynamic environment and ever-changing customer needs.

A full analysis of 2021 online shopping data will be published in The Full Download 2022, NZ Post’s annual review of New Zealand's eCommerce trends. Coming soon.

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.