Shoppers spent $1.5 billion on online physical goods in the third quarter of 2024 (Q3 2024), up 1% from the same period last year (Q3 2023). This growth was driven by an 8% increase in the number of online transactions and offset by a 6% decrease in the average amount spent on each transaction.

We continue to see online shopping holding up much better than instore, which was down 5% on Q3 2023. It appears shoppers are moving their spend online to make their dollar go further as the tough economic times continue.

This quarter’s online shopping story once again reflects the three key trends we’ve been seeing all year, and there’s a new one emerging.

The first trend is the move online. With tough economic conditions, shoppers are searching for value, gravitating online to compare prices and to search around for the best deals. The result has been an increase in the percentage of total retail spending that online represents. In Q3 2024 online spending made up 11% of total retail spend, up on the last two quarters.

The second trend sees shoppers focus the majority of their spending on essential items – like food and clothes - rather than spending on discretionary wants like recreation and entertainment. As always there are some exceptions, for example, cosmetics had a strong quarter, up 7% on the year before. We explore this trend further in the sector update below.

The third, and probably, most significant trend is the change in the shopping basket profile. Shoppers are buying online more often but spending less each time. This suggests shoppers are buying less items, swapping to cheaper alternative brands, and/or choosing to shop while items are discounted. Our recent eCommerce Market Sentiments research tells us they are doing all of the above.

Again this quarter we saw increased online transactions, up 8% on Q3 last year. However, the average spend per transaction dropped by $6, a decline of 6% from the same quarter last year.

This reduced average basket size also reflects one of the big trends in retailer behaviour over the same period. Retailers have understandably focused on cashflow, seeing them frequently discount prices, promote special offers and offer loyalty rewards. And while this makes smaller shopper basket sizes inevitable, it reflects the necessary focus on driving revenue to ensure retailers’ ongoing survival.

Q3 2024 vs Q3 2023

Online Spending $1.5b▲ 1% | Instore Spend $12.1b▼ 5% | Total Retail Spending $13.6b▼ 4% |

This quarter we’ve started to see a new trend emerge as well – the rise of online transactions with overseas retailers. 72% of spending online in Q3 2024 was with local businesses, which is broadly consistent with what we’ve seen over the year. However, the percentage of online transactions from local retailers fell from 70% to 68%, as online transactions from offshore retailers grew at a faster rate.

Looking deeper into this, we also see that the average basket size for offshore retailers has fallen at a faster pace than for local retailers. This supports one of our other key trends, that shoppers are looking to overseas online retailers for lower cost options, and alternative brands not available in New Zealand stores, to make their money go further.

HELPFUL HINT

Going Global. Online shopping is a global trend, with many Kiwis looking overseas to make their money go further. Overseas shoppers are doing the same, looking at New Zealand for quality products they can’t buy locally. This opens up many opportunities to expand your customer base and to grow revenue. Check out our latest article to learn more about tapping into the world of global opportunities that awaits.

The drivers of Q3 2024 spending

As always, three key factors drove the quarter’s online spending – transaction volumes, average basket size, and the number of shoppers online. Growth was driven by strong transaction volume growth, offset by the decline in the average basket size.

Transaction volumes ▲ 8%On Q3 2023 | Average basket size ▼ 6%On Q3 2023 | Online shoppers SameAs Q3 2023 |

- TRANSACTIONS: There were 15.7 million online transactions during Q3 2024, over a million (8%) more than a year ago. This is the largest number of Q3 online transactions we’ve seen in the last five years, even bigger than when physical stores were closed for lockdowns!

- BASKET SIZE: The average spend per transaction (basket size) in Q3 2024 was $96, down $6 (6%) on Q3 2023. Shoppers once again considered what and how much they put in their shopping basket, choosing fewer and/or cheaper products.

- ONLINE SHOPPERS:1.64 million Kiwis (~37% of the population aged 15 and over) shopped online in Q3 2024. This was around the same as a year ago.

HELPFUL HINT

Maintaining and growing basket size. Shoppers want value-for-money so aim to deliver it while still driving revenue. Offer a discount for buying multiple products, reduce prices for a complementary product, or discounted delivery for purchases over a certain threshold. These strategies all encourage additional spending while ensuring customers get the ‘bargain’ they’re looking for.

Q3 2024's online sector trends

Online spending across sectors was once again mixed, with two sectors experiencing growth over the year before, two declining and two staying the same. The overall theme remains the same, sectors offering essential ‘must buy’ products are holding up better than those that represent ‘like to buy’ discretionary spending.

Q3 2024 vs Q3 2023

+4%Department, Variety & | +3%Clothing & Footwear | SameHealth & Beauty |

-3%Recreation, | -1%Homeware, Appliances | SameSpecialty Food, |

Online spending growth in our largest and fastest growing sector, Department, Variety & Miscellaneous Retail, was driven by spending with offshore retailers. This was up 24% on the same quarter last year, with retailers like Temu, Shein and other lower cost providers the most-likely beneficiaries. Online spending with local retailers in this sector fell by 14% compared to Q3 2023.

Instore spending saw all sectors – apart from one – experience a decline in spending from the same quarter last year. Recreation, Entertainment, Books & Stationery was down 14%; Clothing and Footwear down 11%; and Homeware, Appliances & Electronics down 8%. Health and Beauty instore spending grew (up 4%), driven largely by essential chemist and medical product spend.

HELPFUL HINT

Prioritise the customer experience. Capitalise on the growth of online by delivering the best experience possible for your customers. Start with your website, making it easy for customers to find what they are looking for; presenting clear product information; and offering multiple delivery options: from same day express delivery through to slower, but lower cost, options. Remember that delivery is a big part of the experience, so offer services that give customers more confidence like tracking, notifications and photo on delivery. See our tips for creating an excellent delivery experience.

The Year to 30 September 2024

- Kiwis spent $4.36 billion online in the first nine months of 2024. This is 3.4% up on the same period in 2023.

- Growth has been driven by over 5 million more (+13%) online transactions than the same period last year but offset by a $9 fall (-9%) in the average spend of each transaction.

- Instore spending fell by 3% compared to the same period in 2023, driven by both lower transaction volumes and a lower average basket size.

- Five of the six sectors saw online spending growth compared to the first nine months of 2023. Department, Variety & Miscellaneous Retail was the sector that grew the most, up 9%. Speciality Food, Groceries & Liquor was the only online sector to show a decline (-1%), with the Convenience Stores & Speciality Markets subsector contributing the most to this decline.

- Online spending increased in all regions except Wellington, which was down 1% compared to the same period in 2023. Government sector job losses are most likely the key driver behind the Capital’s reluctant online spending.

HELPFUL HINT

Show loyalty to your existing customers. If you stay loyal to your existing customers in tough times, they’ll remain loyal to you in return. Keep communicating with your customers, acknowledging the tough conditions and offering exclusive offers that help them get through. Consider ‘loyalty rewards’ for frequent purchases, for additional spend, for referring a friend or even just for giving you feedback. Read our Not Socks case study for a good example of the value of building customer loyalty.

Looking ahead to the rest of 2024

Inflation is back within the Reserve Bank's target 1-3% band and we’ve seen a 75 basis points cut in the OCR over recent months1. These are all clear signs that the economy is on the improve and good reasons for both shoppers and retailers to feel optimistic that better times are coming.

Despite these signals, the consensus from leading economists and market commentators is that things will not be too different in the short term. While the rate of price increases (inflation) has slowed down, everyday household prices still remain high overall. Add to this fast-rising insurance premiums and council rates; mortgages locked in at higher rates; and a growing number of job losses following a period of high layoffs and business failures, and the conditions in Q4 2024 are expected to remain as tough as they have been all year.

Expect shoppers to keep looking to make their money go further by shopping around and embracing discounts and other value-add offers.

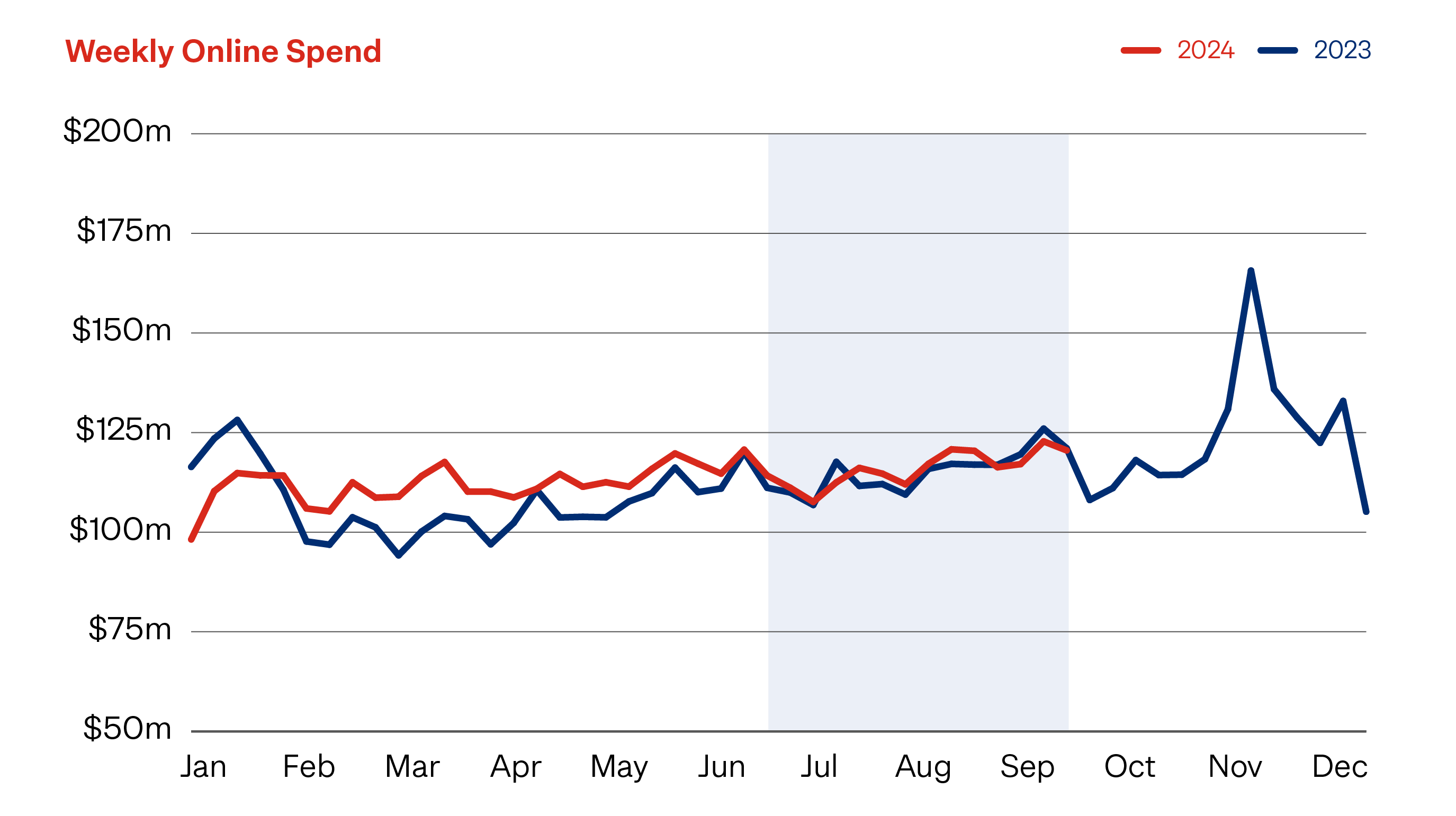

Regardless of the economic situation, October to December is the most important quarter in an online retailer’s calendar. In Q4 2023 Kiwis spent over $1.6b online, which represented a 7% lift on the quarter before (Q3 2023) and made up over 27% of the whole year’s online spending.

The quarter’s big sales events: Singles’ Day, Click Frenzy, Black Friday, Cyber Monday, and the lead into Christmas, present the perfect opportunity for online retailers to end the year with a revenue boost. A strong sales quarter, coupled with further OCR cuts, and an expected lift in business and consumer confidence will help retailers end the year on a positive note. And that bodes well for better times in 2025.

HELPFUL HINT

Peak season is here. Q4 shopping volumes start to pick up from Labour weekend. Last year saw many shoppers start their Christmas shopping earlier,using the November sales events to stretch their Christmas budget further. We also saw them looking around, comparing prices and finding deals. It’s likely we’ll see all these behaviours again this year. Check out our article Are you ready for Peak Q4 2024? for lots of ideas to help you succeed over the peak period.

1 https://www.rbnz.govt.nz/monetary-policy/about-monetary-policy/the-official-cash-rate

How we can help

We’re passionate about helping you grow your online business, through peak and beyond. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. Online spend includes both international and domestic shopping, and is filtered appropriately to only include consumer goods. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.