Auckland has felt the largest impact of lockdowns with most Aucklanders spending half of the last quarter at home. As expected, this led to significant growth in online shopping numbers. The result is an industry-wide challenge to keep up with the extreme volumes over such a sustained period of time.

From the week before lockdown to the last week of the quarter, we saw online sales grow by a phenomenal 94%. All indications are that this has grown even further in October. Putting this in context, this is an unprecedented series of consecutive weeks where online sales volumes are at levels greater than the big November sales weeks and the pre-Christmas shopping rush.

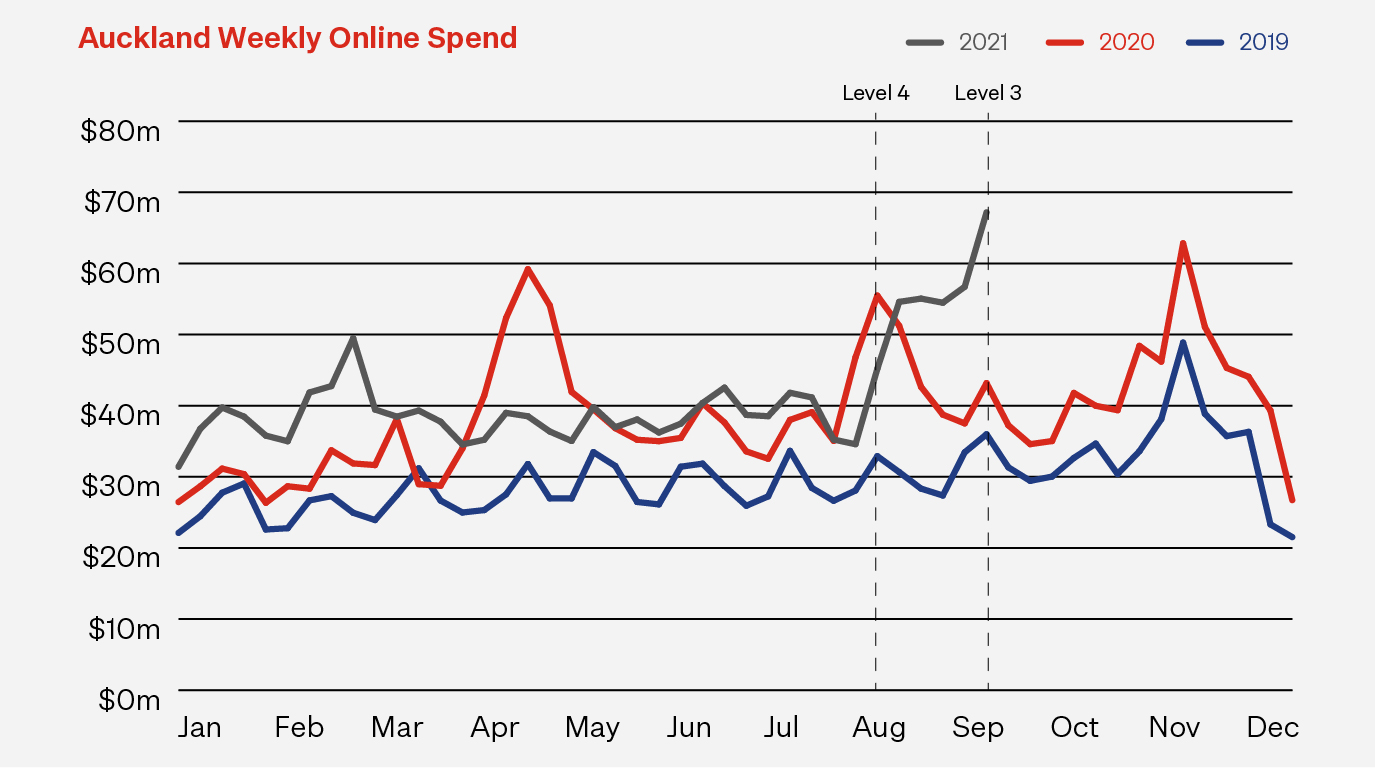

Looking at the weekly sales data, there’s no surprise to see a steep rise in online spend starting from the week commencing 16 August when the country went into Alert Level 4 lockdown. This saw an immediate sales spike which remained at a steady level, well above normal weekly spend, until the week of 21 September. This is the week Auckland moved to Alert Level 3, resulting in another sharp spike in spending as non-essential items became available to shoppers.

Source: Datamine RetailWatch.

Aucklanders spent $702m online in quarter three of this year (Q3 21), up $122m on the same quarter last year. This 21% rise is even more significant if we consider that Auckland was also in Level 3 lockdown for parts of quarter three last year. Going back two years, we see quarterly sales are a massive $241m (52%) higher than the same quarter in 2019.

Drivers of growth

There are three key factors that drive online spending – the number of online shoppers, how often they shop, and how much they spend each time. All three areas made a significant contribution to Auckland’s 21% increase in quarterly spend.

During the quarter there were 586,000 Aucklanders shopping online. That’s around 77,000 (15%) more than a year ago. As we’ve seen with previous lockdowns, these events bring many new and returning people online out of necessity and/or for safety concerns. For many, the usual physical stores they buy from are closed and therefore buying from them, or others, online is the only option. For others, concerned with visiting a supermarket or other open retail outlets during a pandemic, online shopping and delivery offers a safe way to get what they need.

Nationally, the total number of online shoppers has remained relatively stable over the last year, giving more emphasis to how significant Auckland’s rise in shopper numbers is.

The single most significant factor driving Auckland’s growth is the number of transactions, with Aucklanders completing 6.3 million online transactions during the quarter. That's 1.4 million (29%) more transactions than the same quarter last year (Q3 20) and the previous quarter (Q2 21). On average, that equates to nearly 70,000 online transactions per day – 15,500 more than Q3 20 or Q2 21.

During the quarter, Aucklanders purchased something online an average of 10.7 times per quarter. This was up from 9.6 times a year ago and 8.8 times two years ago. The national average for the quarter was 8.2 times, further highlighting the frequency of Aucklanders online spend.

The third driver of spending growth is how much Aucklanders spent each time they got online. Their average basket size this quarter was $112. While this is up on the national average of $103, it’s well down on Auckland’s basket size in the same quarter in 2020. This trend is one we’ve seen all year with Aucklanders, buying less per shop but shopping at much greater frequency. Year-to-date, the average basket size is $114, down from $118 for the same period last year, and more in line with where it was in 2019.

This quarter we saw more Aucklanders online, spending more often and spending more each time than the average shopper in New Zealand. The result was that over the quarter Aucklanders spent $1,199 online on average. That’s a very significant $350 more than the national average over the quarter.

What did Aucklanders buy over the quarter?

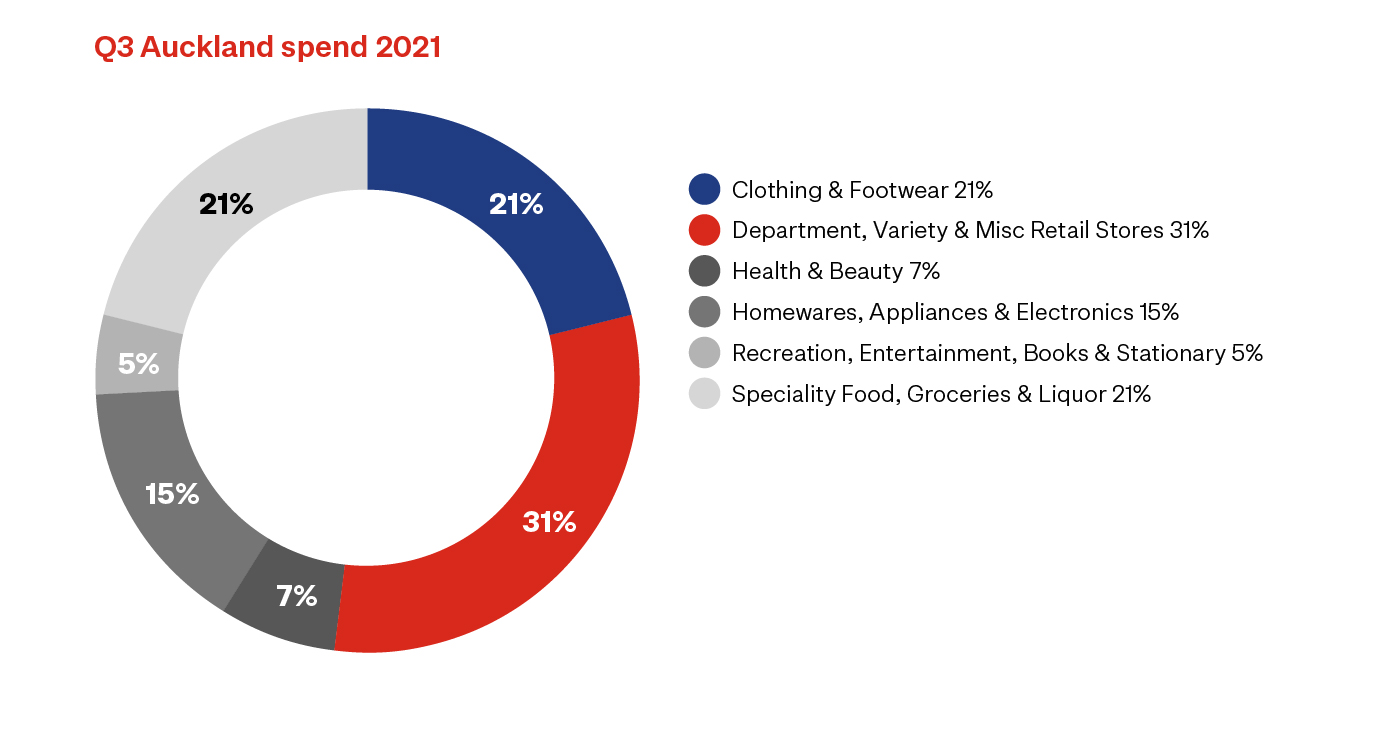

The following chart highlights where Aucklanders $702m online spend in the quarter went. While the quarterly spend was higher than usual, the mix of spend across the sectors remained largely consistent with what we’d seen all year.

Clothing & Footwear led the way for growth, up 39% on online spend from the same quarter a year ago. Department, Variety, & Miscellaneous Retail followed closely behind, up 32% from a year ago.

While Auckland’s online Food, Grocery and Liquor sales for the quarter were only 13% higher than the same quarter in 2020, this is the sector with the largest two-year growth, up 73% on Q3 19.

Auckland’s Health & Beauty sales, which have shown limited growth all year, had a good quarter, seeing sales 15% above the same quarter in 2020. On one hand this seems almost paradoxical, given the inability for most of the city to leave home. On the other hand, it may suggest that Aucklanders are putting more emphasis on their wellbeing.

In 2020’s lockdowns, we saw a big rise in spending on Homewares, Appliances & Electronics. The experience is very different this time, with Aucklander’s spending less on these items this quarter compared to last year. This is the only sector to experience a decline, 1% down on the highs of a year ago.

Looking ahead

Auckland, and neighbouring regions, have continued at higher Alert Levels in October and we’ve seen the high levels of online shopping also continue throughout the month.

We expect the huge volumes to get even bigger as we move closer to the big November sales events and then the Christmas shopping rush. Our expectation is that Q4 21 will be another record breaking quarter for online shopping.

With New Zealand still battles with COVID-19, and restrictions continue to see retail closed (or at reduced operating levels), online shopping will remain the key channel to access goods and services. While higher spend volumes should be positive for online retailers they continue to create a number of challenges for the eCommerce industry. Most notable are the challenges of stock delays, retailers staying on top of extreme processing volumes and getting things delivered in a timely way when there is such extraordinary demand on delivery networks. We shouldn’t forget that online has traditionally represented around 11% of total retail sales but is now being asked to pick up the heavy lifting, especially in Auckland. There is likely to be further strain on the system as volumes escalate and lockdowns remain in force.

Note: To help you stay up to date with what’s happening during this period of unprecedented online growth, we will produce monthly eCommerce Spotlight updates in November and December. We’ll then produce our regular quarterly update of online spending in January 2022.