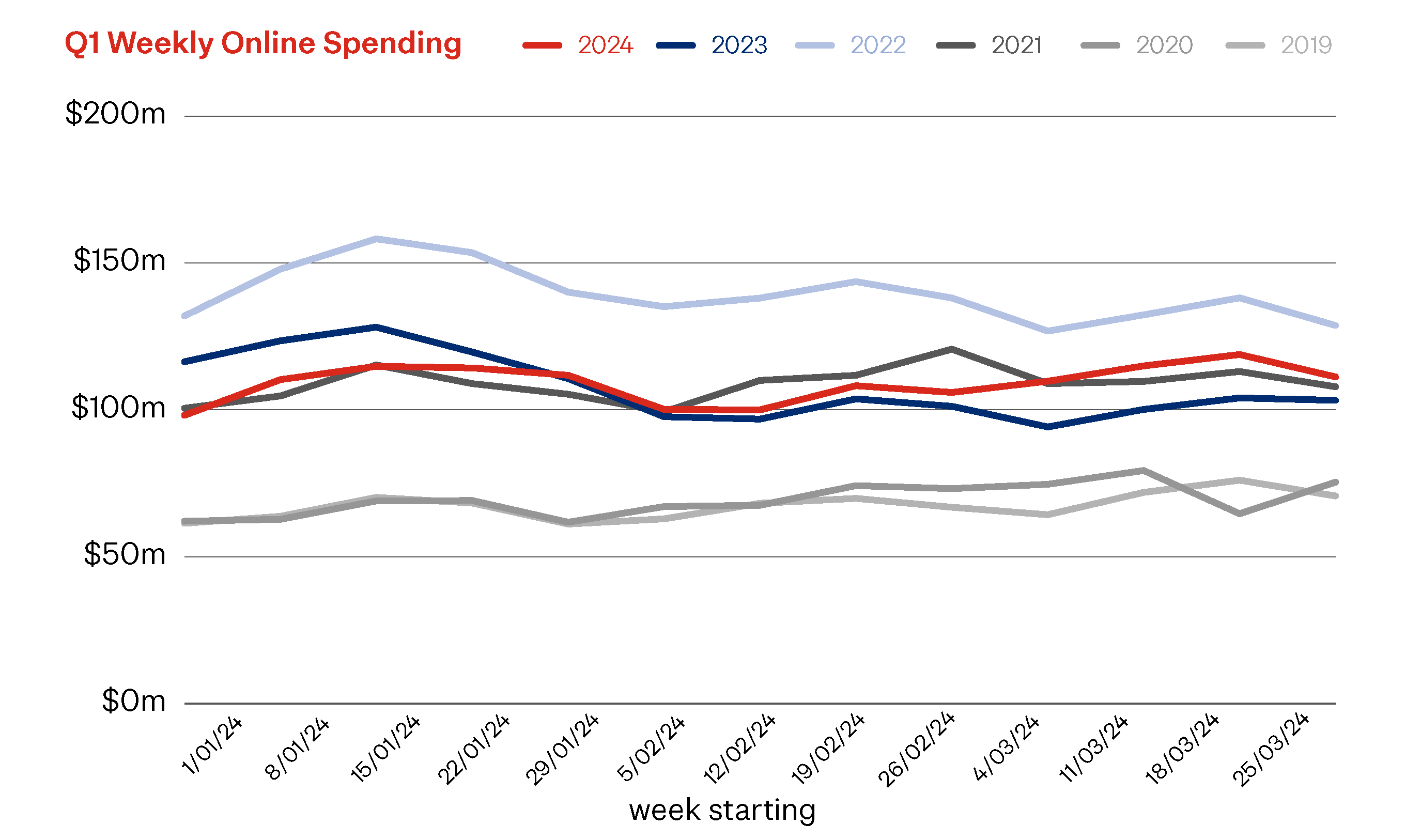

Kiwis spent $1.39 billion online on physical goods in the first quarter of 2024 (Q1 2024). Despite the tough economic times, and a lower average spend per transaction, online spending overall was up 2% on Q1 2023. Online’s continued growth this quarter was driven by 19% more online transactions than the same quarter in 2023.

Q1 2024’s big story was the continuation of the trend that has dominated retail shopping in 2023 – shoppers are adapting their spending behaviours to the economic conditions, in search of value. The result is that online shoppers are spending less per transaction by putting less in their shopping cart, buying discounted items, and/or choosing cheaper alternative products.

On the surface, a 2% increase in online spending may look like a good result, especially in difficult times when shoppers are cutting back on non-essential spending. With inflation at 4% in real terms shoppers continue to react to rising prices, and the string of negative economic news, by spending less.

As a result, it appears many retailers are finding that they need to discount prices or to promote special offers to maintain revenue. While this may give them the cashflow they need to keep going in the short term, it is likely to be eroding their longer-term profits.

Despite the environment, online shopping spend continues to grow. This is the second best Q1 we’ve seen in the last six years, outperformed only by Q1 2022 ($1.75b online spending) when the country was in ‘Omicron’ lockdown. Physical stores were closed during for much of that quarter, making online the only choice for many shoppers.

Despite the environment, online shopping spend continues to grow. This is the second best Q1 we’ve seen in the last six years, outperformed only by Q1 2022 ($1.75b online spending) when the country was in ‘Omicron’ lockdown. Physical stores were closed for much of that quarter, making online the only choice for many shoppers.

Q1 2024 vs Q1 2023

Online Spending $1.39b▲ 2% | Total Retail Spend $13.47b▼ 2% | eCommerce of total spend $10.3%▲ 0.4 percentage points |

Online spending also held up strongly against instore spending which was 2% lower than Q1 2023. This is the first time in a year that instore spending fell compared to the previous year. The decrease in instore spending was driven by a decrease in instore transactions, which may suggest that more instore shoppers are now looking online for cheaper alternatives.

And while there is much talk about the rise of international marketplaces, as a whole, Kiwi shoppers remain loyal to local retailers. 75% of spending online in Q1 2024 was with NZ-based businesses. That local spend number rises to over 90% when we look at just the Speciality Food, Groceries & Liquor sector. It falls to 60% when we look at Department, Variety & Miscellaneous Retail, the sector where low cost marketplaces like Temu and Shein operate in.

HELPFUL HINT

Help shoppers have a good experience. A good online shopping experience can lead to more repeat business. For many shoppers this means having full visibility around the products details, their order status and delivery timeframes and costs. Extend this through the delivery process, allowing shoppers to track their parcels and give their driver instructions. You could even go as far as having a photo sent to them confirming the parcel was delivered.

The drivers of Q1 2024 online spending

Two key changes – which largely offset each other – drove online spending this quarter.

Transaction volumes ▲ 19%On Q1 2023 | Average basket size ▼ 14%On Q1 2023 |

TRANSACTIONS: There were nearly 15 million online transactions during the first quarter of 2024 – 19% more than a year ago, and 90% more than the first quarter of 2020, when COVID first hit.

BASKET SIZE: While online shoppers are buying more often, we see a big 14% drop compared to last year, on the amount they spend each time. The average amount spent per transaction (basket size) in Q1 2024 was $93, a massive $15 down on Q1 2023. Shoppers are clearly being much more selective about what, and how much, they buy to make their money go further. The result is fewer items and/or discounted or cheaper alternative products in their shopping carts.

Anecdotally it appears shoppers are researching online more than ever before to ensure they get the best deals. Many are also making active choices to buy products when they find them on sale, rather than when they need them.

ONLINE SHOPPERS:1.6 million Kiwis (37% of the population aged 15 and over) shopped online in the first quarter of 2024. This was 3% (55,000 people) fewer than Q1 2023.

HELPFUL HINT

Help shoppers make their money go further. Shoppers value discounts and special offers. Think about other ways you can demonstrate value to them while still driving revenue for you. Good examples include free delivery with spend threshold; a discount on your next purchase; or a loyalty card.

Q1 2024’s online sector trends

Online spending across sectors, compared to Q1 2023, was a mixed bag. In very general terms, essential spending appeared to hold up better than discretionary spending, as shoppers prioritised ‘need’ over ‘want.’

Shoppers tightened their belts in all sectors, reflected in higher volumes of online transactions but smaller average basket sizes, across all sectors.

Q1 2024 vs Q1 2023

+1%Clothing & Footwear | +13%Department, Variety & | -3%Health & Beauty |

+4%Homeware, Appliances & | -3%Recreation, | -4%Specialty Food, |

Department, Variety & Miscellaneous Retail, our largest online sector, was the fastest growing sector, with online spending up 13% compared to Q1 2023. This was mainly due to large growth in the Miscellaneous Retail Stores – incorporating a wide mix of specialist online stores - which grew by 25% compared to Q1 2023.

Homewares, Appliances and Electronics sector was up 4% on a year ago, which is surprising given how tight shoppers were with their spending. Instore spending in the sector was actually 9% down. The sector’s online performance was driven by strong growth from electronic stores. Shoppers researching for the best deals, across multiple retailers, is likely to have also been a contributing factor here.

Interestingly, online Clothing & Footwear was up 1% on a year ago, but 5% down instore. This may suggest that shoppers have moved their spending online in search for better deals.

The biggest sector decrease in online spending, compared to Q1 2023, was in Speciality Food, Groceries & Liquor (down 4%). The drop was driven by decreases in Convenience Stores & Specialty Markets and Liquor Stores - both considered non-essential or discretionary spending. These declines were largely offset by growth in essential Grocery Stores & Supermarket spending.

HELPFUL HINT

Leverage your advantages to compete with lower prices. Shoppers are attracted to overseas marketplaces for their lower prices. Give shoppers good reasons to shop from you. For example, offer faster and more reliable delivery options; offer better and more personalised service; provide opportunities for shoppers to see and feel the product; or detail how their purchase helps support the local community.

Q1 2024’s online regional trends

Online spending in Q1 2024 grew in all regions – except Wellington – compared to Q1 2023. Growth rates ranged from a modest 1% through to a healthy 11%.

Hawkes Bay had by far the fastest growth rate of 11%. This is likely to reflect the decreased spending a year ago, post-Cyclone Gabriel, rather than more favourable shopping conditions today.

Wellington, our third largest online spending region, saw online spending down 5% compared to a year ago. Wellingtonian shoppers are clearly feeling cautious due to uncertainty around job security, as several government agencies announce job cuts.

Auckland, where over a third of the country’s online spending comes from, was only 1% up compared to the same quarter in 2023.

The quarter ahead

It’s hard to see the quarter ahead being too different to recent quarters, with online shoppers seeking to make their money go further. A pick-up of the housing market, a lower quarterly inflation rate and a stable OCR may have some feeling more optimistic about the months ahead. For others, any good news is overshadowed by their an increase in mortgage payments; rising rates, insurance payment and weekly grocery bill etc.

What we can be certain of is that shoppers will be online to find value, to research all the options and because of its ease and convenience.

How we can help

We’re passionate about helping you grow your online business, through the tough times and better times ahead. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help