Quarter three of 2023 (Q3 2023) saw Kiwis' online spending up 6% versus the same time last year (Q3 2022). At $1.47 billion, this is the second largest Q3 online spend we’ve seen in the last five years and a massive 51% higher than it was prior to the pandemic (Q3 2019).

Q1 2023 was 22% down on Q1 2022, while Q2 2023 was 7% down on Q2 2022. Q3 2023 saw a reversal of fortunes, with online spending growing on the equivalent quarter a year ago.

For many this growth will seem surprising given the turbulent conditions around us. While inflation seems to have passed its peak, the news around us continues to be largely negative. The rise in the Official Cash Rate (OCR) over the last few years has put increasing pressure on mortgage holders at renewal time. Also, while wages have risen, they haven’t kept up with inflation, progressively reducing shoppers’ spending power.

Through these tough conditions, have shoppers responded by spending more?

The headline figures would suggest that shoppers have increased their online spending, but the real story is how shoppers are continuing to adapt their behaviours to the economic conditions around them. Reality is that things just cost more and that probably accounts for the largest part of the spending increase. Q3 2023’s data shows us that transaction levels are 20% up on Q3 2022 and that the average spend per transaction is down 11% on Q3 2022. This suggests online shoppers are splitting their spend over more transactions, resulting in less items in their shopping cart each time. They also appear to be substituting products for cheaper alternatives. We explore this changing shopper behaviour further in The Drivers of Growth section below.

NZ POST'S TIPEssentially, shoppers are finding smarter ways to make their money go further in tough times. This presents opportunities for smart online retailers who can demonstrate value for shoppers. This could include offers like discounts for bulk, loyalty rewards and discounts for bundled complementary products. |

A similar pattern is emerging with instore shoppers. Q3 2023 instore spend was $12.76 billion, up 5% on the same quarter last year and up 17% on Q3 2019, before the pandemic. Like online shoppers, instore shoppers are also transacting more often but buying less each time and choosing cheaper options.

With $14.23 billion of spending on physical goods – across both online and instore - Q3 2023 was the highest third quarter spending we’ve seen since we started tracking retail spend five years ago. Total retail spending was up 5% on a year ago.

Q3 2023 vs Q3 2022

|

Online Spending ▲ 6% |

Instore Spending ▲ 5% |

Total Retail Spend ▲ 5% |

Even though online shopping seems well suited to inflationary times, offering shoppers the convenience to shop-around for bargains and its easy access to global products, Kiwi shoppers continue to be loyal creatures of habit. Around 10% of retail spend is online, suggesting we still prefer to see and touch products before we buy them and that we also enjoy the physical shopping experience. Online spending grew to over 13% of total spend during 2021, largely due to pandemic restrictions on instore shopping.

Furthermore, 73% of online retail spend is with local businesses. It has remained at about this level since the start of the pandemic. It seems that, even though many shoppers know that there are cheaper products available overseas, they prefer the safety of local, the quicker (and typically cheaper) delivery and the satisfaction of supporting the local economy.

Buy Now, Pay Later (BNPL) continues to be a prominent tool helping online shoppers manage the inflationary pressures they’ve been feeling. Q3 2023 saw BNPL online spend up 18% on the same quarter last year. This continues a long-running growth trend which has delivered 252% growth since Q3 2019.

The Drivers of Growth

No doubt online retailers are feeling the increase in activity, without necessarily seeing the accompanying rise in revenue. This is because there were 2.3 million more online transactions in Q3 2023 than there were in Q3 2022. This is a massive 20% increase and back to the transaction levels we saw at the height of the pandemic in 2021 when parts of the country were in lockdown. The quarter’s online transactions are 51% higher than pre-pandemic Q3 2019 levels.

Instore transaction levels for the quarter were up 6% on Q3 2022.

Quarterly Online Transactions

14.52mQ3 2023 |

12.15mQ3 2022 |

14.50mQ3 2021 |

Quarterly Online Basket Size

$102Q3 2023 |

$115Q3 2022 |

$109Q3 2021 |

One of the most significant changes in shopper behaviour we saw over the quarter was the drop in the average size of each online transaction. The average online basket size was $102 in Q3 2023, down $13 from Q3 2022 and at the same level to what we saw in Q3 2019. This sizable drop is despite rising prices and suggests that shoppers are managing their budget by buying more often, buying fewer items each time and by choosing lower-cost alternatives.

Interestingly, while the online shopping basket dropped 11% in Q3 2023, compared to the same quarter a year before, the instore shopping basket only dropped by 1% for the same period. This may highlight one of the key advantages online offers shoppers – the ability to easily look around for better value options.

Online Sector Spending

Almost all sectors experienced growth in online spending of between 5% and 18%, compared to Q3 2022. The exception was Speciality Food, Groceries & Liquor which saw a decline online.

The sector with the highest online spending growth on Q3 2022 was Department, Variety & Miscellaneous Retail Stores. 18% growth saw an additional $55 million online spent in Q3 this year compared to the same quarter in 2022.

The other sector that saw strong online growth was Clothing & Footwear, up 13% on Q3 2022. Incidentally, Clothing & Footwear instore spending for the quarter was down 1% which may imply shoppers transferred some of their instore spend to online retailers.

Speciality Food, Groceries & Liquor saw its Q3 2023’s online spending down 4% compared to Q3 2022. While online transactions were up for this sector compared to a year ago, a big decline in the average basket size pulled online spending down. Ironically, this sector had the highest instore spending growth compared to a year ago, up 9%. This could suggest shoppers traded some of their online spend for instore spend.

Regional Trends

- Online spending grew across all regions compared to Q3 2022, with the increases varying from 4% to 16%.

- Tasman region experienced the largest increase, up 16% on Q3 2023, followed by Nelson, West Coast and Manawatu/Wanganui at 13%.

- The lowest growth of 4% was in Otago.

- Auckland, which makes up 35% of the country’s total online spend, only grew by 5%. Wellington, the country’s second largest online spend region, also saw a modest 5% increase.

- Throughout the nation online spending is 44% to 85% above Q3 2019 pre-pandemic levels. Gisborne region leads the way, up a massive 85%, followed by Manawatu/Wanganui (78%), Hawkes Bay (71%), Southland (71%) and Northland (66%). Auckland’s online spending growth of 45% since Q3 2019 is one of the lowest in the country.

Year to Date and Looking Ahead to Q4

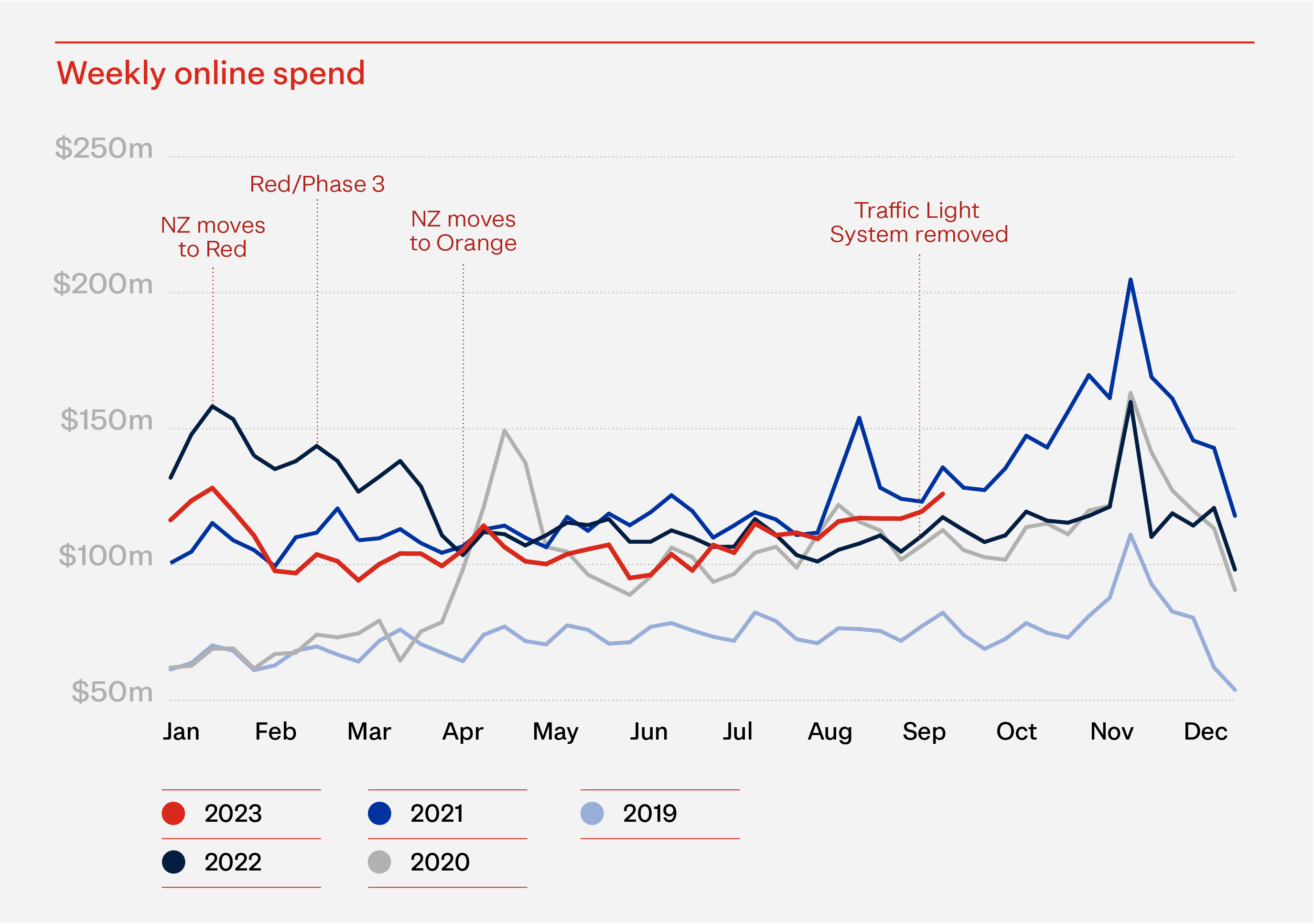

In the year to 30 September 2023, online spending has reached over $4.1 billion. While this is down on the last two years, we must remember that the previous three years have seen instore shopping disrupted by the pandemic, driving spikes in online shopping.

2022 saw online shopping hit new highs in the first quarter, due to the rapid spread of Omicron. Once restrictions were released, we saw online shopping settle back to more ‘business as usual’ levels. Understandably, Q1 2023 online shopping sales were well down by comparison to Q1 2022, still behind, but by a lot less, in Q2 and ahead in Q3 2023.

The final quarter of the year (Q4 2023) features the big shopping events (Singles’ Day, Click Frenzy, Black Friday and Cyber Monday) leading into the Christmas peak shopping period. We don’t expect this year’s Q4 online shopping spending numbers to reach the highs of Q4 2021 when over $1.9 billion was spent in the quarter. However, it wouldn’t surprise us if we see online shopping spending at around Q4 2022’s levels. Pockets of consumer optimism support this outcome, though a second global conflict may help keep this optimism in check.

With the turbulent economic conditions, it’s hard to predict where 2023 may end up. We expect that online sales will land somewhere around 5-7% below last year’s level of $6.07 billion. We must remember, that the last full year with no COVID disruptions was 2019. Online shopping sales only reached $3.74 billion that year.

NZ POST'S TIPWherever the year ends up, the biggest opportunity for online retailers is to capture their share of spending in this upcoming Q4 peak, especially around the big sales events. Last year we saw many shoppers start their Christmas shopping earlier, using the November sales events to stretch their Christmas budget further. We also saw many shoppers looking around to compare prices and to find better value deals. It is likely that we will see all these behaviours again this year. Check out our ‘Top tips for sales events 2023’ article for lots of helpful ways to get the most out of sales event activities. |

The data used in this eCommerce Spotlight is credit card transactional data supplied by Datamine. Online spend includes both international and domestic shopping, and is filtered appropriately to only include consumer goods. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.