Kiwis spent $1.6 billion on online physical goods in the second quarter of 2022 (Q2 2022), down 4% on the same quarter in 2021. Have online shoppers returned to their pre-pandemic habits, once again seeking out physical shopping experiences? The answer is an emphatic no. Retail shoppers are feeling the bite of our economic reality and it’s reducing their ability and willingness to spend – both online and instore.

Online shopping has grown at a phenomenal rate over the last 30 months or so, fuelled by new shopper habits established when COVID restricted our ability to go to stores. Comparing Q2 2022 to pre-pandemic days, we see online sales up a whopping 52% on Q2 2019.

In Q2 2022 physical retail stores were open, with minimal restrictions, and that will no doubt have many wondering if the 4% decline in online spending represents the burst of online’s bubble. We need to consider this question in the context of the wider economic and retail environment.

The backdrop for Q2 2022’s retail spending story is the economic environment that shoppers face. Inflation is at over 7%, a 30-year high, reflecting international factors like petrol prices and the war in Ukraine, and domestic inflationary pressures. Wage increases are lagging behind as the post-pandemic recession, staff shortages and the rising cost of doing business has made it difficult for employers to keep up. Adding to this is the continuation of restricted borders, a housing slow-down, and rising interest rates. This multitude of negative factors has seen shoppers become cautious about their spending, leading to lower spending across all retail channels.

Total retail spend on physical goods (online and in-store) for the quarter was $15.34 billion, down 5% compared to a year ago but 8% up on the equivalent pre-pandemic quarter (Q2 2019). The pattern is similar when we look at just instore spending. Kiwis spent more than $13.7 billion this last quarter instore, 5% down compared to Q2 2021 but 4% above pre-pandemic Q2 2019. In this context, online spending has fared comparatively well to other channels, reinforcing that online shoppers are not making the switch back to instore but they are tightening their purse. What it highlights though is that online shopping is not immune from the same economic headwinds that retail has always been exposed to.

Drivers of spend decline

If shoppers haven’t switched back from online to instore, what’s driving the decline in online spending? In short, shoppers are spending about the same online each time they buy but they are buying with less frequency. During the quarter, Kiwis made more than 12.36 million online transactions. This is down 7% on the same quarter last year. Interestingly though, the average spend per transaction this quarter was up 2% ($2.91) to $131. This is most likely an inflationary symptom, as shoppers pay more for the same items in their basket.

The other significant emerging driver is shoppers move from non-essential to essential spending. Our largest sector, Speciality Food, Groceries & Liquor held its ground online (0% spend decline on Q2 2021) and only experienced a 1% decline instore. Within the sector, however, we see two different stories. The grocery store/supermarket sub-sector saw a 14% rise in online shopping spend on Q2 2021, driven by 17% more transactions. Contrast this with liquor stores which saw a 10% decline in spend. Shoppers are clearly putting less liquor in their basket or substituting products with lower priced items.

Health & Beauty was the only online sector to show spend growth in the last quarter, up 4% on Q2 2021, driven by pharmacy and medical spend. Combined, these essential sub-sectors were up 15% on Q2 2021, driven by strong transactional growth in a period of COVID and flu sickness. Conversely, spending at online cosmetic stores was down 10% compared to a year ago. A possible reason could be the increase of people working from home.

Discretionary spend sectors like Department, Variety & Misc. Retail (down 12%), and Recreation, Entertainment, Books & Stationary (down 10%) experienced the largest declines in online sector spend compared to Q2 2021.

The bigger picture

Looking beyond the last year, Q2 2022’s online transaction volumes were up 28%, with basket size up 19%, compared to pre-pandemic Q2 2019. There’s no doubt, despite a short-term decline in growth, that online shopping is still in a strong position. Online spending this quarter represented 11% of total retail spending, a level similar to Q2 2021 but well up on the 7% it represented in Q2 2019.

Amongst all the negativity of our economic environment, we see online shoppers continue to make the positive choice to buy local. 75% of spending online in Q2 2022 was with NZ-based retailers, up from 71% a year ago. This is the highest quarterly level of local sentiment we’ve seen since the start of 2019.

Online Spending Snapshot Q2 2022

Who’s shopping online?

18%of online shopping spend is by |

67%of online shopping spend is by |

12%of online shopping spend is by |

Where are they shopping from?

35%Auckland |

12%Canterbury |

12%Wellington |

What are they buying?

25%Speciality Food, |

23%Department, Variety |

22%Clothing & Footwear |

2022 Year to Date

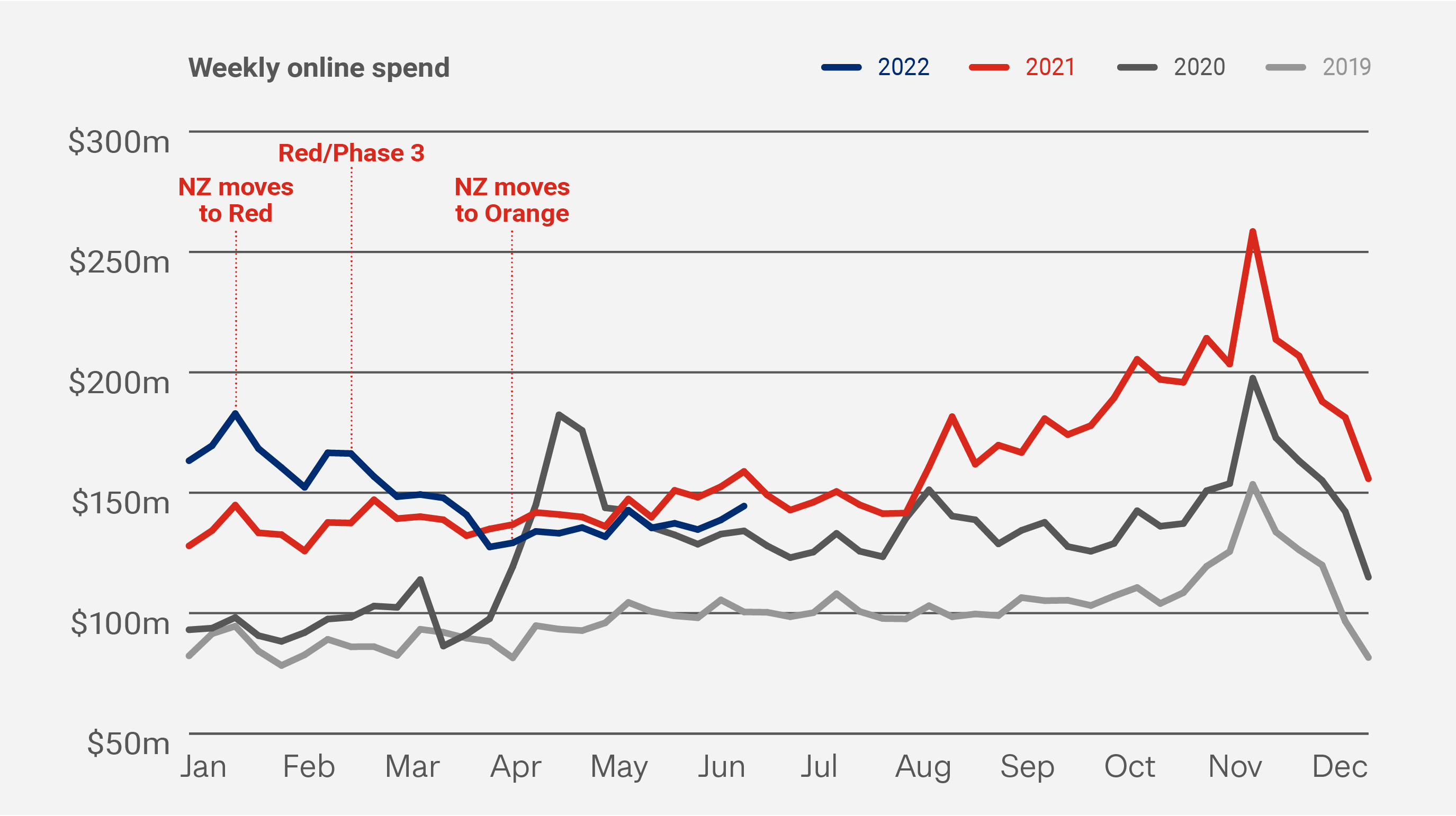

For the first half of 2022, Kiwis spent $3.64 billion online. This is 11% up on the same period in 2021 and a massive 81% (over $1.6 billion) up on the first half of 2019.

Fuelling this growth is the frequency by which shoppers get online, resulting in 28.6 million online transactions in the first half of 2022, up 9% on the year before. This growth is further enhanced by an increase in the average online basket size, up 2% when compared to the first six months of 2021. This basket size growth largely reflects the higher prices shoppers have been paying at the checkout since the start of the year.

This first half year result was driven by strong spend numbers in January and, to a slightly lesser degree, February. In more recent months, we’ve seen monthly online spend numbers at lower levels than the equivalent month a year earlier - April 2% down, May 0% down and June 10% down. This monthly decline compared to last year is likely to continue as the retail sector faces more economic headwinds and consumer confidence continues to take a hit. The recent BCG Consumer Sentiment report* showed that over 80% of consumers are expecting inflation to remain high in the next six-months and as a result are looking to spend less on non-essential items. Our own research, outlined in the recent eCommerce Market Sentiments Report 2022, showed us that online retailers see the economy as one of the biggest impacts on their business success in 2022.

In April we spoke to Jarrod Kerr, Kiwibank’s Chief Economist, who highlighted that shoppers and retailers were in for a tough time in the short-term. Fortunately, he was considerably more optimistic about the medium to longer term prospects for our economy. Watch the interview here.

This slowing down of online shopping growth isn’t a uniquely New Zealand story but something the eCommerce industry is seeing worldwide. Shopify, for example, recently reduced staff numbers, citing the slowing of online growth as the key reason**. After a period of global hyper growth, led by a health crisis, is an economic crisis bringing back a greater sense of ‘normality’ to online shopping growth? We’ll keep a close eye on the trends and what they mean for your business growth.

* https://www.bcg.com/publications/2022/new-zealand-consumer-sentiment-report-series

** https://www.cp24.com/news/i-got-this-wrong-shopify-ceo-announces-plan-to-lay-off-10-per-cent-of-staff