Kiwis spent more than $1.36 billion on physical goods in the first quarter of 2023 (Q1 2023), a massive 22% drop in online spending from the same quarter a year ago. In these tough economic times, when online shopping offers the opportunity to compare prices and search for bargains, why are shoppers reducing their online spend?

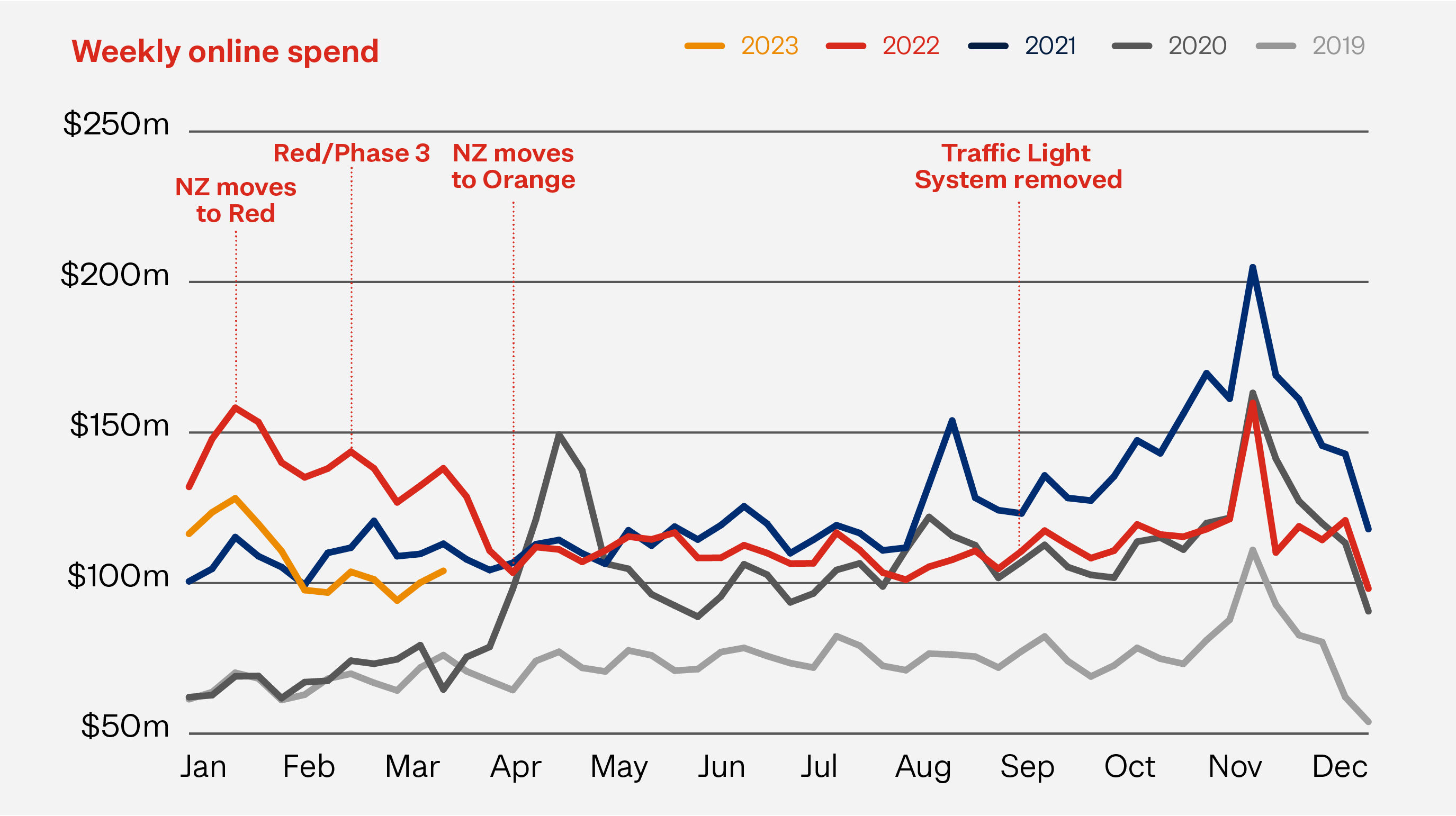

To really understand the reason for this big drop we must go back a year, to Q1 2022. The start of 2022 was greeted by the arrival of the Omicron COVID variant, seeing the country once again back in lockdown by late January. With physical shopping restricted, online shopping was the main option for many of us through the quarter. As a result, Q1 2022 ended up being the second largest online shopping quarter we’ve had in the last five years, beaten only by Q4 2021 with its November sales events and Christmas/Boxing Day sales.

But to suggest this fall in online spending is purely a comparison issue, is to ignore the crucial factor that is shaping shopper behaviours – the economy. It’s a very different economic environment out there from twelve months ago. Annual inflation has hovered at around 7% for the last three quarters, and shoppers are directly feeling this at the checkout. The Official Cash Rate (OCR) has risen from around 2% to over 5% in the last year, putting pressure on mortgage holders, and driving house prices down. And while wages have risen, they haven’t kept up with inflation, further eroding shoppers’ spending power.

So, shoppers have responded in the best way they can, by shopping less often, putting less in their shopping cart and by looking around for cheaper alternatives. The result is that quarterly online spending is back down to the levels we saw in Q1 2021. Putting this decline in context, Q1 2023 spending was still almost 60% higher than what it was three years ago. Q1 2020 was the quarter when COVID first appeared, leading to the first online peak in the following quarter.

Shoppers tightening their belts isn’t a behaviour confined to just online – they’ve cut back spending across all channels. Instore spending for Q1 2023 was $12.35b, down 2% on the same quarter in 2022. On the surface this doesn’t sound like a big drop but remember that a year ago physical shopping was restricted for a large part of the quarter. Shoppers were hesitant to visit stores, fearing the spread of Omicron in the community. We would therefore have expected a more significant lift in instore shopping this quarter compared to a year ago. Add to this the fact that things cost more now, and we can clearly see that shoppers are cutting back spending through this channel as well.

Q1 2023 vs Q1 2022

Online spending ▼ 22% | Instore spending ▼ 2% | Total retail spending ▼ 4% |

Total retail spending for Q1 2023 – online and instore – was $13.71b, 4% lower than in Q1 2022, but still 5% above Q1 2021 and 13% above Q1 2020 when the pandemic started.

Interestingly, despite the tougher economic conditions, Kiwis are spending more on experiences, entertainment, and travel than they were last year. Partly, this is because a year ago there were restrictions on all these activities and also because Kiwis are now prioritising themselves, their families, and their wellbeing in these tougher times.

Finally, we continue to see Kiwis favouring local retailers when it comes to shopping online, with 72% of online spending in Q1 2023 with Kiwi based retailers. This reflects a desire to support the local economy, the quicker delivery available and possibly also the money-saving option to click and collect.

The drivers of decline

In each quarterly edition of eCommerce Spotlight, we look at the three key factors that drive online spending – the number of shoppers online, how often they shop and how much they spend each time. Compared to Q1 2022, this quarter we see fewer shoppers online, buying less often and spending less each time. It’s this trifecta, driven by the economic environment, that drove the sizeable 22% drop.

Quarterly online customers

1.83mQ1 2023 | 1.97mQ1 2022 | 1.58mQ1 2021 |

1.83 million Kiwis (44% of the population aged 15 and over) shopped online in the first quarter of 2023. This is 7% (more than 146,000 people) down on Q1 2022. However, the number of people buying online this quarter was nearly quarter of a million (15%) more than Q1 2021.

Quarterly online transactions

12.55mQ1 2023 | 15.62mQ1 2022 | 7.86mQ1 2020 |

Online transactions were 20% down on Q1 2022, telling us that shoppers were buying online less often. On average there were around 139,000 online transactions a day in the quarter – around 34,000 transactions less a day than the same quarter a year ago.

The quarter’s online transactions were similar to Q1 2021 levels and still 60% higher than pre-pandemic Q1 2020 levels.

Quarterly online basket size

$108Q1 2023 | $112Q1 2022 | $109Q1 2020 |

Along with shopping less often, online shoppers also spent less each time. The average online basket size was $108 in Q1 2023, down almost $4 (3%) from Q1 2022 to a similar level to Q1 2020. This decline was despite rapidly rising prices and suggests that shoppers are managing their financial pressures by buying less items or swapping out their purchases for lower-cost alternatives. Chances are, they were doing both.

Homewares, Appliances & Electronics had the biggest basket size decline online of 18% while the majority of sectors only declined by 1-2%. This suggests that big ticket items were some of the first to be cut back by shoppers, making this sector the biggest contributors to the quarter’s decline. At the other end, Health and Beauty saw an 11% increase in online basket size.

Sector by sector online spending

Homewares, Appliances & Electronics (down 33%) was the sector with the largest online spending decline compared to Q1 2022. This was driven by falls in both transaction numbers and the average basket size. This sector also saw the largest decline in instore spending (down 15%), while most other instore sectors experienced 1-4% increases.

Speciality Food, Groceries & Liquor saw online spending fall 25% compared to Q1 2022. Instore spending remained at about the same level. While essential grocery and supermarket online spending was down 19%, the overall sector was impacted by larger declines in non-essential online spending like liquor stores (-40%).

Interestingly, Health & Beauty didn’t show that same distinction between essential and non-essential spending. After two quarters of holding steady, online spending in this sector for Q1 2023 was 13% down on a year ago.

Clothing & Footwear online spending fell 15% compared to Q1 2022. Conversely, instore spending in this sector saw a lift of 4%, with shoppers embracing the freedom to go to the stores they didn’t have a year ago.

Quarterly online spending at Department, Variety & Misc. Retail Stores was down 20%, while Recreation, Entertainment, Books & Stationery was down 14%. Both sectors saw positive growth (3-4%) in instore spending for the quarter, possibly suggesting that shoppers are returning to stores for these goods.

Buy Now, Pay Later (BNPL) continues its relentless growth, no doubt fuelled by shoppers looking for more ways to manage the economic environment. BNPL is up 6% compared to Q1 2022 and 66% compared to Q1 2021. Since the start of the pandemic, BNPL has experienced mega-growth, and this quarter’s spend was nearly three times the level of Q1 2020 when COVID first hit.

Q1 2023 regional spending round-up

- Compared to the same quarter last year, online spending fell across all regions, with half of all regions experiencing declines of 20% or more. Taranaki and the West Coast were the regions with the smallest declines (-12%).

Regions with the biggest declines in quarterly online spending compared to Q1 2022

Hawkes Bay-24% | Auckland-23% | Otago-23% |

Marlborough-23% | Nelson-22% | Tasman-21% |

- Hawkes Bay and Auckland were adversely affected by severe weather events during the quarter, including Cyclone Gabrielle. While these regions had the highest declines in online spending, the decline rates weren’t significantly higher than other regions so it’s hard to say with any certainty what impact the weather had on their spending.

- Online spending was up for all regions compared to two years ago (Q1 2021), except in Auckland, the Hawkes Bay and Nelson. Auckland was down 3%, the Hawkes Bay down 1% and Nelson’s online spending was about the same as two years ago.

- Going back to when the pandemic broke out (Q1 2020), online spending this quarter was at least 50% higher across all regions.

Looking ahead to Q2 2023

A key reason for the quarter’s 22% decline in online spend is that we are comparing it with the highs of Q1 2022, when COVID fears and lockdown restrictions saw people stay away from stores. Looking ahead to the next quarter, we expect the level of decline to reduce significantly, assuming of course that we will be comparing two quarters with a similar low level of retail restrictions.

We expect shoppers will continue to be mindful of the economy, even following the news of slightly better than expected quarterly inflation numbers. It’s therefore reasonable to expect online shopping levels to remain below 2022 levels in the next quarter. By how much, will depend on how shoppers respond to the ongoing impact of inflation, recent interest rate hikes and their ongoing desire to prioritise spending on experiences, entertainment and travel.

Now more than ever, shoppers love a bargain. And of course this quarter offers a number of good opportunities for online retailers to stimulate spend from existing and new customers with Easter, ANZAC Day, Mother’s Day and King’s Birthday promotions.

We’ll continue to monitor and report on the market, providing relevant data and insights to help you navigate this tricky time. Keep an eye out for our latest Market Sentiments Report in the next few weeks. This research with both shoppers and retailers will help you gain a better understanding about what’s driving the behaviours behind the latest numbers.

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.