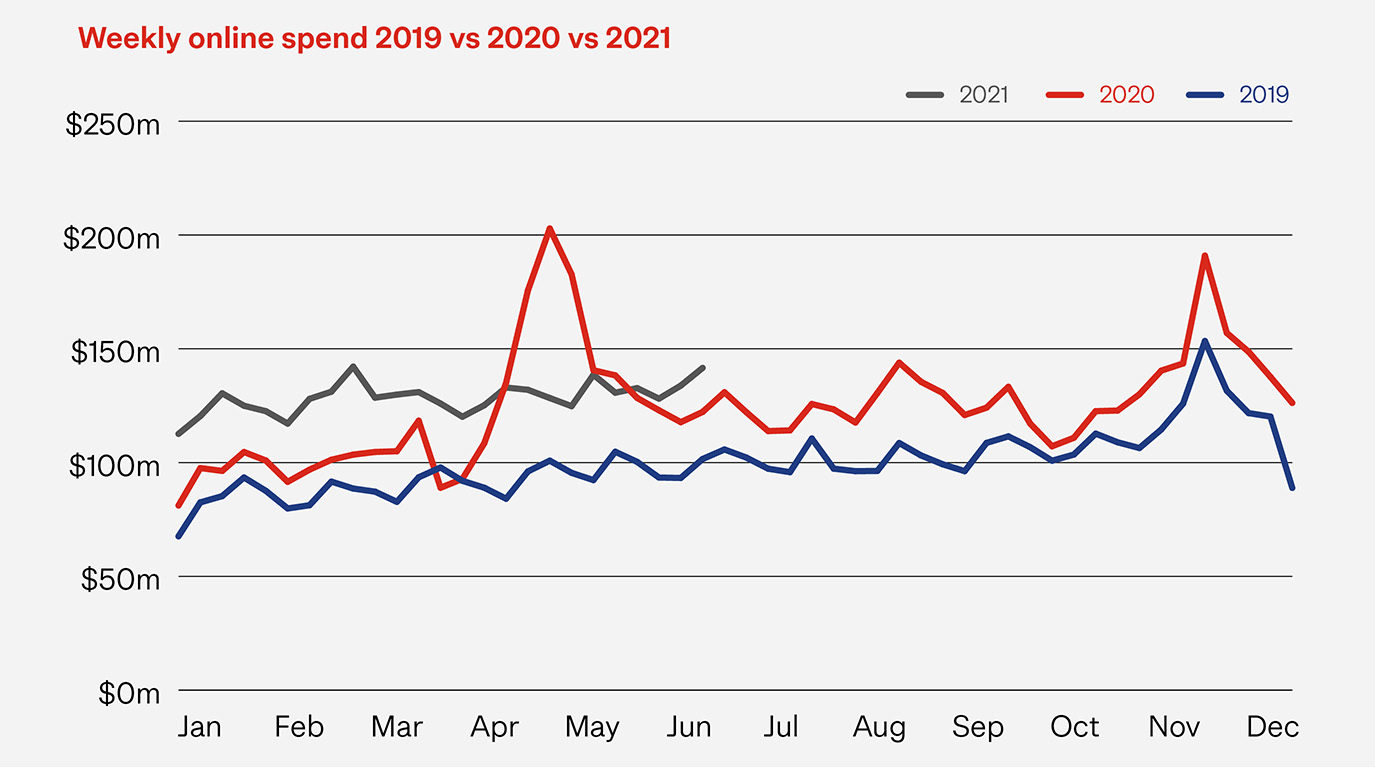

Quarter two 2021 (Q2 21) saw online spend of $1.52b, down 6% on the record high of $1.61b a year ago (Q2 20). While at first glance this may suggest that online spending has peaked, context is important here. Over April and May in 2020, New Zealand was in lockdown with physical stores closed. Online shopping reached new highs that haven’t been matched again.

By all other measures, Q2 21 represents a continuation of New Zealand’s ever-growing love affair with online shopping, up a massive 36% on spend numbers for the equivalent period in 2019.

With half the year gone already, online shopping is on track to end 2021 at a best-ever result, with spend likely to be above $6.6b. This would be around 14% higher than 2020, an unprecedented year that was already 25% higher than the year before.

This is more good news for Kiwi online retailers, with ever growing online shopping numbers and a continuation of strong local sentiment. Over 70% of online sales continue to be with local retailers.

Overall retail sales (online and in stores) in Q2 21 were $13.54b, making it the best Q2 ever and putting 2021 on track to be another record year for retail. Given that physical stores were closed for much of Q2 2020, it’s not surprising the physical store spend numbers are well up on last year – up 22% in fact. When compared to the same quarter in 2019 the numbers are a more modest 8%.

The drivers of growth.

In each eCommerce Spotlight edition, we look at the three key factors that are driving online spending – the number of shoppers, how often they spend and how much they spend each time. While we see a decline in some areas from the highs of last year, all three areas show significant increases over the two year period from Q2 2019.

Shoppers online

2.13mQ2 2021 |

2.03mQ2 2020 |

1.9mQ2 2019 |

The total number of Kiwis shopping online continues to reach new highs, but within that we are seeing a decreasing number of new shoppers coming online quarter by quarter. Not surprising, the second quarter of 2020 saw record numbers of new online shoppers, over 100,000. Q2 21 saw 65,700 new shoppers, a significant drop on last year and 15% lower than the new shoppers that entered the market in the same quarter in 2019.

Average number of transactions per customer per quarter

6.59Q2 2021 |

7.26Q2 2020 |

5.58Q2 2019 |

After the spike in 2020, fuelled by an inability to go to physical stores, online shopping transaction numbers have normalised at a level not too far off the highs of a year ago. Transaction levels continues to be one of the biggest contributors to the ongoing growth of online shopping. In Q2 21 there were 14.1m online transactions, and while that’s down on the 14.8m of last year, it’s a huge 3.2m transaction (30%) up on the same period in 2019.

Average Basket Size

$108Q2 2021 |

$109Q2 2020 |

$103Q2 2019 |

Basket size, the average size of each online transaction, has plateaued at $108, up $5 on two years ago, a dollar up on Q1 21 and just a dollar short of the highs of 2020. Most interesting is the comparison with physical store transactions, where the average basket size for the quarter was $56, just above half that of online.

Sector Growth

Recreation, Entertainment, Books & Stationery continues the strong comeback we saw last quarter, following a very disappointing 2020. It saw a 27% increase in sector spend online, compared to the same quarter in 2020, with strong performances from both local and international retailers. The Clothing & Footwear and Health & Beauty sectors are both slightly up on Q2 2020 spend numbers. Compared to the highs of Q2 2020, at first glance the remaining sectors look like they are in decline. The reality is that all sectors are well up on where they were at the same time in 2019.

A year ago we saw huge growth in Department, Variety & Miscellaneous Retail, Homewares, Appliances & Electronics and Specialty Food, Groceries & Liquor. This reflects lockdowns where we were all working from home, setting up home offices, getting groceries delivered and buying new equipment. Compared to those numbers, Q2 21 was somewhat underwhelming for these sectors with all three seeing declines in spend. Homewares, Appliances and Electronics saw the biggest decline, 23% down on the same period in 2020.

Who’s shopping, where and when.

The regions that lead the way in 2020 continue to do so in 2021. Auckland’s spend in Q2 21 was even higher than the peak a year ago and 54% higher than the same period in 2019. Gisborne and Taranaki were only 2% down on the same period in 2020 and 61% and 77% respectively up on two years ago. Overall between Q2 19 and Q2 21 we see an average increase of 38% across all regions.

A year ago we saw the over 60 age groups show the highest growth rates, with many buying online for the first time. While this year their overall shopper numbers are up, the level of growth is significantly lower. Interestingly, it’s the younger 20-25 age group leading the way for growth.

Over the last year we’ve seen the continued growth of Wednesday as a key online shopping day. A third of all online shopping now happens on a Tuesday or Wednesday, largely as a result of a declining share of transactions on Friday and Saturday.

Key Shopping Trends

Our weekly spend analysis has started to show some distinctly positive spend trends in the back half of the quarter and in particular with overseas spend. These are signs that potentially support growing shopper confidence and lead us to feel even more optimistic about the prospects for Q3 and Q4. We’re encouraging our retailers to start planning now for what potentially could be record breaking quarters ahead.