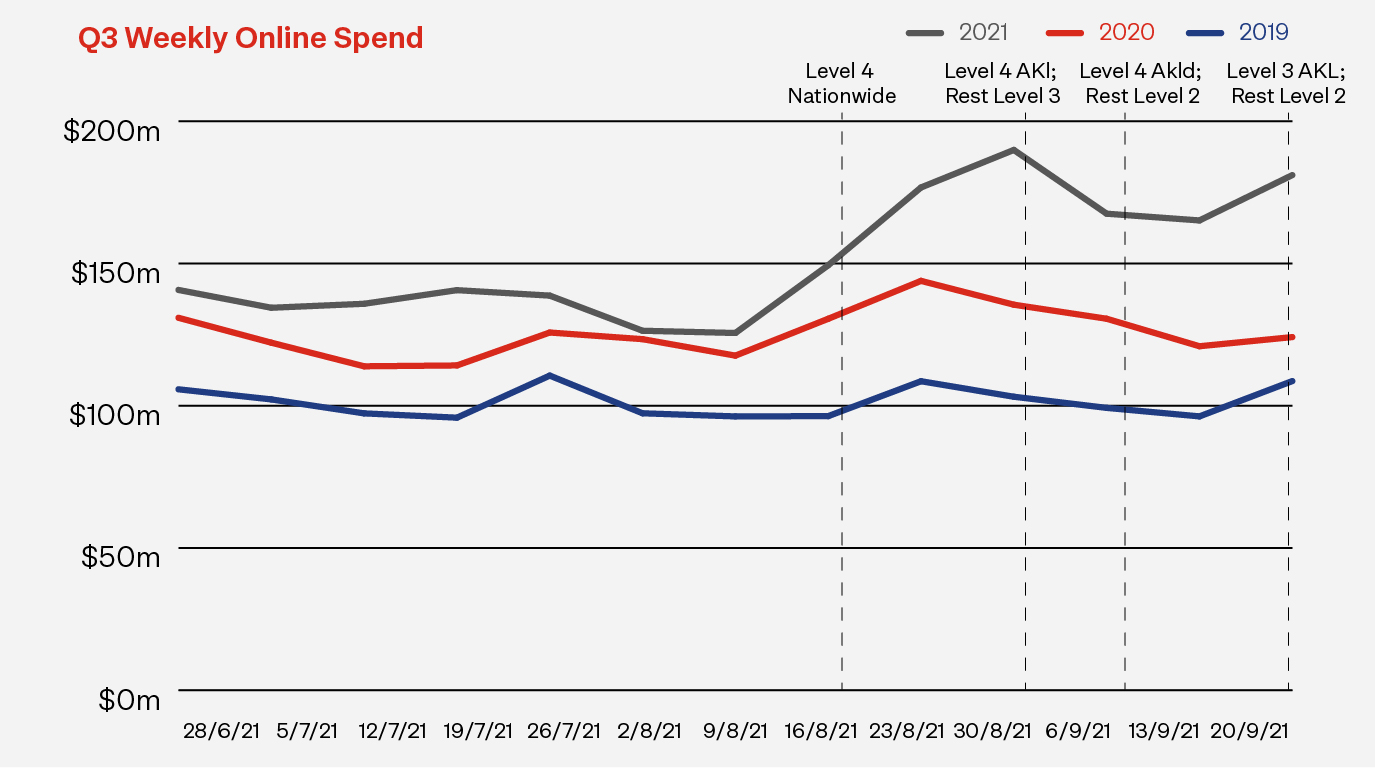

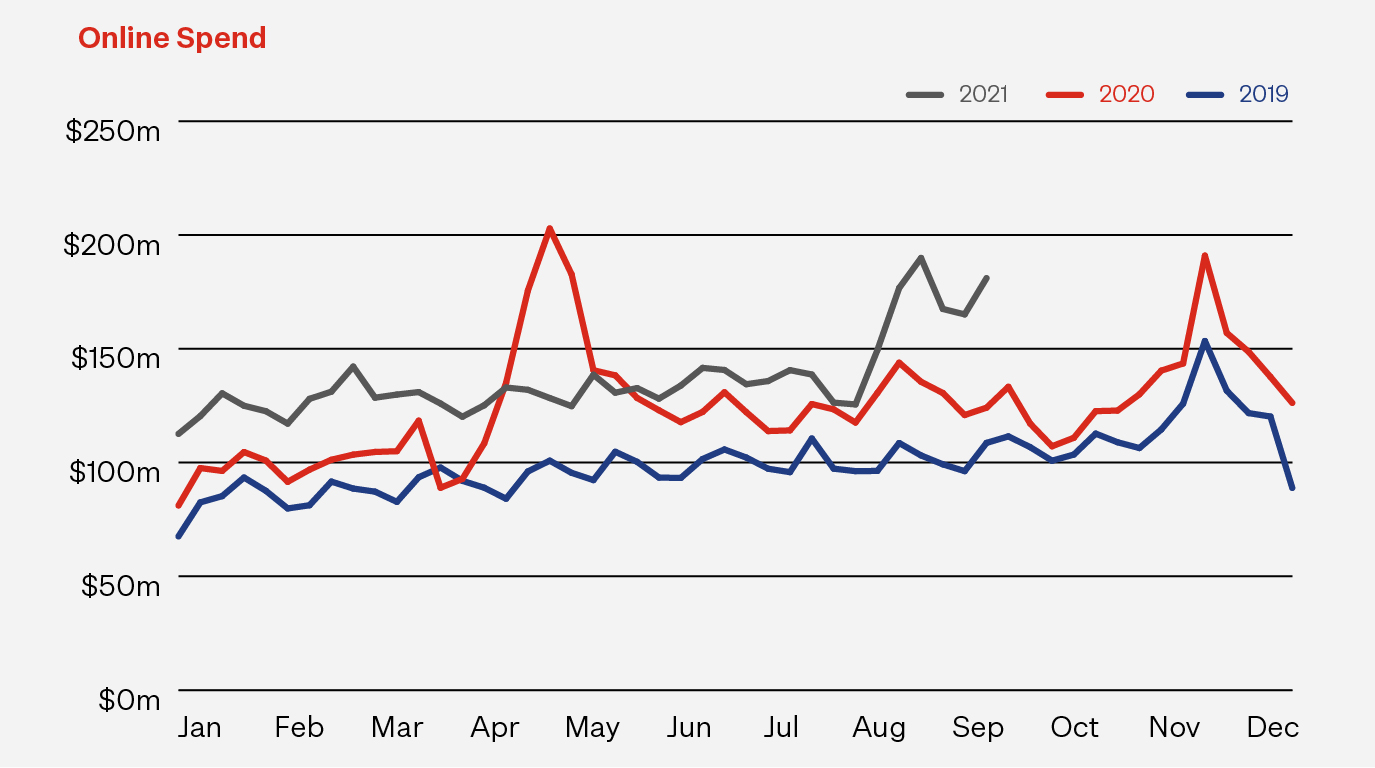

Quarter three 2021 (Q3 21) was not surprisingly a big quarter for online shopping, thanks to lockdowns significantly reducing shoppers’ access to physical stores. An online spend of $1.78b was a massive 22% increase on the same quarter last year. In comparing to last year, we shouldn’t forget that Q3 20 was also impacted by lockdowns and saw sale figures elevated as a result. If we compare online spend to the same quarter two years ago (Q3 19), we see an increase of over 50%.

Q3 21’s $1.78b online sales is the biggest quarter since we started monitoring the markets over three years ago. Putting this in context, Q2 20, which saw an online sales spike due to the first nationwide lockdown, had online retail sales of $1.6b. Q4 20, driven by multiple big sales events and the Christmas sales peak, had online sales of $1.57b.

The percentage of total retail from online has been steadily rising, from around 10% two years ago, to this quarter accounting for 14% of all retail sales. No doubt the prolonged closing of physical retail stores was a big contributor to this. Offline (in-store) spending for the quarter was 12% down on the same quarter last year and 4% below Q3 19. Despite lockdowns, year-to-date physical spending is still up a healthy 4% on last year.

Online year-to-date spending is up 13% on the first nine months of 2020. This represents over half-a-billion dollars more spent by Kiwis online so far this year compared to last year. Comparing this to pre-Covid days in 2019, we see spend online in the first nine months of this year is 44% higher than two years ago.

Based on how we are tracking after three quarters, and with lockdowns still impacting physical retail spend, and the big sales days still ahead of us, we continue to forecast that 2021 will exceed $6.6b annual online spend. That’s around 14% above 2020’s spend numbers, a year that was already 25% higher than 2019.

The drivers of growth

In each eCommerce Spotlight edition, we look at the three key factors that drive online spending – the number of shoppers, how often they shop and how much they spend each time.

There can be no doubt about what was driving growth in Q3 – transactions. There were over 17.26m transactions online this quarter. That’s nearly 4 million more than the same quarter last year – a 29% rise. Growth in transactions is also the key force behind the year-to-date growth, with 45m transactions so far this year, up 15% on the same time last year. That averages out to over 165,000 online transactions per day!

The quarter’s shopping drivers reinforce a couple of key trends we’ve seen all year. The total number of customers online was slightly down on this time last year, and has remained relatively steady, at just over half the adult population of New Zealand, throughout 2021. Despite the total shopper number being flat, there were 20% more first-time shoppers than in the same quarter of 2020. The second trend is that online shoppers are spending less on average each time, but shopping with much greater frequency. The average basket size was $103 this quarter compared to $110 in the same quarter last year. Offsetting this is the increasing number of times shoppers are buying online each quarter – on average 8.2 times. This figure was 6.3 in the same quarter last year.

Over the quarter, shoppers averaged $849 online spend, $155 (22%) more than the same quarter a year ago.

Q3 21

2.1mCustomers online |

8.2Transactions per |

$849Average quarterly |

Year-to-date 2021 (compared to YTD 2020)

$106Average basket size |

45mOnline Transactions |

$4.8bOnline Spend |

One final factor is domestic spend, with over 70% of online spend with local retailers. We’ve seen Kiwi shopping patterns stay at around this level since the start of lockdowns in Q1 20.

One final factor is domestic spend, with over 70% of online spend with local retailers. We’ve seen Kiwi shopping patterns stay at around this level since the start of lockdowns in Q1 20.

Sector growth

In last year’s lockdowns we saw significant growth in Homewares, Appliances & Electronics as Kiwis focused on setting up their home office, getting the kids ready for home schooling, and improving the space they were spending so much more time in. The sentiment this year has been very different with this sector only showing a 6% increase over the same quarter last year. In fact, year-to-date the sector is only marginally above the heights it had reached at this stage last year.

The big winner over the quarter has been Clothing & Footwear, up an impressive 37%. This is the second good quarter for this sector and sees its year-to-date spend up 25% on last year.

Our largest sector, Department, Variety & Miscellaneous Retail also had a good quarter, with spend over $570m, up 27% on the equivalent quarter last year.

Speciality Food, Groceries & Liquor had steady growth of 16% over the quarter as many Kiwis returned to getting their groceries delivered. The quarter’s spend is up a staggering 71% over the same quarter two years ago. This is the highest two-year growth of any of the sectors.

Q3 21 (compared to Q3 20)

+37%Clothing & Footwear |

+27%Department, Variety, |

+12%Health & Beauty |

+6%Homeware, Appliances |

+19%Recreation, Entertainment, |

$+16%Speciality Food, |

Who’s shopping, where and when

As expected, Auckland drove the quarter’s growth. Even though they represent about a third of the population, Aucklanders made up 40% of the whole country’s spend for the quarter. Auckland’s online spend of over $700m was up 21% on the same quarter last year. This was driven by a 29% increase in transaction volumes over the same quarter last year. And compared to the same quarter two years ago, transactions are up a massive 63%.

As it has done all year, Gisborne remains the fastest growing online shopping region, with Q3 21 spend up 36% on Q3 20. Year-to-date it is 23% up on last year. The quarter’s other strong growers included Tasman (29%), West Coast (28%), Bay of Plenty (26%) and Taranaki (25%). Nelson has seen the lowest growth rate (9%) compared to other regions so far this year, and this was the case again this last quarter.

It’s the younger group, aged 15-40, that continued to embrace online shopping this quarter, with their spend up by nearly 30% compared to the same quarter last year. The under 25s led the way, up 43%. The 40-65 group, who make up over a third of all online shoppers, also had a strong quarter growing their spend by around 20%. The much smaller 65+ age group, which showed huge growth during 2020, had more modest growth with spend around 14% higher than the same quarter last year.

Key shopping trends

Retailers haven’t been able to ignore the phenomenon that is Buy Now Pay Later. BNPL spend this quarter was 38% higher than the same quarter last year and 125% up on the same quarter two years ago. So far this year, it’s up 37% on last year.

We’ve seen a number of BNPL provider promotions over the quarter which saw spikes in sales volumes and introduced a number of new shoppers to the service.

The numbers also showed us a strong correlation between BNPL growth, the growth of the younger age groups online, and the growth of sectors like Clothing & Footwear and Department & Variety which are over-represented by the younger age groups. This would suggest BNPL is enabling the younger generation to get online and buy the things that are important to them.

On the other hand, local marketplaces which showed strong growth in 2020, have had a much quieter 2021. For Q3 21, marketplace growth was only 1% up on the year before (which was 24% up on the year before that). So far this year, marketplace spend is only 6% higher than in the first nine months of 2020.

Note: To help you stay up to date with what’s happening during this period of unprecedented online growth, we will produce monthly eCommerce Spotlight updates in November and December. We’ll then produce our regular quarterly update of online spending in January 2022.