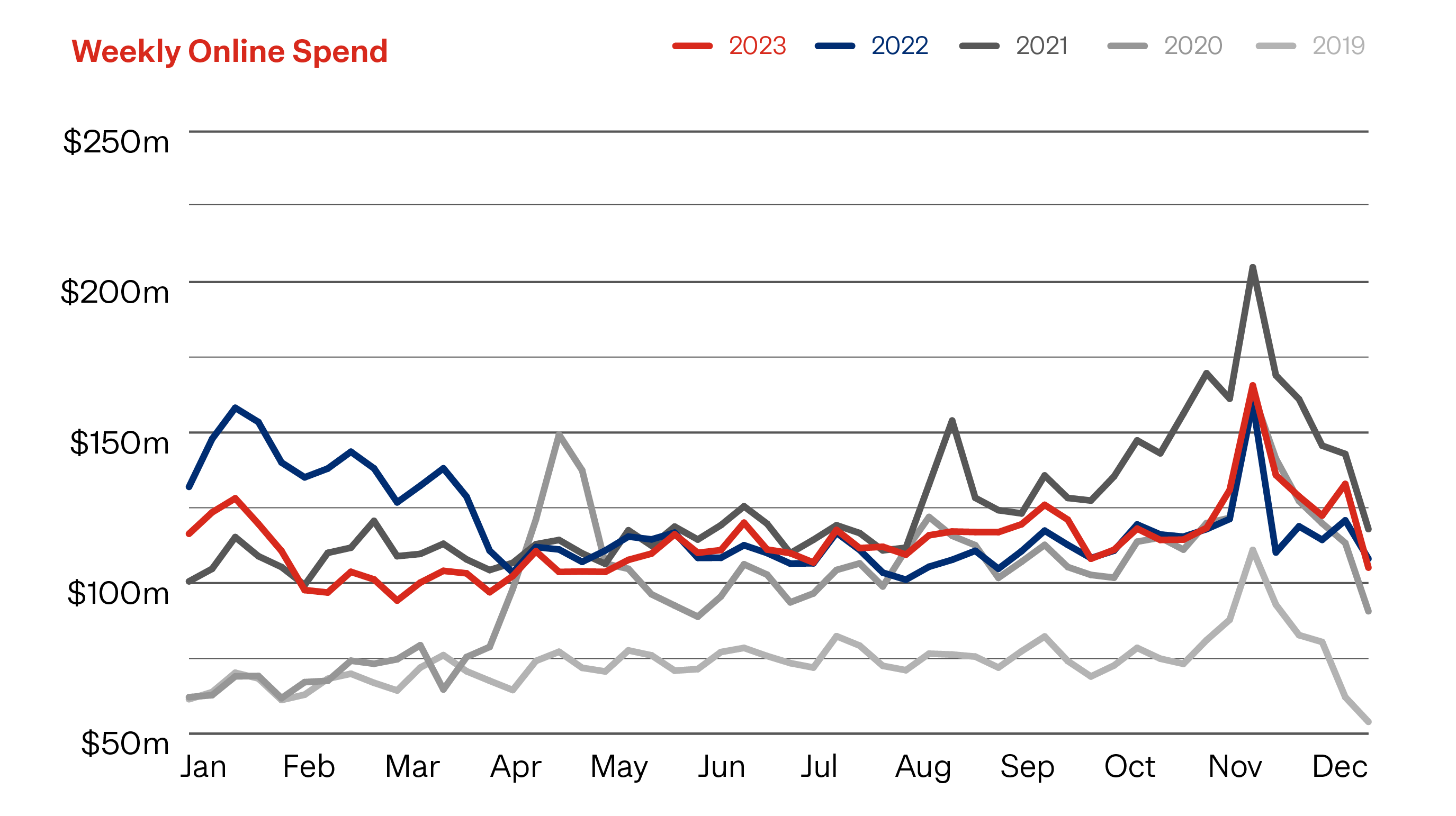

Online spending reached $5.8 billion for 2023, just 4% below 2022’s level. Given how tough the economic conditions were in 2023, the extent shoppers tightened their belts, and the fact that 2022 had an exceptionally strong first quarter due to COVID restrictions, this should be considered a strong result.

2023 marks the first full year where physical retail has not been restricted by COVID since 2019. Competing on level terms with shoppers spending across a broader range of options not limited to physical retailers, but also now able to enjoy hospitality, events, experiences and travel, made 2023 a challenging and more competitive year for online retailers. However, 2023’s biggest challenge wasn’t other places shoppers could spend their money but the overall operating environment. Post-COVID economic pressures such as rising supply costs, interest rates, a declining housing market, and wages, coupled with global conflicts, and significant domestic weather events made 2023 a difficult year for all retailers and their customers.

Across the year shoppers responded to the conditions by changing and adapting their behaviours, looking to make their money go further. As a result, the key trend in 2023 saw shoppers buy more often but spend less each time.

Around 10.1% of retail spending in 2023 was online, down slightly from 10.6% in 2022.

Throughout 2023’s difficult conditions, shoppers continued to support local retailers with 74% of online spending going to local businesses.

Instore spending reached $51.7 billion, marginally higher (1%) than in 2022, despite a full year of unrestricted trading and higher prices due to inflation.

Combined, total retail spending, online and instore, was flat, reaching $57.6 billion, a mere 0.7% higher than the year before.

2023 retail spending (compared to 2022)

Online Spending $5.8b-4% | Instore Spending $51.7b+1% | Total Retail Spending $57.6b+0.7% |

Key drivers of online spending decline in 2023

The fall in online spending seen in 2023 compared to 2022 was primarily driven by a decrease in the average online basket size. Shoppers were cautious, spreading their spend over more transactions, prioritising essential items, and purchasing lower-cost alternatives.

- Average basket size: The average online basket in 2023 was $102.73, down $9.91 (9%) on 2022.

- Transactions: Kiwis made more than 56.5 million online transactions in 2023. This was 2.6 million higher (5%) than the previous year. On average there were around 150,000 online transactions per day during 2023.

- Shopper numbers: At the start of 2023, there were fewer people shopping online each month compared to the equivalent month in 2022. This was not surprising given instore restrictions in the early parts of 2022 drove more people online. However, this changed from June 2023 onwards and there were more people online month-by-month in 2023, compared to 2022.

What Kiwis were buying online in 2023

Department, Variety, & Misc. (up 3%) and Clothing & Footwear (up 1%), our two largest online sectors, were the only sectors where online spending grew in 2023 compared to 2022. In both cases, growth was driven by increased transactions, partially offset by a smaller average basket size. Clothing & Footwear saw a decline in instore spending, suggesting that online growth was supported by shoppers switching to online to seek better value.

The four remaining sectors all experienced a decline on 2022 spend levels.

The Speciality Food, Groceries, and Liquor sector saw the largest rate of annual decline, down 11% for online spending. While transaction levels were up, it was a significant drop in the average basket size that drove the sector’s performance. There is a visible shift with non-essential spend, like liquor, declining significantly when compared to essential supermarket spend.

Homeware, Appliances, & Electronics was the sector with the second largest drop in annual spend down 8% in both online and instore spending. It’s a sector with higher price tags and more discretionary spend items, which further demonstrates consumers cautious behaviour.

Again, this year, shoppers looked for ways to afford their purchases, resulting in 14% growth in the total value of online Buy Now Pay Later transactions in 2023. Buy Now Pay Later experienced phenomenal growth over recent years, with the total value of online transactions in 2023 over double the value of transactions in 2020.

Regional changes

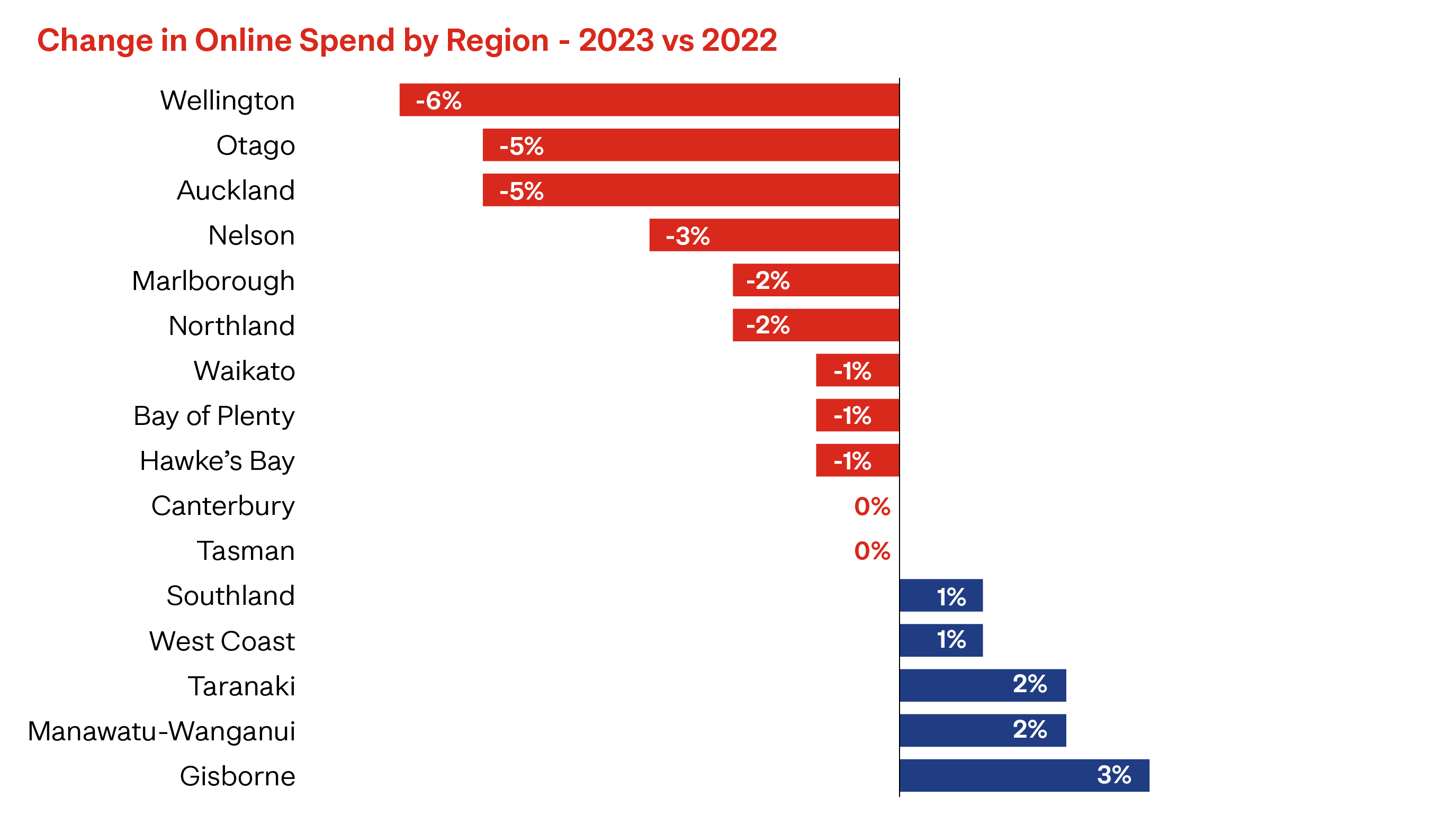

Online spending growth for 2023 compared to 2022 varied across the regions, with no demonstratable differences between North vs South or Urban vs Rural.

Auckland, which accounts for around 35% of online spending in New Zealand, drove the overall decline compared to 2022. But this wasn’t the region with the highest decline rate in online spend. That region was Wellington. One possible contributor to this could be the change of Government, and the uncertainty associated with public sector staffing requirements. While there is no specific evidence as yet, this may be something to monitor over the coming months.

Gisborne, on the other hand, saw the highest increase in online spending (+3%) continuing the strong growth trend evident since COVID. Regional weather events, resulting in reduced access in, out, and around the region, are likely to have contributed to increased online shopping.

Looking ahead to 2024

The last half of 2023 saw online shoppers continue to adapt their behaviours to the uncertain conditions. There is little to suggest things will be any more certain for shoppers, or retailers, in 2024.

The economic environment will no doubt continue to be the biggest influencer of online shopping’s performance in the year ahead. While inflation is already easing from 2023 levels, most commentators forecast household spending to remain weak and consumer confidence low. And as more homeowners come off mortgages they locked in 3-5 years ago, the economic bite will become a reality for more Kiwis.

NZ POST'S TIP

Help shoppers make their money go further in 2024. Delivering perceived value will help you retain existing customers and attract new customers. Consider offering cheaper alternative products, bundling products together, discounts for bulk, loyalty rewards, more payment options and higher value through a better delivery experience.

We are still witnessing significant ongoing global conflicts, and a number of major elections on the horizon, foreign pressure on the local economy is likely to be a key factor again.

Although restrictions have ended, COVID is far from over with the fifth wave gripping the nation over the last few months. While the disease is now considered endemic rather than pandemic, staff shortages due to illness remain a key risk for retailers in 2024.

Increased Government spending and tax cuts may provide the impetus for a positive change in economic fortunes, or at least confidence, in the back half of 2024. Retailers should start getting ready for better times by consistently reinforcing their key points of difference and the reasons, beyond price, why shoppers should choose them over the competitors.

Uncertainty however still remains the key theme for 2024. Time will tell whether shoppers will keep adjusting their behaviours to maximise value in an uncertain world. With online shopping making up just 10% of retail spending, well below similar countries like Australia (19%) and Ireland (18%)1, there is still plenty of room to grow online. Retailers will need to do the same, adapting their products, pricing strategies, promotional activities, website, and delivery experience to meet customers changing needs. In this tough environment, listening to what your customers’ needs remains the best strategy for driving growth.

1. International Post Corporation’s domestic e-commerce shopper survey 2022 - Overall Report

NZ POST'S TIP

Keep up to date on the latest data and trends. See how Q4 contributed to the key numbers and trends in 2023 in our Q4 2023 eCommerce Spotlight.

How we can help

We’re passionate about helping you grow your online business. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help.

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. Online spend includes both international and domestic shopping, and is filtered appropriately to only include consumer goods. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.