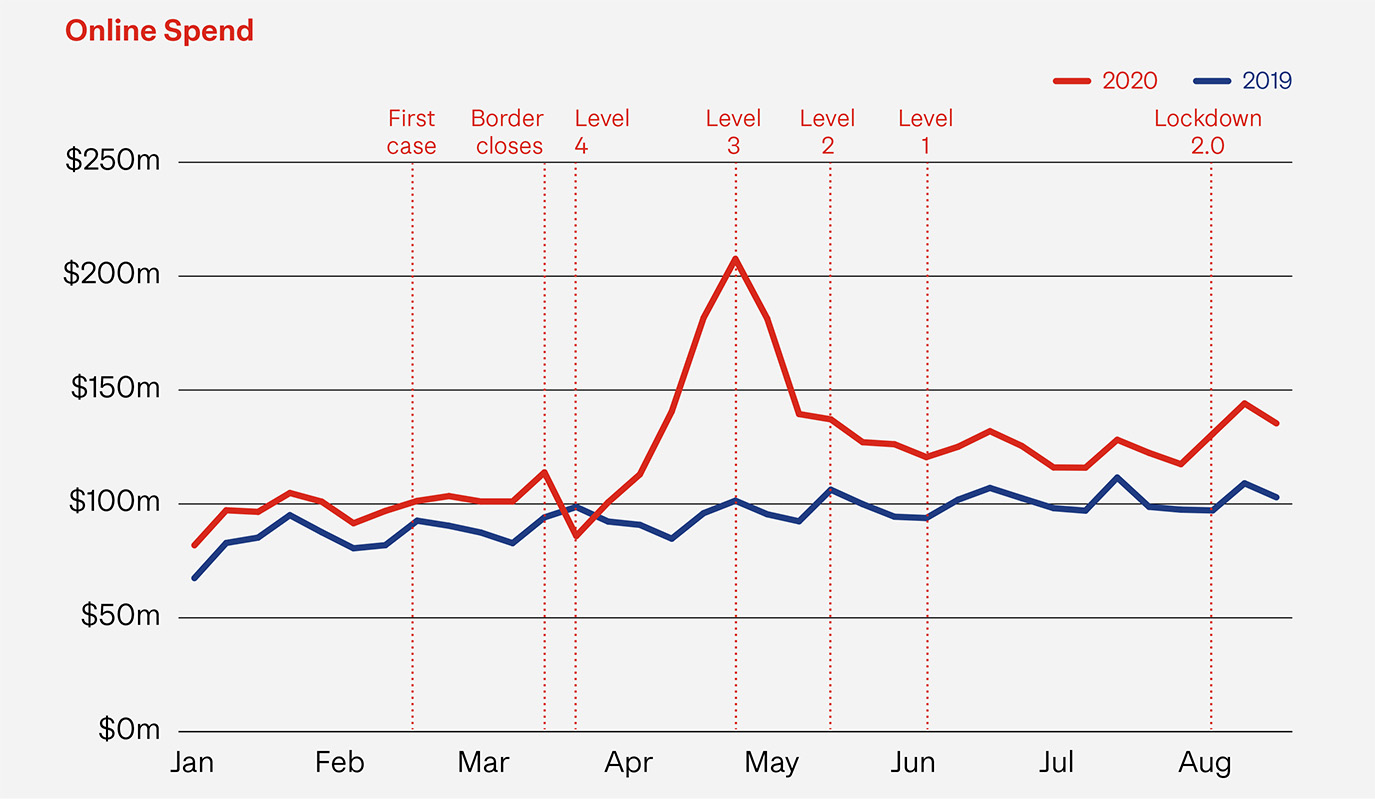

Like the move to Level 3 back in May, online sales rose in August while physical shopping took a dip. At over $511M, online spending in August was up 31% on August last year. This is a significant step up from July which was 18% on the previous July. Physical store (offline) transactions were down 6%, reflecting Auckland’s lockdown status, the reduction in the number of people out and about and limits on numbers allowed instore.

While August numbers were big, the impact on shopping behaviours was less extreme than the first time we went into lockdown. In April we saw online spend up 56% on the previous year. Offline spending was down 41% in the same month.

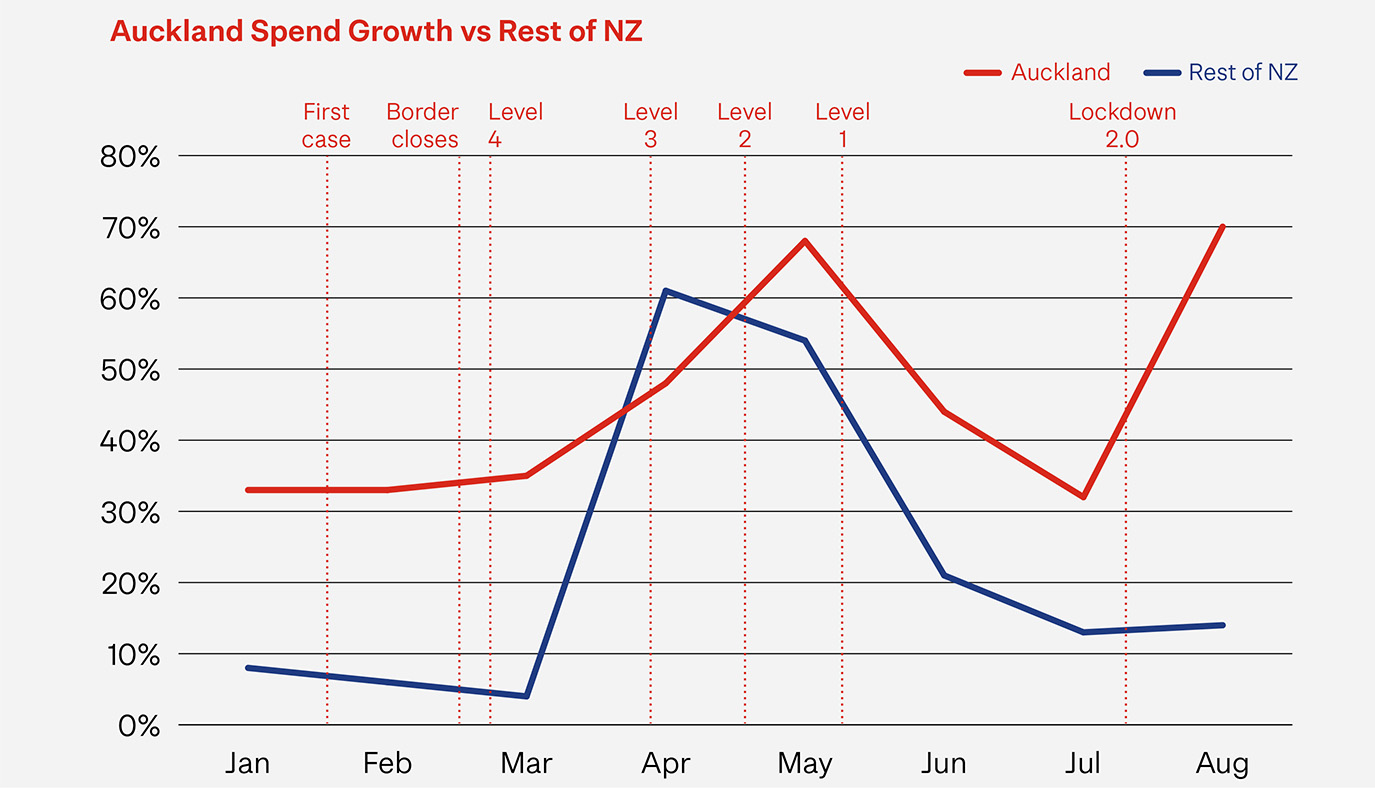

Auckland leads the way

As you’d expect, online spending in Auckland stood out as the city went into Level 3 lockdown. Online spending was a massive 70% up on August last year, exceeding even the highest point achieved during the first lockdown (68%, May).

There is much talk about the importance of Auckland on New Zealand’s economy and this was sharply highlighted in August, with 43% of all online sales coming from Auckland customers.

For August 2020:

70%Increase in Auckland |

43%Of all online sales |

x5Auckland’s growth |

Auckland’s online spending growth in August is five times the growth rate of the rest of the country (14%). The move to level 2 saw a slight increase in online spending (from 13% in July) across the rest of the country, possibly suggesting that Lockdown 2.0 did little to change non-Aucklanders shopping habits.

The growth in Auckland’s spending in August was across all categories, mirroring that of the first lockdown. The biggest increases was once again in the homewares and food categories.

For 2020 so far, Auckland’s growth in online spending is double the rest of the country. Interestingly though, Auckland isn’t the region with the highest online growth this year – that honour remains with Taranaki, followed by Northland.

Growth Drivers

In the first eight months of 2020, Kiwis nationwide have spent $3.7b online, up 29% compared to same period in 2019. Offline spend decreased by 2% for this same period in 2019.

For the eight months to 30 August (compared to same period 2019):

29%Growth in |

11.4%Of all retail |

71%Of all online spend |

Three key factors drive online growth – the number of people shopping, how often and how much they spend each time. Online shopping continues to grow to the power of all three.

- In August there were 1.36m shoppers online. 1.8% of these were new shoppers (approx. 24,000) who hadn’t shopped online in the previous 12 months. All age groups experienced growth in their shopper numbers in August, with the 75+ group leading the way with 38% growth.

- Online transactions were up 26% for August 2020 compared to August 2019. So far this year, the number of online transactions is up 21% compared to the first eight months last year.

- The average online transaction (known as basket size) so far in 2020 is $108. This is 7% up on the same time last year.

In August (compared to August 2019):

1.36mKiwis shopping |

26%Increase in |

$108Average spend per |

In August we saw domestic clothing and footwear up 47% on August 2019. For the same period, domestic department and variety spend was up 66% and domestic homewares spend up 51%. Not surprising, August’s big winner was domestic food and grocery spending, up 62%.

Further fuelling growth for domestic online retailers is the continued preference to shop local with 71% of online shopping so far this year with domestic retailers. This is 11% up on the previous year. However, there are recent signs, including during August, that international online spending is on the rise as Kiwis look for lower prices and more product options. We’ll keep an eye on this trend in the months ahead.

What’s ahead

Online sales have remained strong all year and we know traditionally they ramp up from Black Friday / Cyber Monday (in late November), through Christmas, and well into the new year. With COVID-19, higher unemployment, less discretionary spend, the continued closure of our borders and the onset of a ‘long and deep’ recession, will ‘peak season’ reach the levels it has in recent years?

Next month we’ll consider this question further and help retailers prepare for peak.