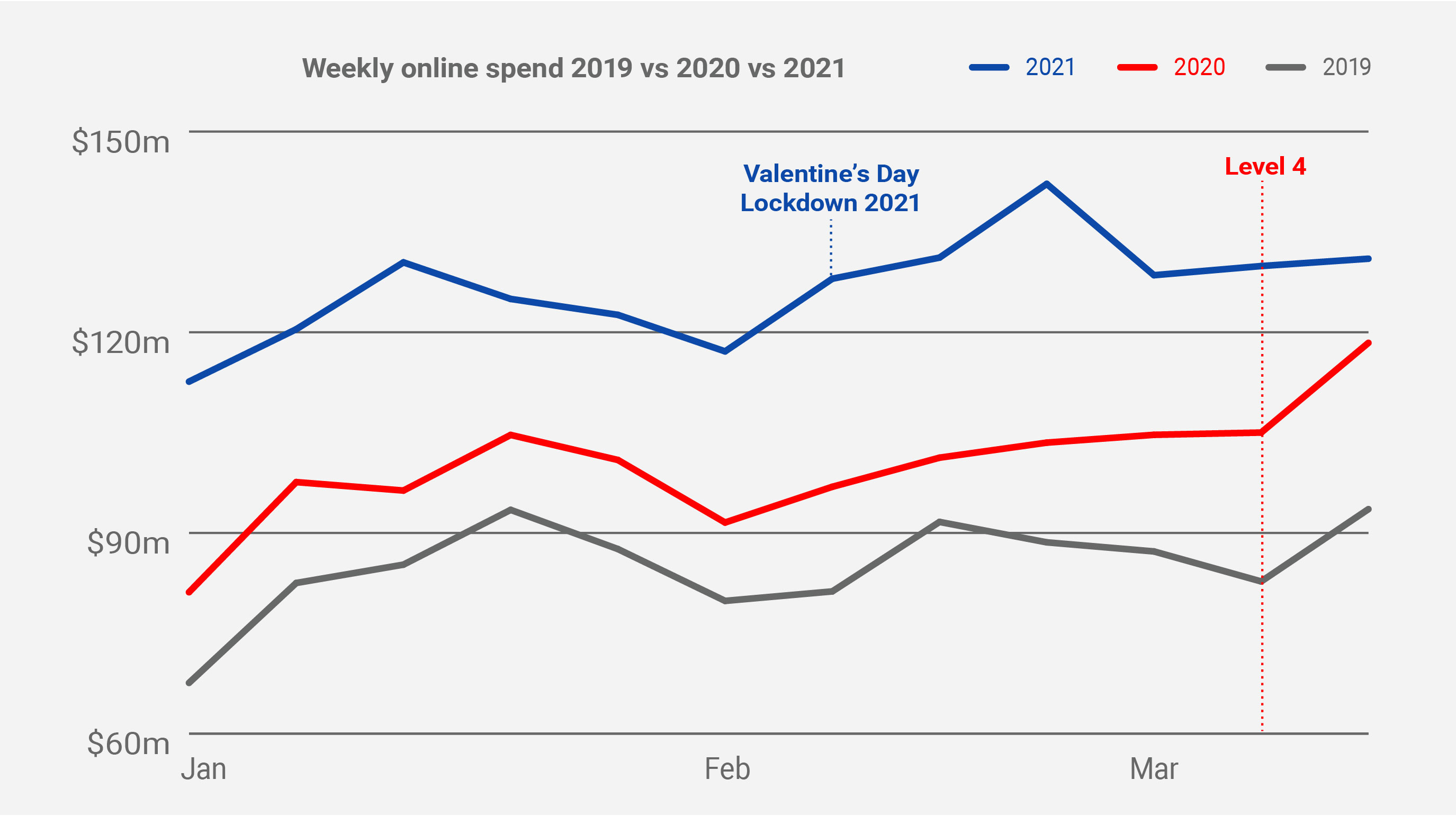

Quarter one 2021 (Q1 21) saw online spending of $1.47b, up 27% on the same quarter in 2020 and up nearly 50% on the equivalent period in 2019. This growth is up there with the sort of accelerated quarterly growth numbers we saw throughout 2020. It seems the love affair with online shopping continues. Retail shopping growth, across both online and instore, was a more moderate 5% up on the same quarter last year.

Covid-19 lockdowns were a factor in shopping spend numbers for the first quarter of both 2020 and 2021. Late March 2020 was when the first, and nationwide, lockdown came into effect. This hit retail stores hard and many were fully closed until they could activate an online platform. Q1 21 saw a couple of short lockdowns for Auckland and, while there was definitely an impact, the overall feeling is that both retailers and consumers were better prepared for these.

As anticipated, February’s lockdowns saw an immediate spike in online shopping, led by Health & Beauty products, Homeware, Appliances & Electronics, Clothing & Footwear and Department, Variety & Miscellaneous Retail goods. And of course, there was another rush on food and liquor as Aucklanders stocked up in preparation for yet more time in lockdown.

In each edition, we look at the three key factors that drive online spend – the number of shoppers, how often they spend and how much they spend each time.

Quarter one 2021 (Q1 21):

2.16Milllion shoppers online |

3.3Transactions per customer |

$107Average basket size |

The number of shoppers in Q1 2021 was 135,000 higher than the same time last year. However, if we compare it to the previous Quarter (Q4 2020), it appears to have plateaued. In fact, there were about 1,000 less Kiwis shopping online compared to Q4 2020. Interestingly, 62,000 shopped online in this quarter for the first time, suggesting that a number of existing shoppers didn’t shop. Overall basket size remains about the same (1% up) however new shoppers seem to be entering the online world at the higher price point, with their basket size at nearly $140.

What is driving this quarter’s growth is a huge increase in transaction numbers. Online shopping has become the ‘way we shop’ for many Kiwis and they are buying online more often and across more sectors. In Q1 21 there were 13.7m online transactions, that’s up 25% (over 2.75m transactions) on the same period last year and 33% up on the same period in 2019.

The two sectors that show the biggest growth over the same quarter in 2020 were Clothing & Footwear (up 40%) and Department, Variety & Miscellaneous Retail (up 32%). Surprisingly, these weren’t the sectors that led the way in 2020. Homewares, Appliances & Electronics (up 31%) and Specialty Food, Groceries & Liquor (up 28%) both continued their strong run from last year. After a disappointing 2020, Recreation, Entertainment, Books & Stationary is making a comeback, up 6% on Q1 20. 2020’s other disappointing performer, Health & Beauty, continues to see a decline in shoppers, transactions and spend.

Quarter one 2021 (Q1 21):

26%Marketplaces |

49%Buy Now Pay Later |

71%Local online spending |

While we continued to see the ‘buy local’ trend we saw last year, it was a good start to 2021 for international spend, well up on the equivalent quarter in both 2020 and 2019. Clothing & Footwear and Department, Variety & Miscellaneous Retail benefited the most with both sectors seeing international spend over 20% higher than the year before.

The North Island regions that lead the growth in 2020 continued to see good growth at the start of this year. Gisborne was up 44%, Northland up 32%, Hawkes Bay up 32% and Taranaki up 29%. What is most pleasing to see is the strong growth in South Island regions like Southland (32%), Nelson (37%), Tasman (29%) and Marlborough (27%).

A key trend in 2020 was the rise of the older demographic online and that continues in Q1 21. Shoppers 60 and over grew by over 15% and their spend was up over 25%. Under 30s also had a strong quarter, growing their spend well over 35%. But it’s still the 30-59s who dominate online shopping. They continue to spend more often, and across more sectors, with transactions up over 25% on Q1 20.