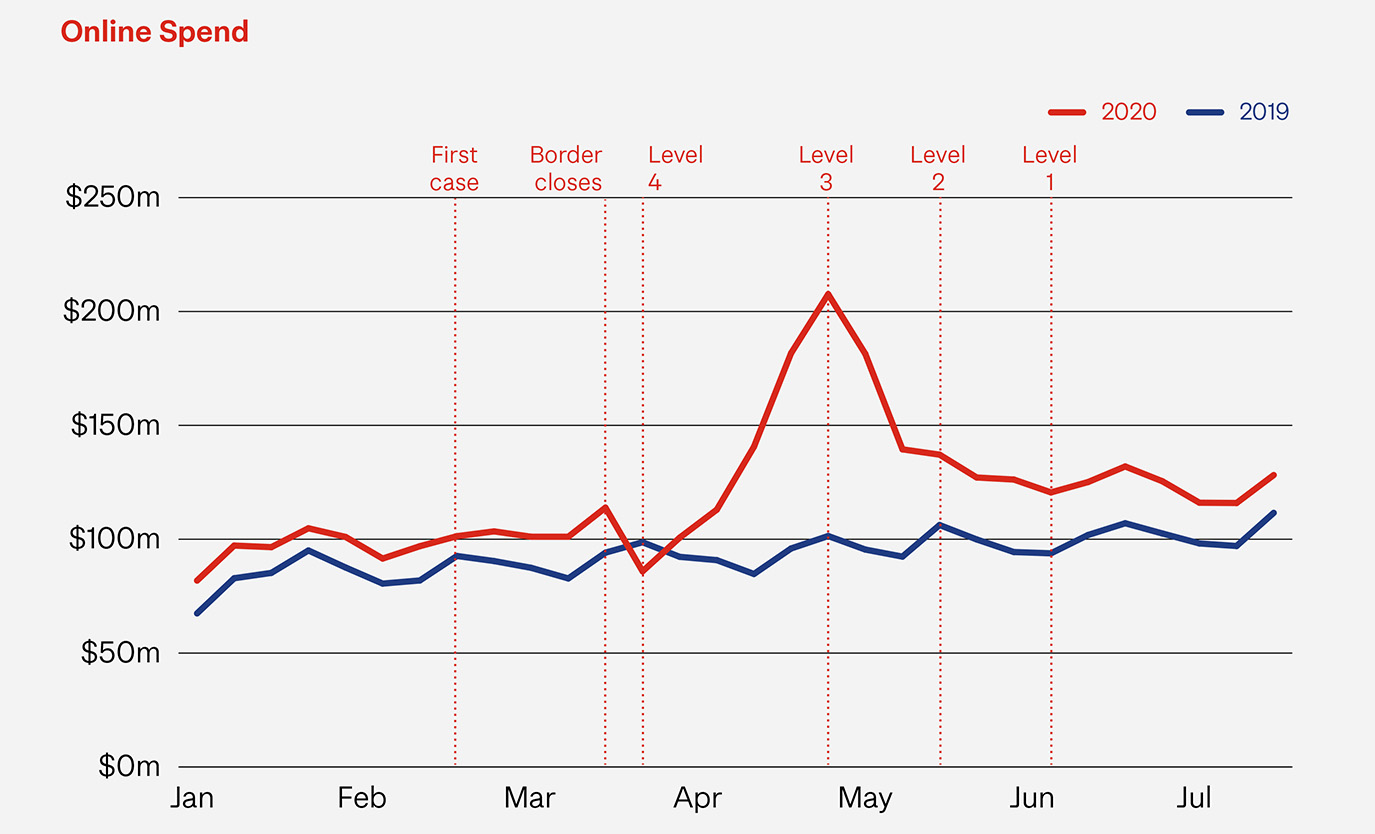

Online shopping continues its strong growth through the year to the end of July, up 28% on the same period last year. But the big story isn’t just how much more we’re spending online but where we are spending it. The call has been to support local businesses and we are seeing Kiwi shoppers embrace this with a phenomenal 71% of all online spend so far in 2020 with domestic retailers.

July spending online was 18% up on the same month last year and while this is a good result, it’s about a third of the growth we saw through April and May. New Zealanders are settling into their new shopping routines and that looks like good news for online retailers. The ‘new normal’ sees higher levels of online spend driven by more shoppers, shopping more often and spending more each time.

For the seven months to 31 July (compared to same period in 2019):

28%Online spend higher than |

10.3%Of all retail |

71%Of all online spend was |

1.29MKiwis shopping online |

3.13online transactions per |

$108Average spend per |

Online transactions are up 20% so far this year, driven largely by the growth of online grocery and liquor purchases and the big rise in electronics and appliance sales. Our online baskets are also growing, up 7% from the same period last year. And of course there are more of us choosing to shop online each month. In July there was another nearly 20,000 Kiwis who came online for the first time. What was interesting about this new batch is that, on average, they shop 1.4 times during the month. This is well below the 3.1 monthly transactions we see from seasoned online shoppers. This leaves plenty of room for future growth from this new segment.

Alongside the normalisation of online spending in July was the continued return of shoppers to physical stores. At 10%, this was the second good month of growth for offline retailers, helping support their ongoing business recovery. This appears to be driven by a renewed sense of safety to venture to the stores and also the national sentiment to support local businesses. Undoubtably these growth numbers will be impacted again in August, especially in Auckland.

Support local

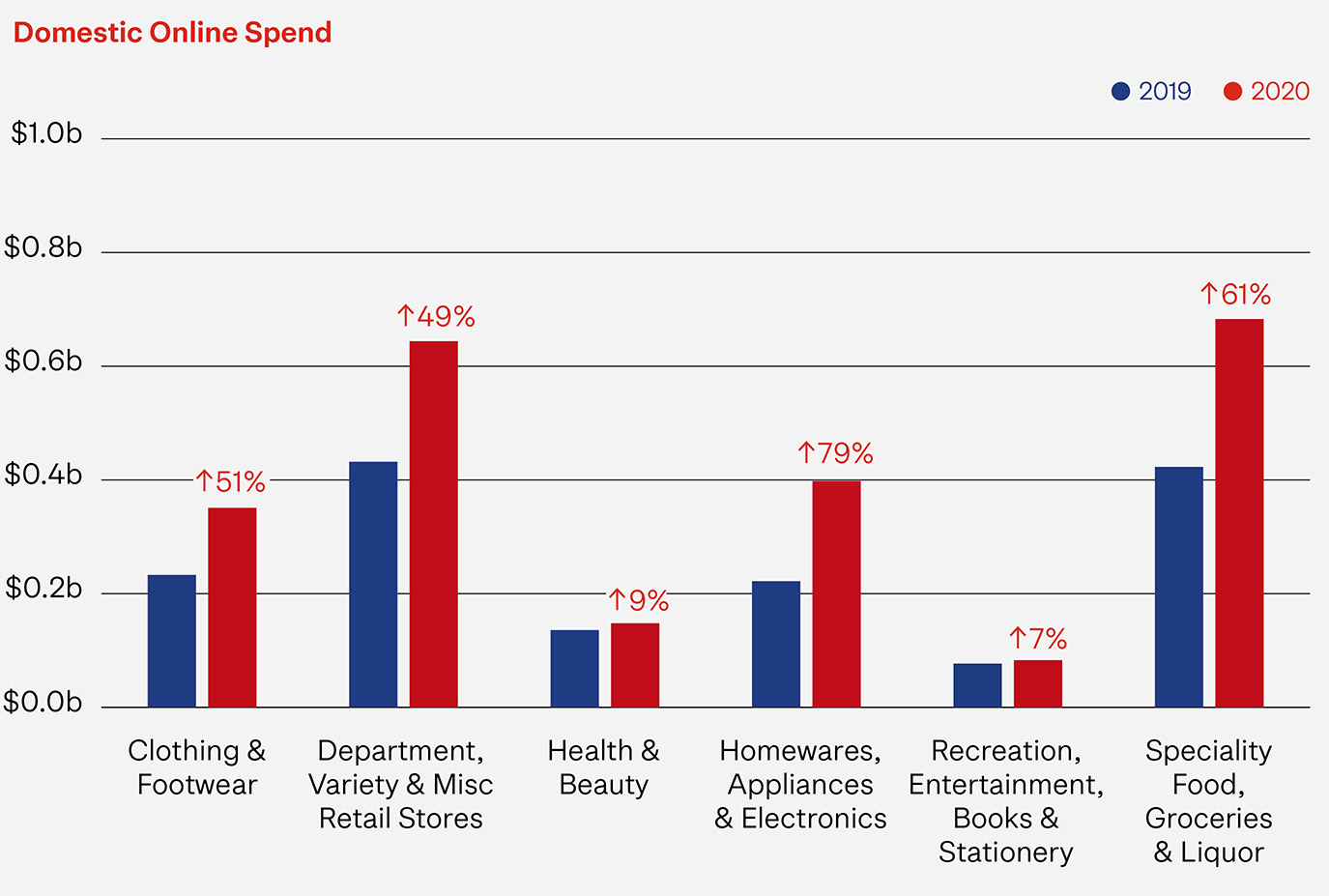

This drive to buy domestically has been a feature of Kiwi online shopping habits for the last 18 months but it really accelerated during the April/May lockdown and since then. Domestic online spend for the year to date is 51% up on the same period last year, making up 71% of all online spend so far in 2020. All categories have benefited from this local sentiment with growth ranging from 7% for recreation, entertainment, books and stationery right up to a massive 79% for homeware, appliances and electronics.

And while Kiwi’s aren’t spending as much on international shopping overall, homeware, appliances and electronics as well as speciality foods, groceries and liquor saw their international spend rise by 11% and 12% compared to the same period in 2019. With tough economic times forecast ahead, international spending is likely to rise again as shoppers return to making purchase decisions based on lowest price.

Two interesting global trends we’ll continue to keep an eye on are: (1) The growth of international buyers actively choosing to buy from New Zealand. Our comparative COVID-19 status, the clean green positioning and the perception of us as an innovative and corruption-free country continues to make New Zealand an attractive market for foreign online shoppers. The Au Natural Skinfood story that follows highlights just how much of an opportunity ‘brand NZ’ may be. (2) International retailers choosing to target Kiwi shoppers. As our online shopping numbers continue to grow, we become a much more attractive market for international retailers looking for customers with a strong willingness to shop online. We are already seeing signs of this out of Australia and the US.

Other emerging trends

The other big trends coming out of 2020 so far has been the meteoric rise of Buy Now Pay Later services. Year to date BNPL is 64% up on the same period last year. Domestic marketplaces are also experiencing a surge in spend, up around 50% on the previous year. There are a few sectors driving both these trends and we’ll take a closer look at these in the next eCommerce Spotlight.