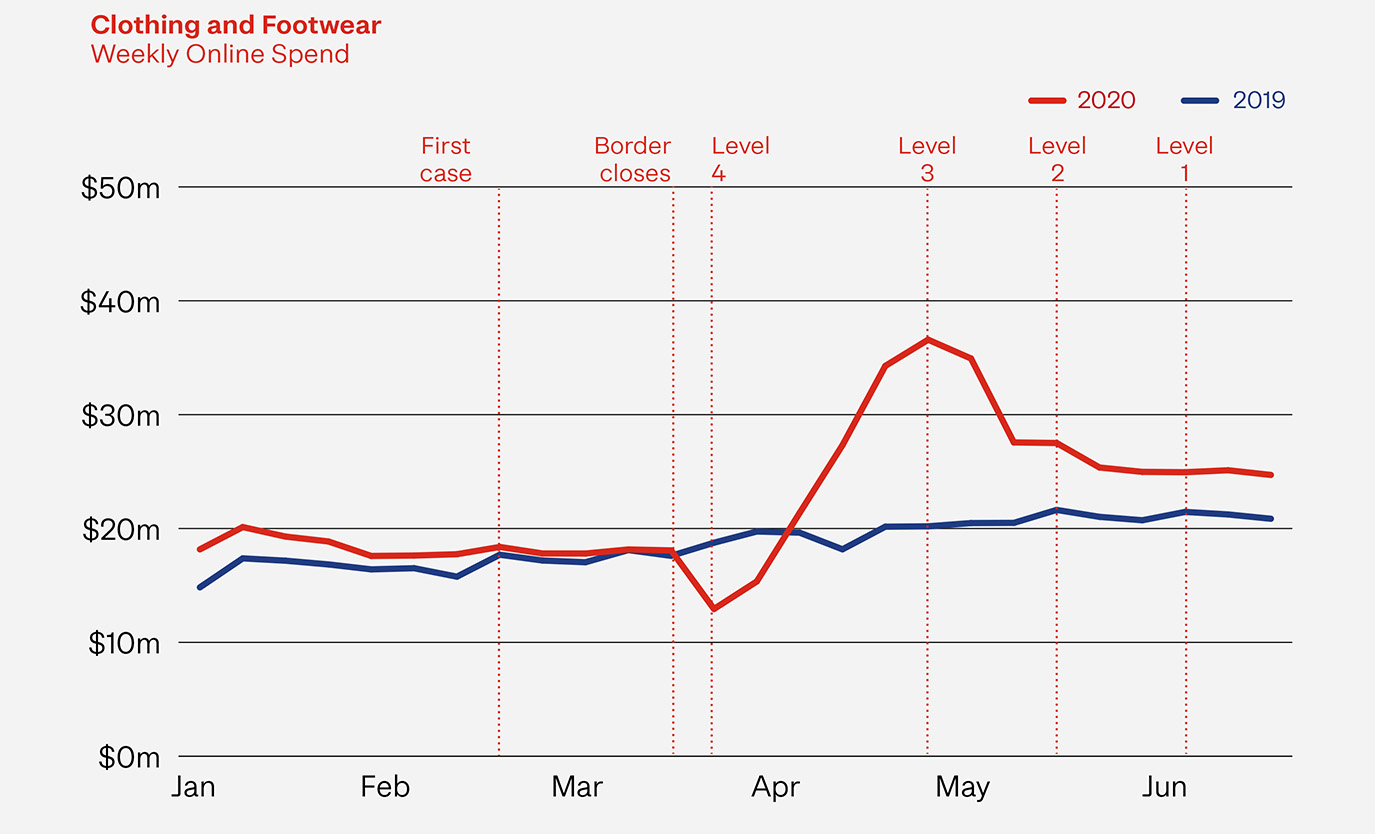

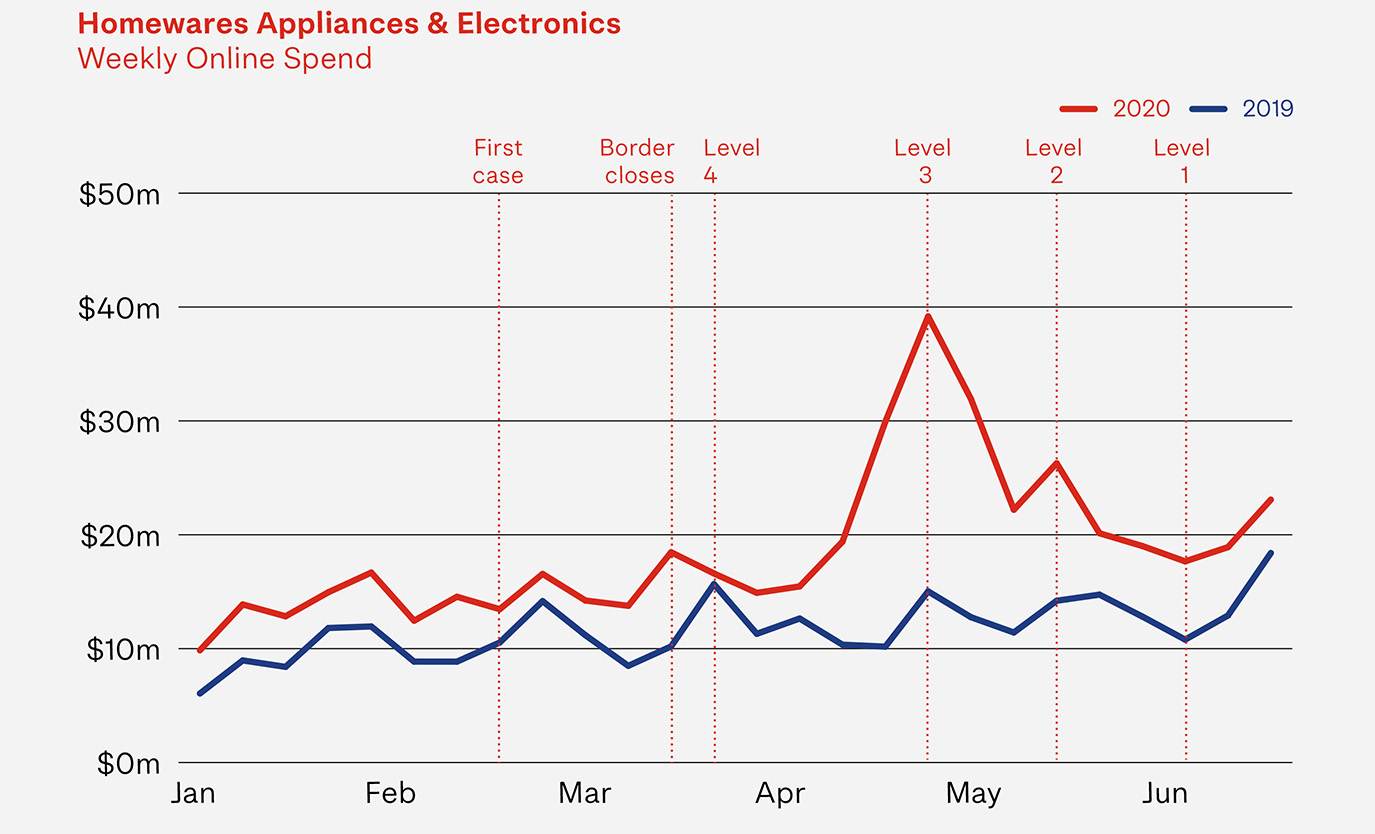

Overall online spend and transaction increased significantly thorough lockdown peaking at the start of Level 3. But not all sectors shared the spoils evenly. It’s not surprising that the big winners were the essentials: Food, Groceries & Liquor and Clothing & Footwear. What may be a little more surprising is the growth in Homeware, Appliances & Electronics. This possibly reflects the establishment of working from home arrangements, the popularity of cooking over lockdown and the extra demand on device watching and game playing.

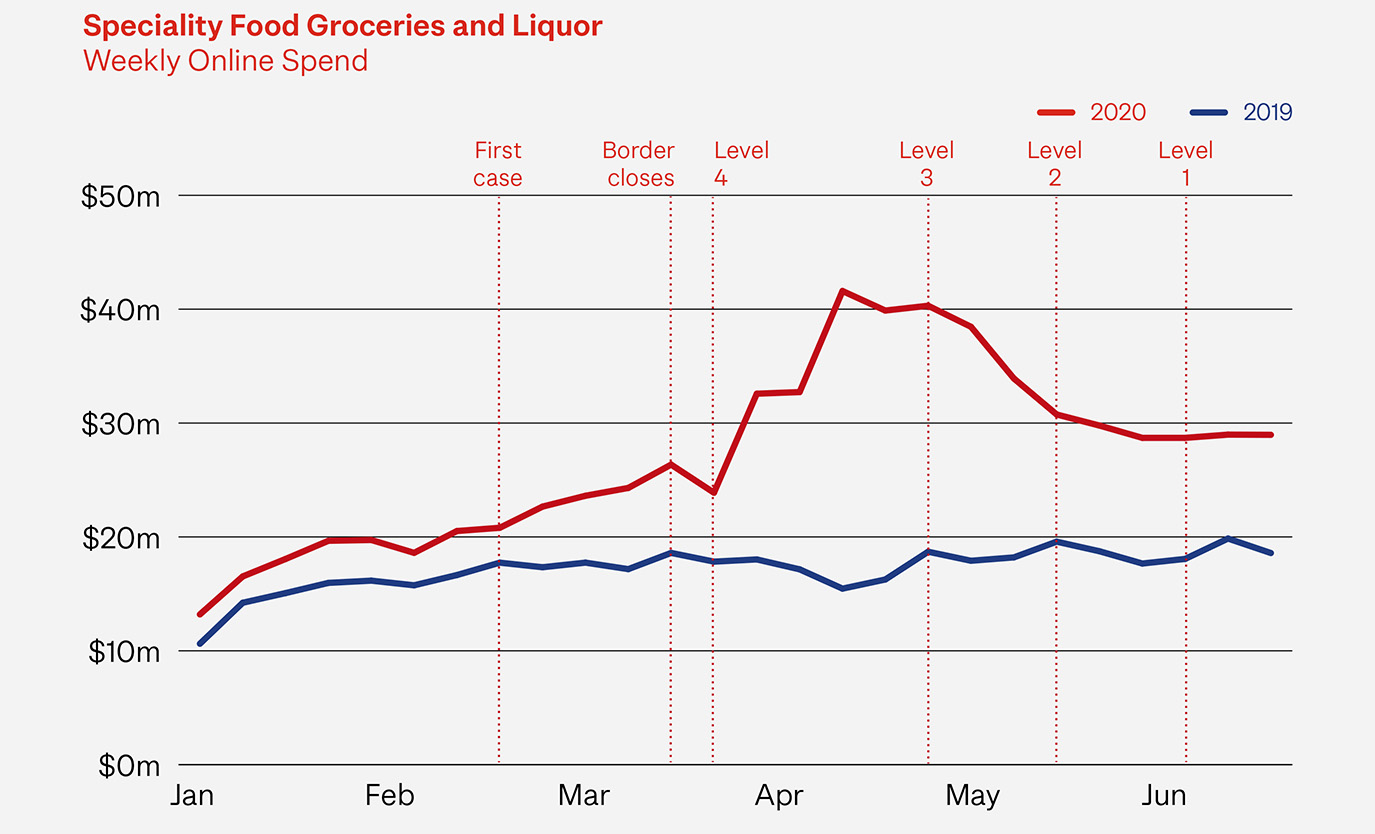

Average weekly spend and transaction experienced significant growth before and during all levels of lockdowns. During Levels 3 and 4, average weekly online spend increased by more than 105% over a year ago.

Spend continued to grow over lockdown, peaking in Level 3 with spend 62% greater than a year ago.

Continued growth over lockdown, peaked in Level 3 with average weekly online spend up 135% over a year ago.

At the other end of the spectrum, Health & Beauty and Recreation, Entertainment, Books & Stationary saw overall declines in online spend and transaction over lockdown.

Health & Beauty spend initially grew over Level 3 and 4 but dropped off during Levels 2 and 1. Recreation, Entertainment, Books & Stationary online spend, which had already been declining before lockdown, decreased significantly during lockdown and continued to decline in Levels 2 and 1.

In the next eCommerce Spotlight, we’ll take an indepth look at how each of the sectors are tracking and where they may be heading.