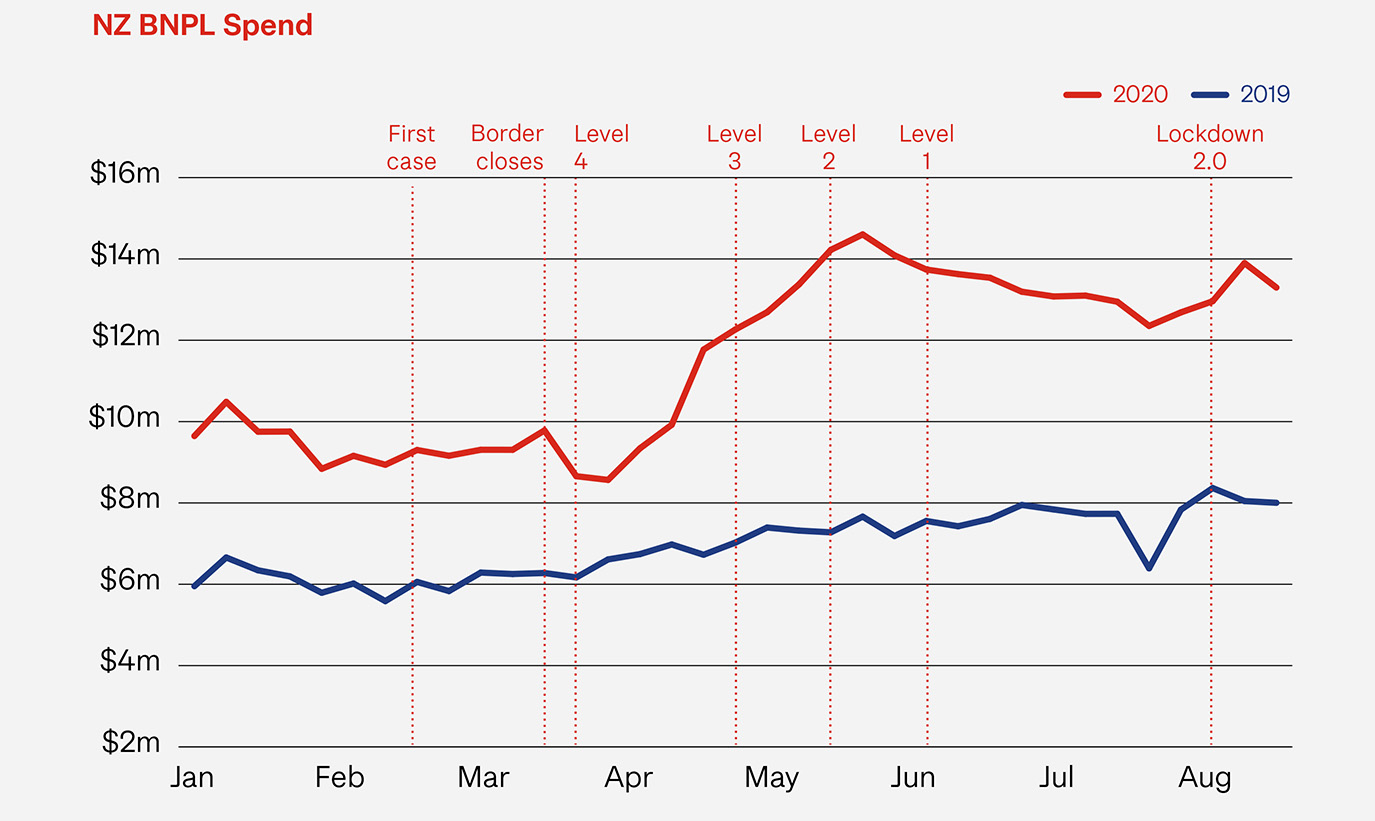

Despite growing warnings against rising debt levels, especially in these tougher economic times, Buy Now Pay Later (BNPL) has continued its meteoric rise from the last three years. In 2020, BNPL grew by 65% over the same period in 2019. This is driven by an increase in the number of customers (37%), transaction (49%) and basket size (10%)

Lockdown 2.0 didn’t have a specific impact on BNPL, growing in line with online spending as a whole. It rose for the start of the month but tailed off as Level 3 reduced to 2.5.

Around 86% of BNPL customers are aged 45 or under, rising by over 35% since the start of the year. The fastest growth however, is coming from the much smaller 60 plus groups. Some commentators suggest that this growth reflects the older generation’s familiarity with the original Layby concept. Others see it as evidence of tightening economic conditions, requiring those with fixed income to adopt spread payment options.

BNPL is growing in popularity nationwide with just about every region experiencing double-digit growth so far in 2020. The stand out areas for growth in August were Auckland (90%), Northland (78%) and Hawkes Bay (60%).